Parte I: Bitcoin come albero, persistenza e strutture profonde

Una fantasticheria

Forse se Ero stato più sfacciato, il titolo della prima parte di questa serie sarebbe finito per essere qualcosa di più allettante, qualcosa di incisivo come”Bitcoin Is A Palm Tree, And Fiat Is A Coconut”. Ma nel bene e nel male, un titolo del genere sembrava saturo di un po’troppa leggerezza, troppo tropicale e banale per un argomento così pesante.

In verità, però, l’immagine della palma sarebbe stata davvero molto accurata allegoria di come la roadmap di bitcoin e fiat si evolverà man mano che avanziamo nel 21° secolo. Una palma reale, roystonea oleracea, che ondeggia febbrilmente in una burrasca torrenziale, sebbene non smetta mai di mantenere una salda presa alle sue radici in profondità sotto il suolo. E come per ogni tempesta, l’unica necessità darwiniana per questo albero è la sopravvivenza, per cavalcare la tempesta il più indenne possibile.

Altri alberi e strutture potrebbero frantumarsi e cedere ai duri capricci della natura, lasciando più luce solare da assorbire per la nostra palma reale una volta che il cielo si sarà schiarito. I detriti di tutto ciò che non erano stati abbastanza robusti per sopravvivere all’attacco, metabolizzati da colonie di termiti e incendi di cespugli, si trasformarono in terreno fertile e rigoglioso. Un nuovo strato di base da cui ricostruire e prosperare. Una metafora azzeccata, alla luce del fatto che il suolo risulta essere l’unico mezzo fisico mai osservato in natura in grado di trasformare la morte in vita. Allo stesso modo, una moneta solida assolutamente scarsa e incorruttibile è l’unico mezzo economico in grado di infondere vita economica in un sistema finanziario decadente e degradato.

Un avvertimento

“Il passaggio innocuo del tuo tempo nella prateria lontano

Solo vagamente consapevole di un certo disagio nell’aria

Farai meglio a stare attento

Potrebbero esserci cani in giro

Ho esaminato la Giordania e ho visto

Le cose non sono come sembrano

Cosa ottieni fingendo che il pericolo non sia reale

Mansueto e obbediente, segui il leader

Giù per corridoi ben battuti nella valle d’acciaio

Che sorpresa!

Uno sguardo di shock terminale nel tuo occhi

Ora le cose sono davvero come sembrano

No, questo non è un brutto sogno”

-Roger Waters, “Sheep”, 1977

Fonte: Nareeta Martin, @LudiMagistR

Una profezia

“Hai sentito della rosa che è cresciuta da una fessura nel cemento?

Dimostrando che le leggi della natura erano sbagliate, ha imparato a camminare senza avere piedi.

Divertente, è sembra che, mantenendo i suoi sogni, abbia imparato a respirare aria fresca.

Lunga vita alla rosa che è cresciuta dal cemento quando a nessun altro importava.”

–Tupac Shakur,”La rosa che crebbe dal cemento”, 1999

Prima di poter apprezzare appieno la caratteristica di persistenza del bitcoin sopra dedotta, è forse utile contestualizzare come e perché tale”antifragilità”(qualcosa che definiremo più dettagliatamente più avanti) si rivelerà inevitabilmente come uno scoppio di tuono, uno schiaffo in il volto, permettendo a tutti noi di testimoniarne l’utilità profondamente sottovalutata.

Per ottenere ciò, facciamo una piccola deviazione utilizzando una versione modificata della tecnica dell’interrogatorio socratico.

Una teoria: la fuga precipitosa della classe degli investitori di massa

Lo stimato investitore tecnologico eclettico Balaji Srinivasan, nel suo modello concettuale di un’economia pseudonimizzata decentralizzata, ha dichiarato polemicamente:

“Nell’ottocento, tutti erano agricoltori. Nel 1900, tutti erano nella produzione. Negli anni 2000, tutti diventano investitori… E una delle cose che le persone non capiscono finché non diventano investitori è l’idea che i soldi abbondano.”

-Balaji Srinivasan,”Investi come il miglior podcast con Patrick O’Shaughnessy”

Fonte: Balaji Srinivasan

A Discussione

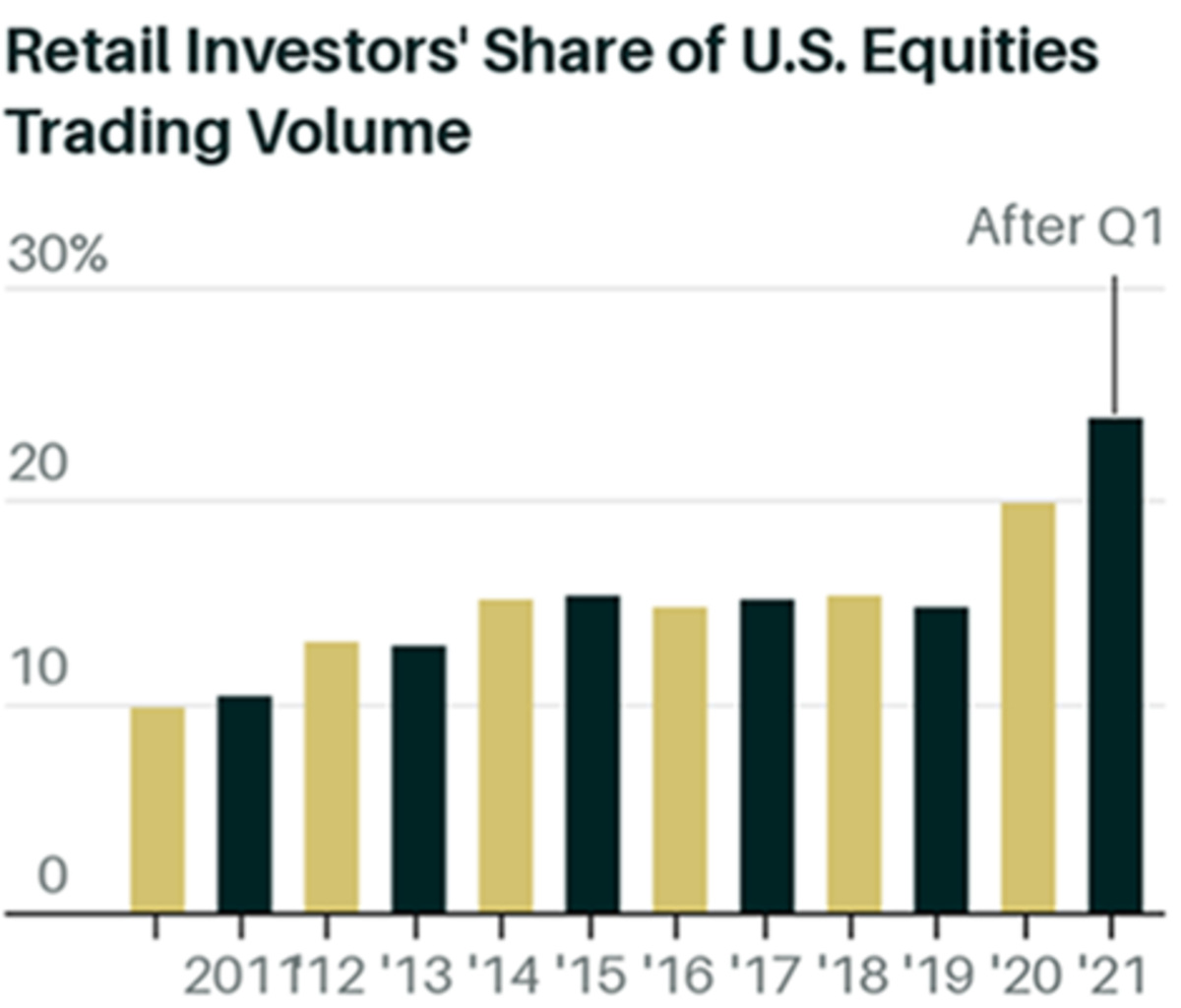

Prendiamo alla lettera l’affermazione di cui sopra e accettiamola per il momento come una realtà a priori in evoluzione. Penso che la maggior parte di noi sarebbe d’accordo sul fatto che un tale ampliamento della portata della classe degli investitori sta effettivamente subendo un rapido aumento, in particolare accelerando nel mondo post-pandemia. È difficile negare le prove concrete (discusse di seguito), così come i riflettori culturali osservati che hanno enfatizzato l’investimento autodiretto del mercato azionario. Le prove sono ovunque, anche scorrendo il mio feed di notizie mentre scrivevo questo saggio:

“Robinhood Working on Feature to Let Users Invest Spare Change”

“Investire il resto ha diventare una strategia sempre più popolare per i nuovi operatori di borsa ed è un elemento chiave di app concorrenti come Acorns, Chime e Wealthsimple.”

Con la simbolica IPO di Robinhood ora impressa nella nostra memoria recente, i titoli come affermato sopra sono esempi perfetti per la nostra discussione. Gli investimenti nel mercato azionario microfinanziato incarnano questa evoluzione verso una classe di investitori di massa. Io, per esempio, vedo questo cambiamento intorno a me, nella mia vita professionale nel settore degli hedge fund, in una cultura di crescente FOMO, avidità e ansia, fino alle mie interazioni personali con amici e familiari e sui social media. Credo persino che questo sia ciò che molti politici e tecnocrati aspirano consapevolmente a incentivare. E mi disturba.

Quali sono le implicazioni di una tale trasformazione della società? E quali sono le sue cause profonde?

Queste domande aperte che sorgono da questa osservazione sono una delle ragioni per cui sono così attratto e incuriosito dalla congettura di Srinivasan in primo luogo. La sua dichiarazione apre la porta a una serie di discussioni e tocca alcuni temi molto importanti.

Alcuni di questi temi relativi all’inevitabilità di un’economia decentralizzata sono argomenti che verranno discussi in maggior dettaglio nella seconda parte di questa serie. Nel frattempo, prepariamo il terreno comprendendo perché viene incoraggiata una classe di investitori di massa, come porterà a una centralizzazione ancora maggiore e come tutte queste porte aperte sono scale mobili a senso unico, garantite per portare a ulteriori decisioni dipendenti dal percorso , e alla fine generano un’instabilità quasi infinita e una fragilità sistemica.

E ciò che diventerà estremamente chiaro sarà l’interazione olistica tra l’inevitabilità e l’insostenibilità di questo percorso su un lato della medaglia. E poi la persistenza di bitcoin dall’altra parte, aspettando pazientemente che il suo turno venga issato in aria, girando freneticamente, sebbene calmo e raccolto mentre pazientemente anticipa un atterraggio a faccia in su.

Una metafora a sandwich

Ciò che la profezia di Srinivasan espone inconsapevolmente è la realtà di un pericoloso periodo di transizione in cui si trova attualmente l’economia globale. In questo momento ci troviamo in uno stato confuso di limbo, precariamente incastrati tra decentramento e centralizzazione.

L’energia culturale di questo fluido stato temporale suscita certamente un certo “inquietudine nell’aria”, sebbene il crescente malcontento sia palpabile. E proprio come gli eventi della pandemia di COVID-19 hanno spinto l’intensificarsi di molte tendenze, una di queste tendenze è davvero una manifestazione di una classe di investitori”proletariato”e in espansione aggressiva. E mentre una tale progressione ha molti attributi positivi-che vanno dall’autoaffermazione, l’opportunità di creare nuova ricchezza nel breve periodo, e l’educazione finanziaria sui mercati, la gestione del rischio, il denaro e la teoria economica-tutti questi benefici sono purtroppo fuorvianti e di breve durata. avvistato. Alla fine, questi benefici molto tangibili sono destinati ad essere diluiti e sconfitti da forze minacciose.

Le ragioni principali per cui una mercificazione della classe degli investitori è un’evoluzione così pericolosa possono essere principalmente attribuite al tempismo, contesto storico e le implicazioni di ciò che questa società di investitori di massa richiederà sotto forma di effetti secondari e terzi derivati.

Si prega di pazientare di seguito, poiché questa prima sezione è inevitabilmente pesante con alcuni dati finanziari e terminologia. Tuttavia, tali dati sono indispensabili per aiutarci a comprendere il quadro più ampio di ciò che sta accadendo e ripagheranno ulteriormente l’articolo e la serie man mano che espandiamo le idee più grandi della nostra tesi.

Non sono un arrogante. Non vivo in un bunker. Ho visto troppi investitori cadere vittime di narrazioni eccessivamente ribassiste, perdendo grandi inflazioni di asset che tale negatività ha offuscato. Lo scopo di questo saggio, tuttavia, non è quello di presentare qualche tesi di investimento a breve termine. Detto questo, ciò che ho iniziato a testimoniare con crescente chiarezza come investitore, come membro della nostra società che si preoccupa del mondo che ereditano i miei figli, è la crescente evidenza di una trappola inevitabile. Una trappola con una sola soluzione realistica. Quindi, i dati finanziari qui riportati sono semplicemente uno strumento, un linguaggio per aiutarci a vedere questa intuizione. In effetti, il messaggio principale di questa serie riguarda molto meno la finanza e i mercati, e molto di più la natura umana, la storia e l’impatto che gli incentivi e il conflitto ideologico avranno sull’esito della maggior parte di questo secolo.

Quindi, abbi pazienza mentre ci porto più in basso in questa tana del coniglio di blocchi predestinati nella nostra catena di reazioni.

Blocco uno: il contesto storico conta. Si scopre che il tempismo è tutto

Una classe di investitori di massa, guidata da false premesse e incentivi perversi, si sta formando ironicamente dopo un periodo di inflazione storica senza precedenti.

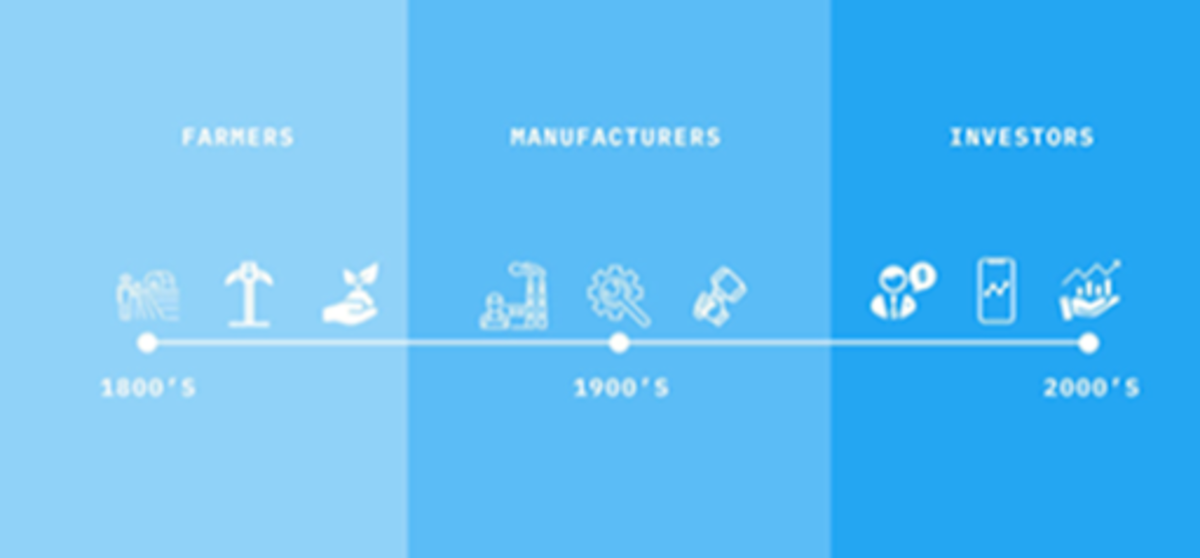

Abbiamo appena assistito a oltre 40 anni senza precedenti di inflazione delle attività finanziarie, accumulo di debito, deregolamentazione e opulenza monetaria. Un epico mercato rialzista obbligazionario in cui il tasso privo di rischio è passato dal 16% a quasi zero, il mercato azionario relativo alla nostra capacità produttiva è record (vedi grafico sotto), quasi tutte le metriche di valutazione sono ai massimi storici e il comportamento irrazionale ha si è espansa drammaticamente (esemplificata da SPAC, r/WallStreetBets, titoli meme, debito con margine al dettaglio e, naturalmente, molte tasche dell’universo”cripto”).

Allo stesso tempo, anche la leva governativa e aziendale sono entrambe agli estremi. Queste statistiche diventano ancora più eccessive una volta contabilizzate le passività pubbliche fuori bilancio come la previdenza sociale, l’assistenza sanitaria, gli obblighi pensionistici e i budget per la difesa fuori bilancio. Questo in aggiunta al prendere in considerazione le rosee ipotesi di guida aziendale e molti team di gestione aziendale che diventano disperatamente creativi con trucchi per aggiungere guadagni e strategie di ingegneria contabile aggressive. Detto diversamente, il singolo investitore si sta professionalizzando alla fine di una delle più grandi feste omeriche di tutti i tempi. Perdona la metafora del baseball cliché, ma questo è come un giocatore che viene chiamato dalle leghe minori subito prima della bassa stagione, dopo un drammatico finale di sette partite delle World Series.

È davvero un buon sviluppo per la società? Questo è in realtà piuttosto tipico del comportamento osservato e della partecipazione che si verifica nei periodi di punta dei mercati rialzisti. Tuttavia, ci sono alcune differenze chiave qui rispetto al tipico scoppio di bolle.

In primo luogo, ci riferiamo a tale comportamento nel contesto di questi investimenti fatti con il pretesto di una nuova professionalità e di cambiamenti di carriera potenziati. C’è un senso di diritto alla ricchezza e un’aspettativa sia da parte dei decisori politici che dei nuovi investitori che è loro diritto ottenere ricchezza dai mercati dei capitali, e di farlo con pochissimi rischi incorporati. Inoltre, come evidenziato da un tasso di partecipazione al lavoro in calo, una società di investitori crea un doppio rischio. Man mano che sempre più persone rinunciano ad altre modalità di lavoro, diventiamo una società di”affittuari”piuttosto che di”operatori”. Rovesciamo la freccia della storia che ha sempre portato a una maggiore specializzazione e divisione del lavoro. Quindi, non solo ora più individui sono esposti alle attività finanziarie che mai, ma questa coorte in espansione lo ha fatto a costo di opportunità di lavoro perso e salari guadagnati altrove.

La posta in gioco è più alta e il margine di errore più basso. E tale comportamento viene effettivamente approvato sia culturalmente, come mezzo per rivoltarsi contro la classe benestante, sia politicamente, come un diritto liberale per la proprietà dei beni di vedere una maggiore distribuzione, senza alcun riguardo al valore e al rischio sottostante di tali beni. Questo è diverso da una semplice bolla finanziaria transitoria. Questa è una mongolfiera che fluttua nella stratosfera, per non sentire mai più il fermo abbraccio della terra.

US capitalizzazione di borsa rispetto al PIL in dollari nominali, 1971 ad oggi. Fonte: @LudiMagistR, Bloomberg

L’adozione di classi di investitori di massa sta accelerando.

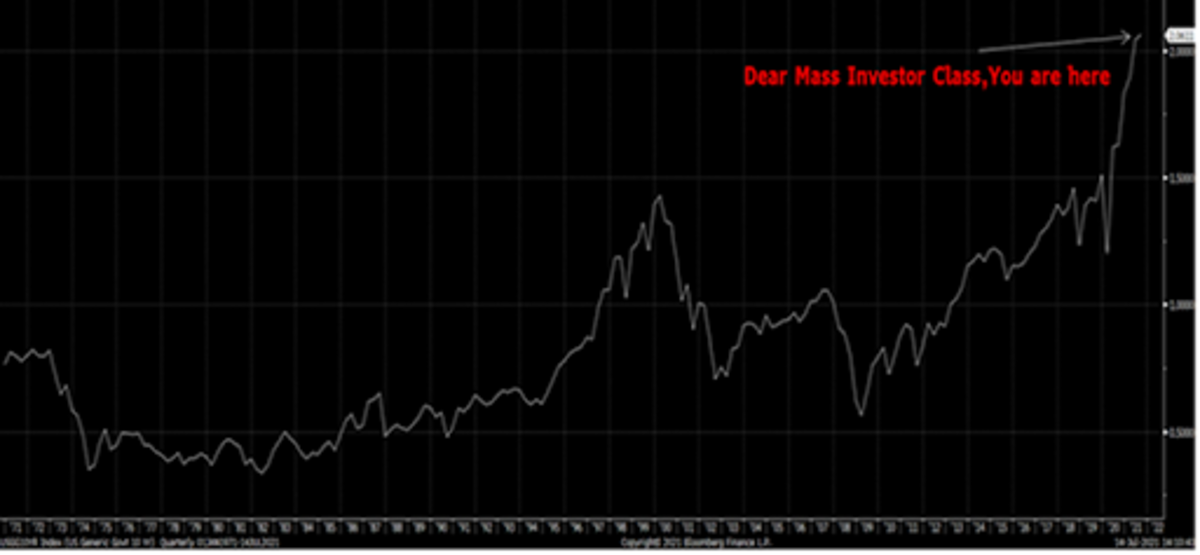

Il tasso annualizzato di afflussi azionari finora per il 2021 è di circa $ 1 trilione. Per una certa prospettiva, questo è maggiore dell’afflusso cumulativo totale in azioni nell’intero periodo degli ultimi 20 anni!

Fonte: Bank of America; Michael Hartnett

Il grafico sopra illustra l’afflusso annualizzato di $ 1 trilione in azioni nel 2021, rispetto agli afflussi cumulativi di azioni di $ 800 miliardi dal 2001 al 2020. Lascia che affondi per un minuto prima di continuare questo saggio. Vediamo così tanti grafici, meme e statistiche folli e senza precedenti in questi giorni, che è facile sorvolare su questo grafico. Ma questo dice davvero qualcosa di profondamente preoccupante su dove stanno andando le cose.

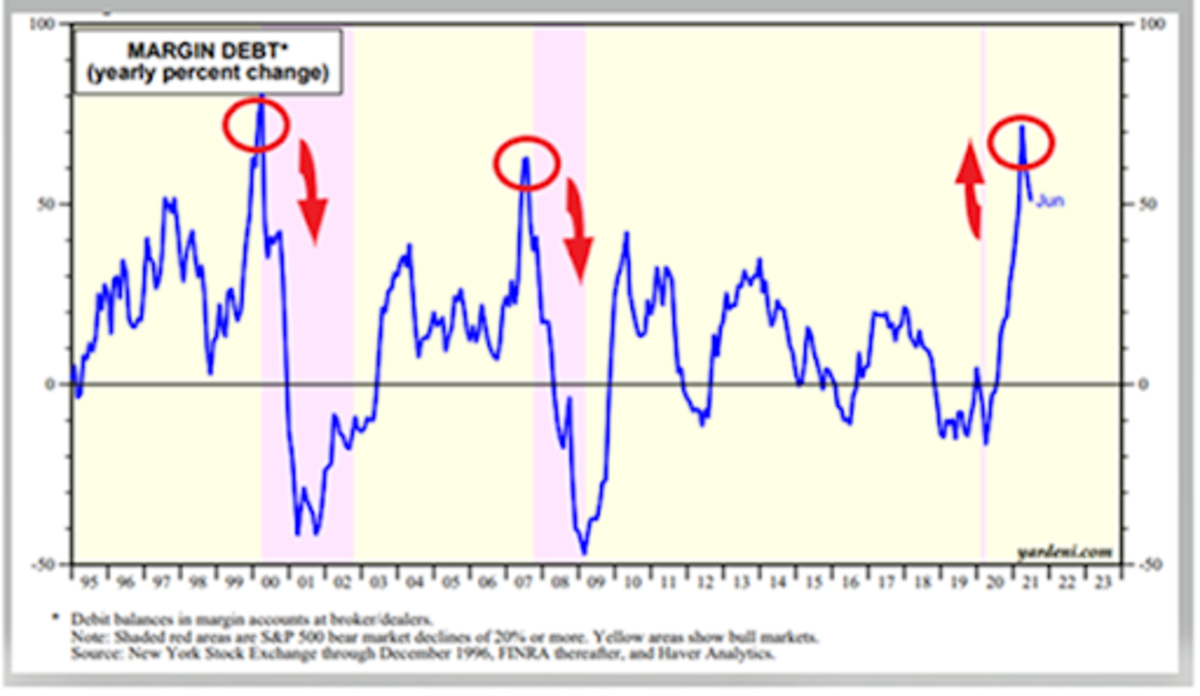

Il debito a margine per la negoziazione di azioni con leva finanziaria, monitorato dalla Financial Industry Regulatory Authority (FINRA), è stato storicamente un segnale di eccitazione e avidità degli investitori individuali (o”al dettaglio”) all’interno dei mercati azionari.

Il grafico sottostante traccia il tasso percentuale annuo di aumento del debito a margine, che storicamente ha anticipato le recessioni, contrassegnate dalle regioni viola. Tuttavia, possiamo vedere nel periodo recente che il margine è aumentato a un ritmo storicamente senza precedenti, forse con un picco nel breve termine.

Ma l’osservazione chiave qui è che questo rapido aumento si è verificato dopo quella barra viola, piuttosto che prima. Il debito marginale non ha preceduto una crisi, ma ne è stata la risposta. Abbiamo visto indizi di questo nel 2009, ma è stato dopo una massiccia eliminazione della leva bancaria e immobiliare e un’ampia svalutazione dei valori delle attività. La crisi del COVID-19 non ha consentito tale epurazione e ha istituito politiche per rinvigorire drasticamente gli investimenti azionari al dettaglio. Questo è un nuovo comportamento.

Fonte: Ed Yardeni (yardeni.com); NYSE; FINRA; @LudiMagistR

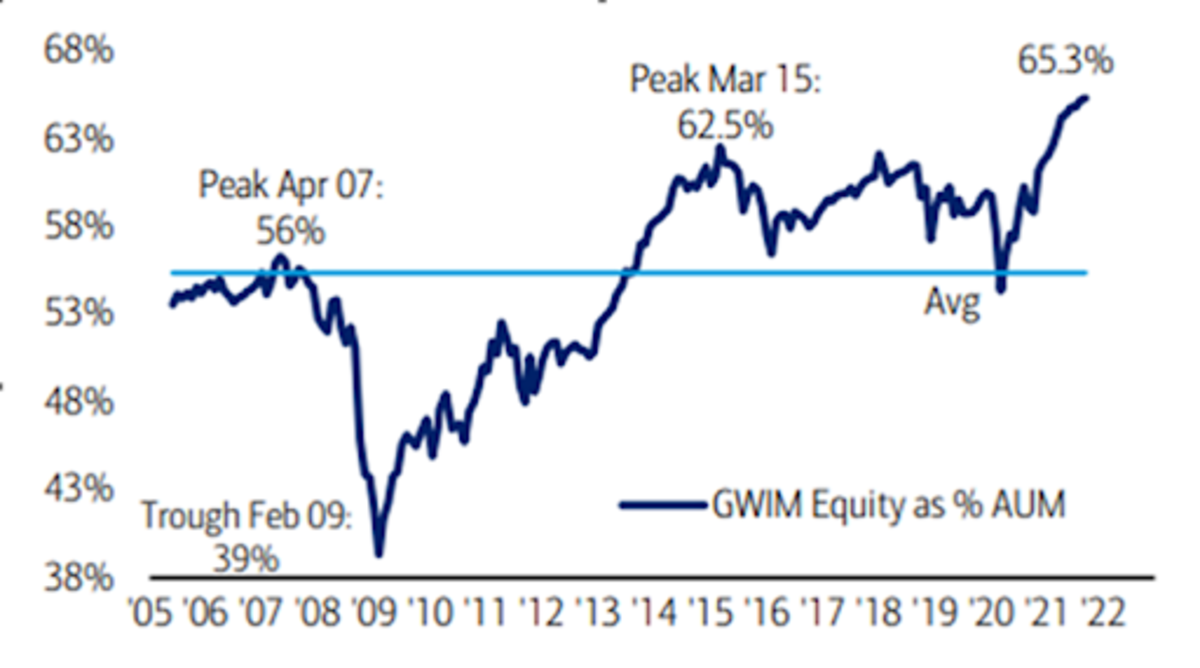

L’allocazione azionaria dei clienti di Bank of America (BofA) Wealth Management è ai massimi storici.

Partecipazioni azionarie private di BofA come percentuale del patrimonio gestito. Fonte: Bank of America; Michael Hartnett

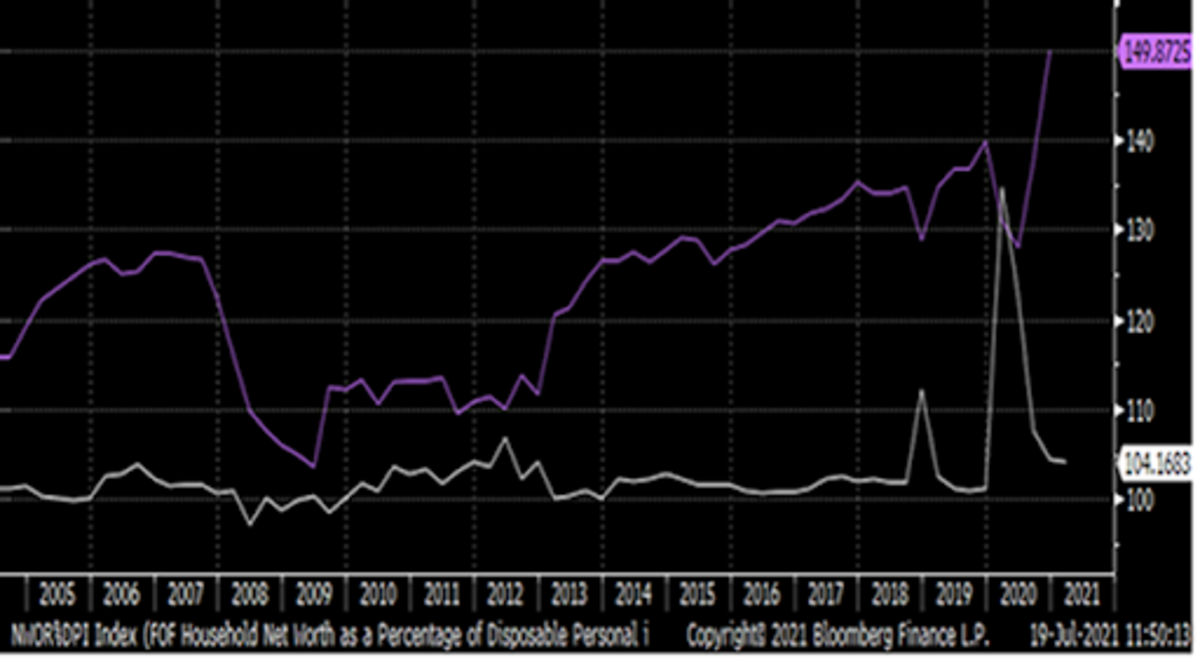

Patrimonio netto delle famiglie in percentuale del reddito personale disponibile (viola), rispetto al rapporto tra tasso di crescita anno su anno del risparmio personale/tasso di crescita anno su anno del patrimonio netto (linea bianca. Fonte: @LudiMagistR, Bloomberg, St. Louis Federal Reserve

Ciò che questo ultimo grafico direttamente sopra dimostra è che gli individui negli Stati Uniti non stanno più accumulando risparmi dal reddito in eccesso, ma dall’inflazione delle attività. e le attività finanziarie sensibili all’inflazione sono ora le principali riserve di valore per la maggior parte delle famiglie che possono permettersi di possederle.

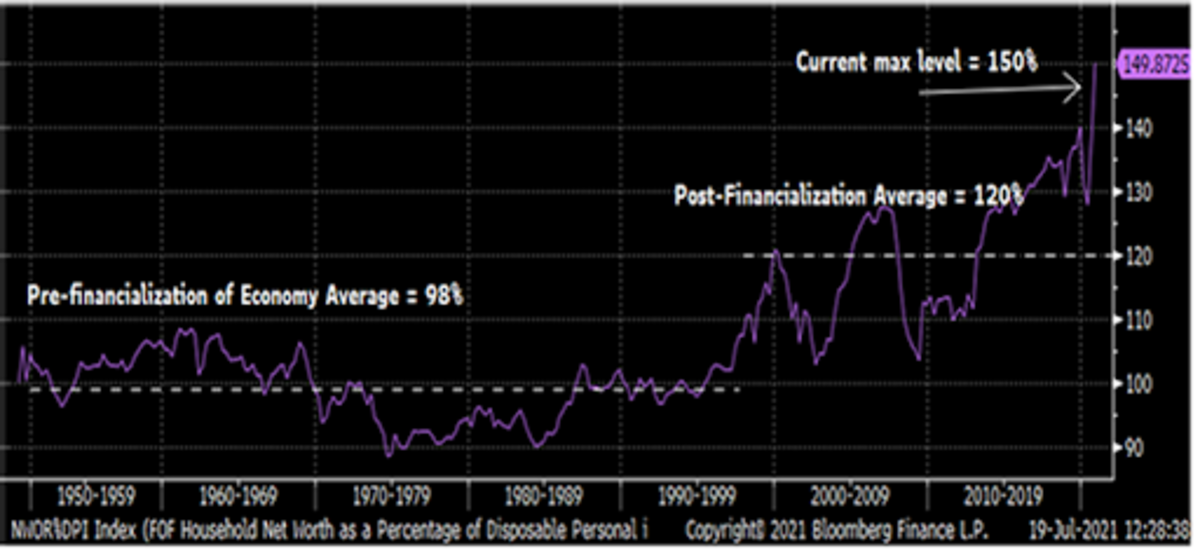

Per un contesto storico più ampio, di seguito è indicato lo stesso patrimonio netto delle famiglie come percentuale di reddito personale disponibile, risalente al 1945.

Fonte: @LudiMagistR, Bloomberg, Federal Reserve di St. Louis

La morte se la distruzione creativa

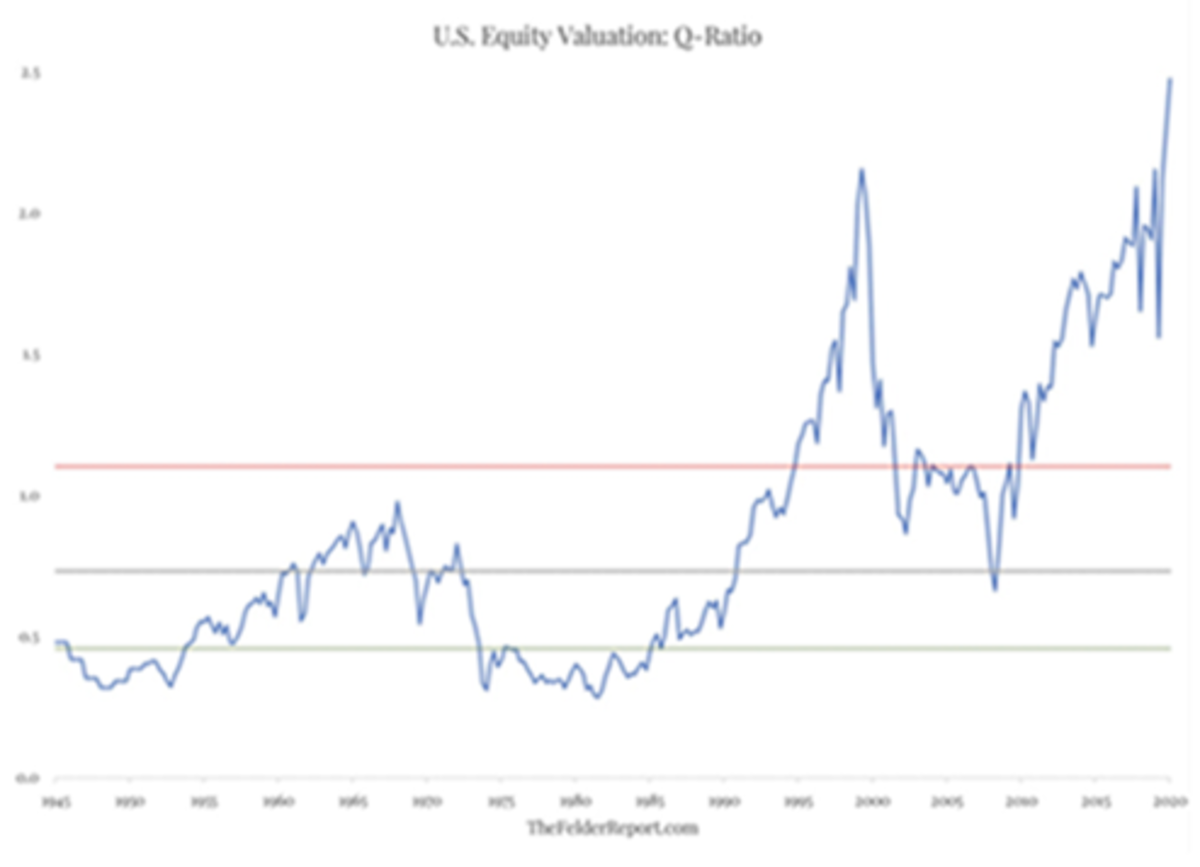

Di seguito è riportato un grafico di un indicatore noto come Quoziente di Tobin, noto anche come”rapporto Q”. In sostanza, è il rapporto tra l’attuale capitalizzazione del mercato azionario, divisa per il costo di sostituzione reale delle attività associate a quell’equità.

Come visualizzato nel grafico sottostante, questo rapporto è a livelli storicamente senza precedenti. Il grafico va dal secondo dopoguerra al presente ed esprime che le valutazioni azionarie sono attualmente quasi due volte e mezzo il loro valore di sostituzione. Ciò si confronta con un rapporto medio di 75 anni più vicino al valore di sostituzione.

Certo, questa analisi non è priva di sfumature, poiché la nostra economia si è spostata in un’era dell’informazione caratterizzata più dalle economie digitali, in cui le risorse diventano più intangibili e quindi diventa più difficile valutare i costi di sostituzione come la proprietà intellettuale e la buona volontà degli effetti di rete. Ma anche se teniamo conto di questo cambiamento, l’attuale rapporto Q si attesta ancora a oltre tre volte il valore di sostituzione, rispetto all’era del busto pre-dot-com degli anni’90 con una media del valore di sostituzione di 1,4 volte e un post-dot.com media dell’era busto di più vicino a 2,3 volte il valore di sostituzione.

Non importa come si suddividono i dati, ciò che dimostra è l’enorme estensione di società valutate finanziariamente in un modo completamente slegato dalla loro realtà economica. Le cosiddette società”zombie”che non dovrebbero esistere in un mercato veramente libero, spesso portando grandi quantità di debito improduttivo per sostenersi, prosperano in un nuovo mondo così coraggioso. Queste entità intrappolano il buon denaro e lo tengono pietrificato all’interno di strutture in decomposizione. In qualità di investitore professionista che trascorre molto tempo a investire in crediti aziendali ad alto rendimento, vedo questa follia su base giornaliera.

Ad un certo punto, l’unico modo per riconciliare tali squilibri è tramite ristrutturazioni di massa, fallimenti e insolvenze o attraverso l’inflazione. L’inflazione agisce per aumentare il denominatore del valore di sostituzione, in una pozione alchimista di rettitudine superficiale. L’inflazione, come testimoniato nel corso della storia umana, è di gran lunga la soluzione più appetibile per gli economisti, gli investitori di Wall Street e, naturalmente, i politici che hanno una visione del mondo di due o quattro anni.

Ma l’ironia di questo fatto è che una tale realizzazione spiega anche come siamo arrivati fin qui.

Quoziente di Tobin, 1945 ad oggi: valutazione del mercato azionario rispetto al valore di sostituzione dell’economia. Fonte: The Felder Report

The Denial Of Quality

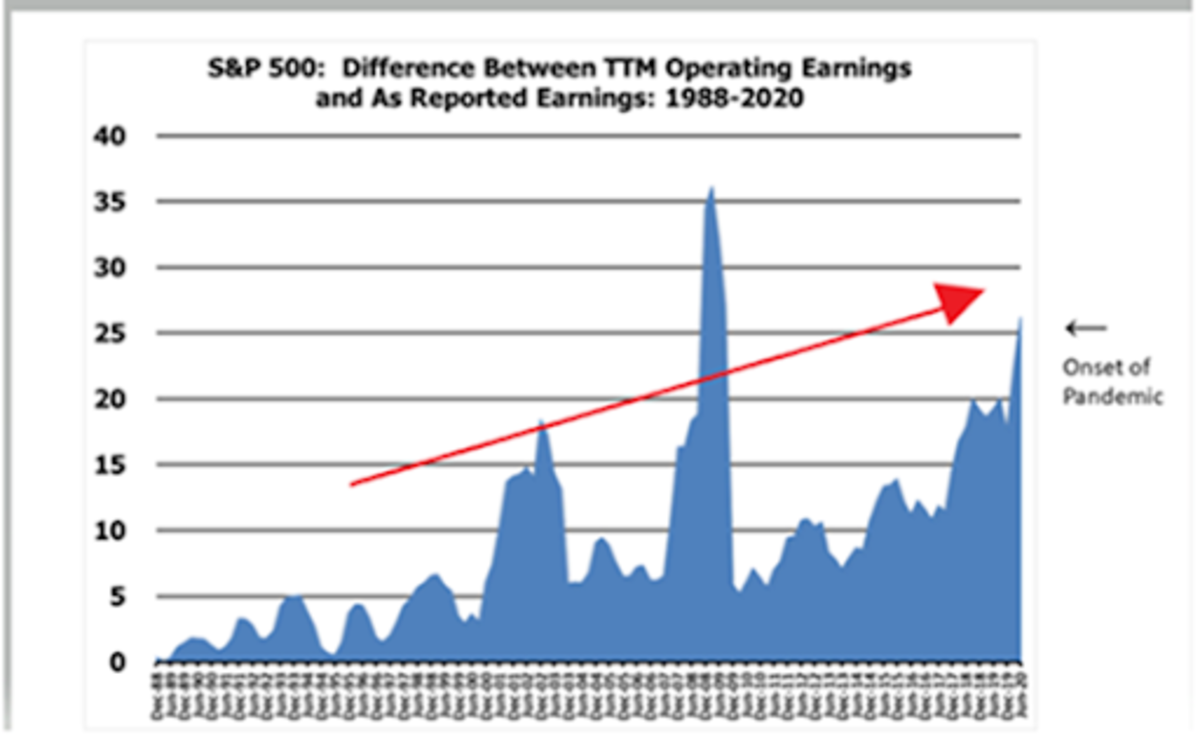

Di seguito, possiamo osservare ulteriori prove di un calo della qualità. In questo caso, non ci riferiamo solo al crollo della distruzione creativa e della qualità del bilancio, ma alla qualità degli stessi guadagni aziendali complessivi.

Le stesse metriche di cui ci fidiamo per aiutarci ad accertare il complesso mondo dei dati che ci circonda sono state manipolate e manipolate al punto che la misura è diventata l’obiettivo. GAAP, o”principi contabili generalmente accettati”, è un protocollo contabile progettato per limitare la svalutazione dei guadagni attraverso aggiunte opache, arbitrarie e fuorvianti. A volte, ci sono effettivamente delle rettifiche non-GAAP valide che devono essere fatte per ottenere un quadro accurato del reale potenziale di guadagno del tasso di esercizio di un’azienda. Nel complesso, tuttavia, tali adeguamenti”non-GAAP”al reporting GAAP hanno avuto la tendenza a produrre un’immagine di minore integrità e fiducia.

Nonostante ciò, ci siamo così abituati a tali aggiustamenti che i partecipanti al mercato e le autorità di regolamentazione hanno accettato la deviazione graduale senza battere ciglio. Forse non sorprende che le rettifiche non GAAP siano state”radicate nel tessuto del reporting finanziario ” nel 1988, quando molte politiche di finanziarizzazione dell’economia accelerarono. Vale anche la pena ricordare che la maggior parte delle spese di compensazione basata su azioni viene aggiunta ai guadagni non GAAP. Quindi, c’è una dinamica autoreferenziale in gioco qui, poiché i guadagni non GAAP aumentano l’aspetto dei profitti, contribuendo a gonfiare le valutazioni delle azioni, che a loro volta gonfiano la stessa compensazione basata su azioni che sta aiutando a gonfiare i guadagni in primo luogo !

Il grafico seguente mostra lo spread degli utili non GAAP meno gli utili GAAP:

Questo spread tende a salire nelle recessioni man mano che si accumulano perdite non operative. Ma è interessante notare che, negli anni oltre la recessione, la tendenza riprende il suo percorso verso una qualità più debole.

Fonte: Lark Research

Blocco due: una mongolfiera

Il risultato di questa situazione è che la fragilità del sistema aumenta rapidamente, rendendo necessaria una dipendenza deterministica dal percorso di un aumento dei dati manipolazione, supporto governativo, regolamentazione e intervento sul libero mercato.

Un tale contesto storico di valutazione e performance degli asset come articolato sopra significa che l’ampliamento dell’esposizione degli asset finanziari a una popolazione più diversificata e più ampia crea un rischio sistemico inaccettabile per l’economia nel lungo periodo. Per prendere in prestito una frase della teoria dei giochi, il mercato azionario diventa un singolo punto di fallimento.

Come ho esposto in un precedente articolo,”Thinking Too Small And The Pitfalls Of The Inflation Narrative”, diventa anche un mezzo per stampare denaro insidioso tramite la creazione di attività finanziarie, piuttosto che evidente espansione dell’offerta di moneta delle generazioni dei nostri genitori e dei nostri nonni. Questo incentivo a gonfiare per decreto di azzardo morale-o inflazione di attività finanziarie implicitamente garantita-è ancora più facile da realizzare quando la tecnologia rende sempre più prodotti e servizi più economici o del tutto privi di costi, e quando i vincoli di fornitura come quelli che stiamo vivendo ora rendono il consumo di “cose” fisiche meno desiderabili o addirittura impossibili in alcuni casi.

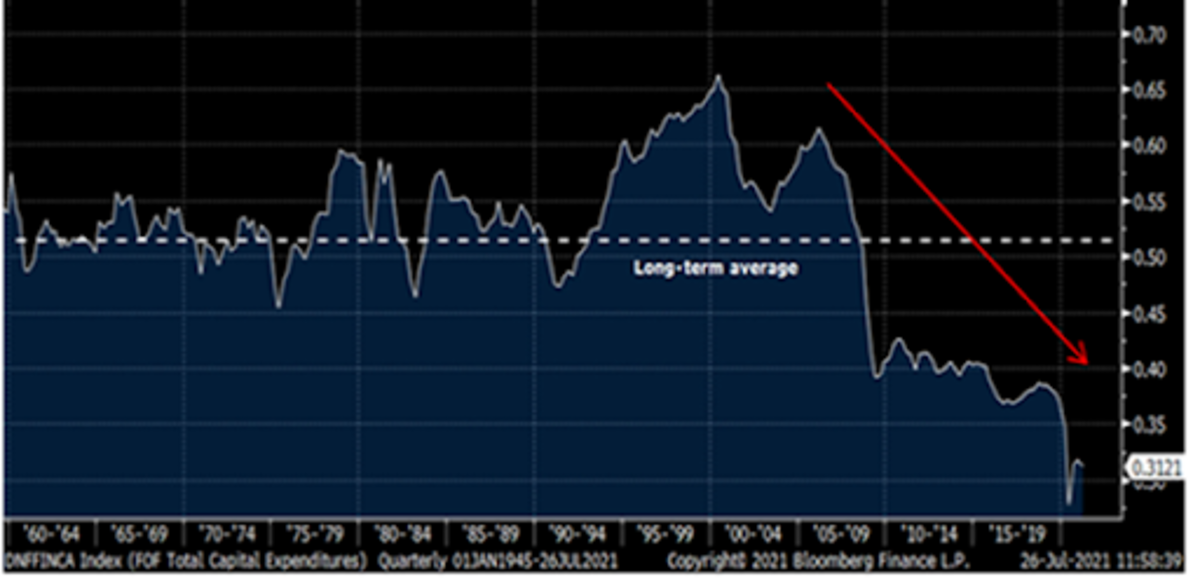

I mercati del debito a prezzi adeguati creano ostacoli al ritorno agli investimenti che incentivano solo quegli sforzi che possono creare nuovo capitale produttivo. Il debito eccessivamente economico incentiva la leva finanziaria dello stock di capitale esistente, senza la necessità o il desiderio di guadagni produttivi. E anche quando alla fine vengono fatti nuovi investimenti di capitale, il chiaro incentivo è farlo con quel finanziamento a basso costo, piuttosto che con risparmi e flussi di cassa. Questo alla fine porta anche gli allocatori di capitale produttivi verso percorsi di leva finanziaria eccessiva.

Nel frattempo, mentre le attività si gonfiano, l’unico modo per mantenere il tenore di vita desiderato consiste nello spostare i risparmi invece in attività finanziarie più rischiose come azioni, obbligazioni e immobiliare. Questo perché il ritorno sull’investimento per la nuova formazione di capitale richiede sempre più tempo rispetto al recupero dello stock di capitale esistente quando l’inflazione è quasi assicurata dall’azzardo morale sistemico. Aggiungete a questo il fatto che i tassi di interesse oppressi e manipolati stanno rubando proprio dal futuro per il quale verrebbe investito nuovo capitale (discusso più sotto). Ciò disincentiva ulteriormente qualsiasi investimento materiale in nuovo capitale sociale.

Il grafico seguente traccia un rapporto tra le spese in conto capitale totali degli Stati Uniti in dollari nominali, diviso per il denominatore della moneta base immessa nel sistema, misurata dall’offerta di moneta M2. Da quando ha raggiunto il picco nella crisi delle dot-com, gli investimenti in nuova formazione di capitale sono crollati rispetto alla creazione di nuova moneta. Questo pone la domanda retorica su dove tutto il nuovo denaro in eccesso sta fluendo, se non verso la nuova formazione di capitale. La risposta sono le risorse finanziarie, ovviamente.

Fonte: Bloomberg; @LudiMagistR

Quindi, gli incentivi sono chiari come un duro colpo di Stoli. E, per la maggior parte degli ultimi 30 anni, solo i ricchi hanno fatto parte di questo progetto di gioco, guadagnandosi un posto al tavolo con le loro risorse esistenti, il loro”prova della posta in gioco.”

Tuttavia, sta diventando sempre più evidente che l’azzardo morale onnipresente, un’ulteriore riduzione delle preferenze temporali e i risparmi appena coniati sono i più fase successiva efficiente in questo albero decisionale del falso libero arbitrio. I responsabili politici su entrambi i lati della navata hanno incentivi ad abbracciare una tale narrativa. Mireranno a guidare il patrimonio netto della classe media rispetto al vecchio manuale relativo al miglioramento del reddito della classe media, all’istruzione, agli ammortizzatori sociali e alla ridistribuzione delle tasse. Nel frattempo, la parte destra passerà volentieri il testimone dall’economia monetarista dal lato dell’offerta, con il suo”hopium”autoilluso che la corporatocrazia americana condividerà la ricchezza, e allo stesso modo abbraccerà l’inflazione finanziaria e il capitalismo socializzato. La destra percepirà tale centralizzazione dei mercati dei capitali come sgradevole, ma migliore di un’alternativa al socialismo e alla redistribuzione keynesiana. Entrambe le parti scambieranno i loro principi fondamentali per una soluzione che effettivamente dia risultati, anche se a un costo enorme.

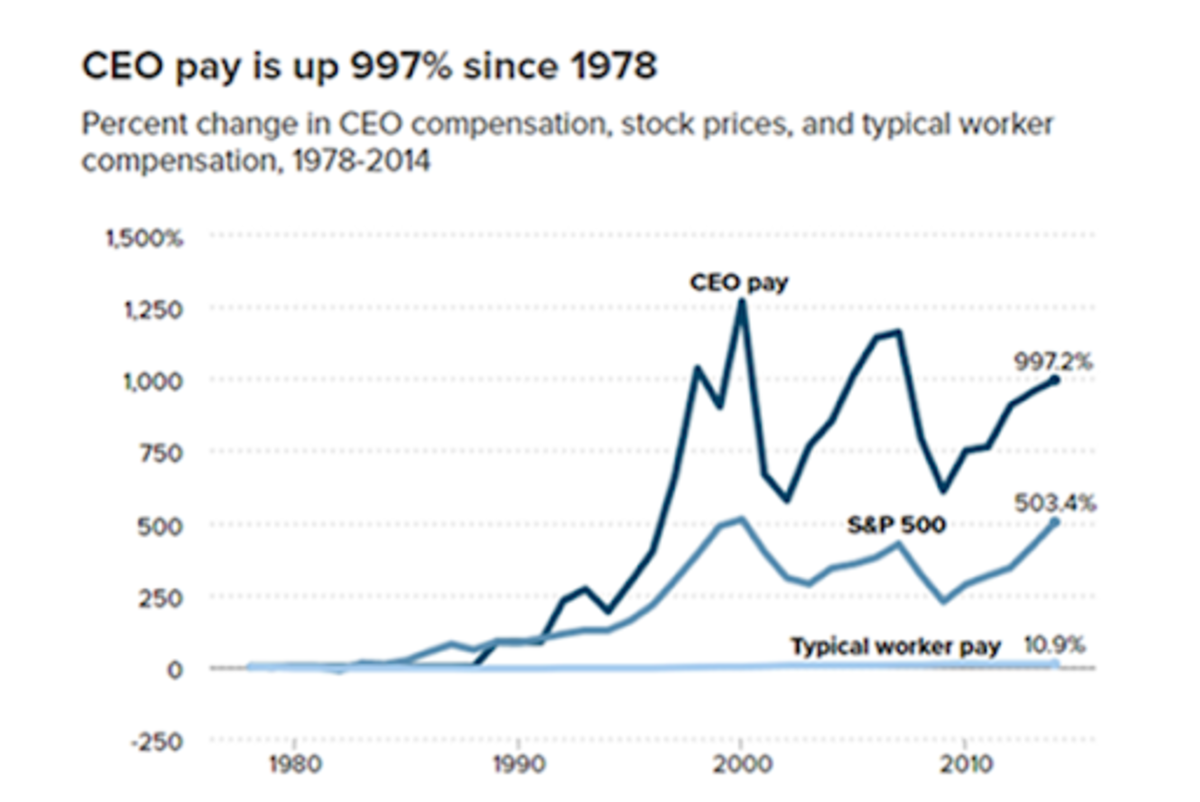

Se fossi un decisore politico guardando il grafico sottostante, quale sarebbe il meccanismo meno rischioso e più ovvio per correggere tale immensa divergenza? Facile: basta collegare la”paga del lavoratore tipico”all’S&P 500 e boom! Missione compiuta!

Fonte: Istituto di Politica Economica; Dati economici della Federal Reserve (FRED)

Ok. Quindi, supponiamo che ora abbiamo la palla rotolante e stiamo davvero iniziando a legare la retribuzione dei lavoratori al mercato azionario attraverso vari mezzi. Ma come si realizza un’impresa del genere? Non è che il governo possa costringere i datori di lavoro a pagare gli stipendi sotto forma di indici di borsa.

Beh, non direttamente. La risposta sta in una ricetta mista di incentivi alterati. L’azzardo morale e l’implicito sostegno dei prezzi azionari, come descritto sopra, sono certamente l’epicentro di tale strategia.

Ma ce ne sono infiniti altri: maggiori risparmi individuali indotti dal bilancio con incentivi a investire eventuali risparmi in eccesso; sforzi di de-globalizzazione che incoraggiano i cittadini statunitensi a investire e risparmiare di più sul mercato interno piuttosto che sulle importazioni di consumo dalla Cina; e la naturale progressione della tecnologia e dell’innovazione finanziaria semplicemente”facendo le loro cose”, creando maggiori rampe d’accesso per gli investimenti democratizzati-esempi di ciò sarebbero prodotti come fondi negoziati in borsa (ETF), piattaforme di trading come Robin Hood che semplificano l’utente esperienza, blog basati sui social media, canali YouTube e piattaforme di infotainment alternative che creano fiducia e poi cospargono questo brodo con una buona dose di FOMO a livello culturale. Un altro meccanismo ovvio sarebbe attraverso imposte sul reddito più elevate per deviare denaro verso investimenti finanziari e maggiori tasse sulle plusvalenze per incentivare il comportamento HODLing del mercato azionario. Questi sono solo esempi. Il punto qui è che c’è una cassetta degli attrezzi illimitata disponibile per perseguire tali obiettivi, sia intenzionalmente che organicamente attraverso gli incentivi naturali del sistema.

“Ma aspetta”, dici. “Cosa c’è che non va in un tasso di risparmio più alto e meno consumi? Dopotutto, non è questo un principio fondamentale di molti Bitcoiner?”

Il problema è che anche prima di un tale cambiamento di carriera sociale come stiamo assistendo oggi, il livello dei prezzi delle attività rispetto a il loro valore fondamentale aveva già superato un punto di non ritorno, creando un frustrante senso di fatalismo per molti partecipanti al mercato con gli occhi aperti.

Decenni di tassi di sconto in calo hanno già rubato così tanto valore al futuro che non ci sono più germogli di crescita futura che possano mettere radici. Quindi, il problema qui non è il risparmio in sé e per sé, ma i pascoli di risparmio specifici in cui gli individui vengono ammassati. Il risparmio non è risparmio se non viene incanalato in vere riserve di valore. Esattamente l’opposto, infatti. L’unico modo per mantenere gli attuali standard di vita richiede tassi di crescita perpetui dei prezzi delle attività, che a loro volta richiedono sempre più debito.

Se il governo e gli influencer culturali normativi dovessero esportare una tale dinamica alle masse, quale dovremmo aspettarci che sia il risultato? Eguaglianza e abbondanza utopiche? O è una pianificazione centralizzata, un libero mercato emarginato e un’attività economica socializzata? Hai indovinato! Porta numero due, Bob!

Fonte: Business Insider, CBS

Blocco tre: matematica

Una delle variabili più influenti che storicamente è stata associata alla fine di periodi di grande stabilità e forza è stata la disuguaglianza di ricchezza. Mentre tale asimmetria è raramente l’origine di un collasso sistemico, è quasi sempre un sintomo del decadimento, e altrettanto spesso svolge un ruolo nel catalizzare il punto di svolta verso il declino. Dai Maya all’Impero Romano, dai Tre Regni Cinesi agli Ottomani fino alle rivoluzioni francese, russa e cinese, la disuguaglianza di ricchezza ha sempre giocato un ruolo importante.

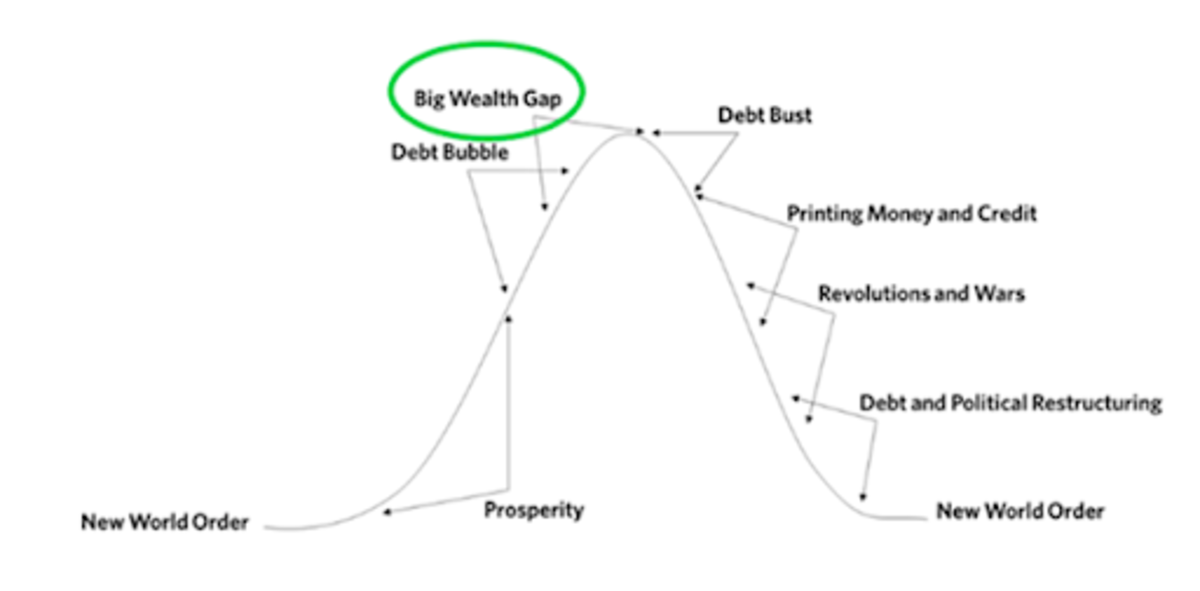

Fonte: Ray Dalio,”The Changing World Order”, capitolo uno

Questo è un grosso problema per la strategia della classe degli investitori di massa. This is because a goal of wealth redistribution with a strategy centered around asset inflation is statistically impossible to achieve.

Many proponents of this new investor class take the “fight fire with fire” approach. Yes, asset inflation — driven by modern monetary policy — has been the prevailing impulse of inequality over the last several decades. Why should the average individual not be able to get their just desserts as well? Ethically speaking, I take no issue with such retribution to some degree.

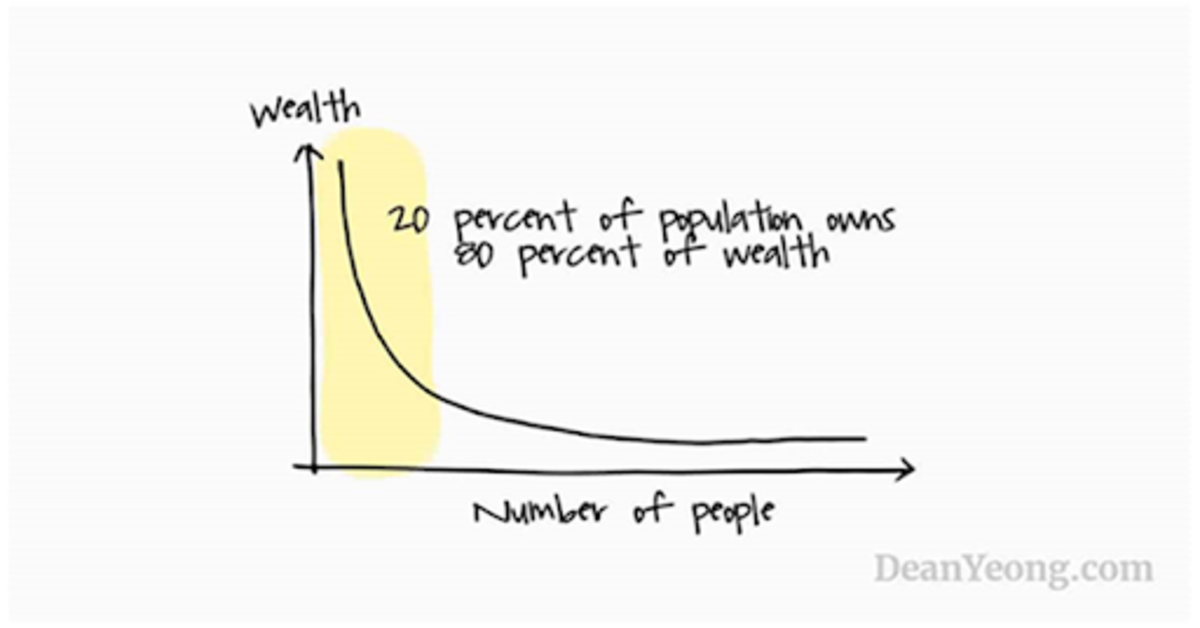

Unfortunately, it’s an illusion. The presiding growth curve that has been empirically witnessed as it pertains to wealth distribution has been found in the Pareto principle, a probability distribution whereby a small percentage of the sample group acquires most of the attainable value. Facets of this law, more colloquially known as the “80/20 rule,” are observed not just in wealth distribution, but prolifically throughout much of nature and human social environments.

We have experienced at least a half-century of Cantillon effects that have supported asset owners in exponentially outperforming relative to income owners. Even if we disposed entirely of such Cantillon effects and allowed the broader population equal access to financial assets going forward, and even if financial assets continued to generate historically anomalous returns, the “80 percenters” would never catch up. The reason for this is simply due to the nature of exponential growth curves as seen in the Pareto principle. Inequality would be maintained at the very least, if not continue its asymptotic expansion.

Pareto’s law: How asset inflation becomes a highly entropic state for wealth distribution, regardless of policy.

Source: DeanYeong.com

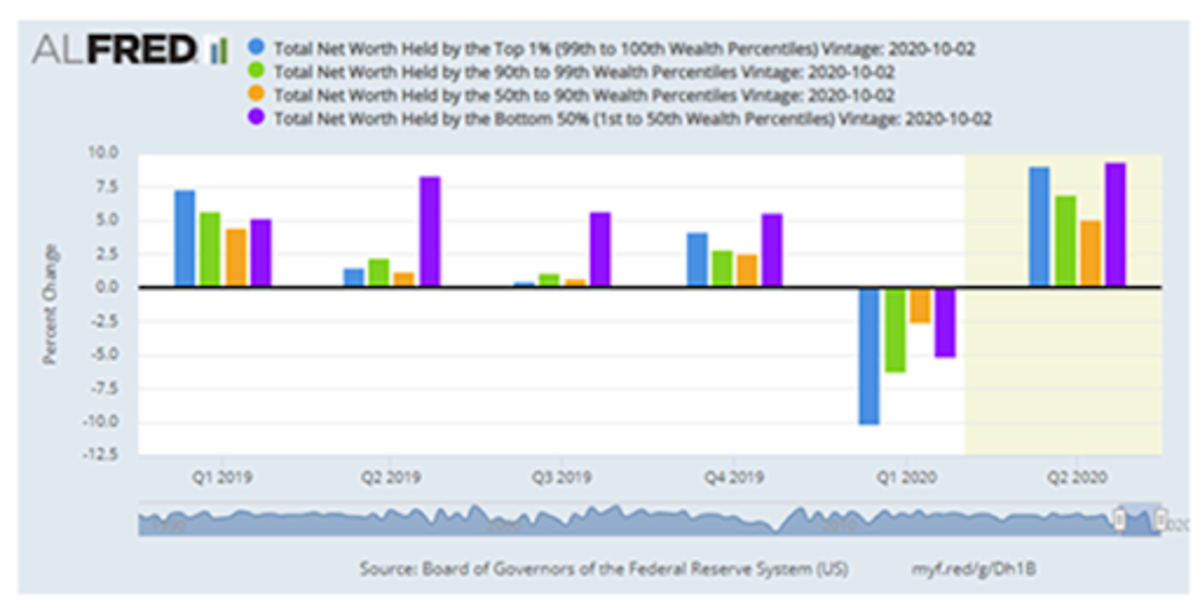

This Pareto probability distribution is exemplified quite dramatically after looking at 2020 as an outlier year, whereby the least wealthy percentiles actually saw the largest percentage improvement in wealth. However, while this is a lovely-sounding statistic for social media hype and political propaganda, it is purely a mathematical outlier caused by starting from such a low base and from such a low level of prior financial asset ownership.

Unfortunately, the banner year for the bottom 50% (purple bar below), did next to nothing to narrow the wealth gap from the top percentiles, as evidenced by the below chart.

Source: Federal Reserve

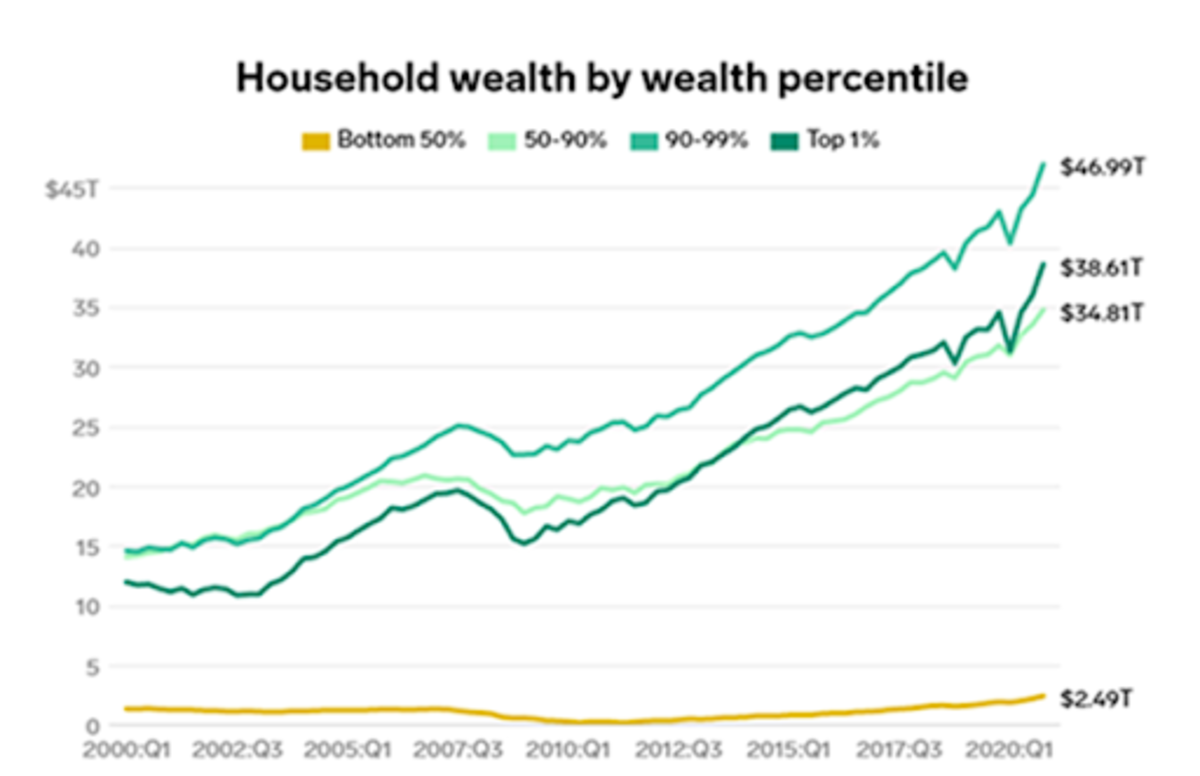

2020 did nothing to rectify the problems of inequality. In fact, inequality only got worse. Why would a continuation of asset inflation look any different in the future?

Source: Federal Reserve, “Distributional Financial Accounts”

If inequality cannot be corrected by the only policy tools available, the risks for social instability will only rise further. Ironically, when stability is threatened, this tends to only increase levels of centralization.

Have you ever been driving your car on a wet, slippery road, only to fish-tale unexpectedly? While our instinctual response would be to tense up and violently steer the wheel in the opposite direction to regain control, such a reaction would only worsen our dire predicament. One must steer into the chaos. Once control has gone, such a fate must be embraced, not opposed. This is the only way out. Further attempts at control only make matters worse.

Block Four: All Roads Lead To One Road, More Centralization

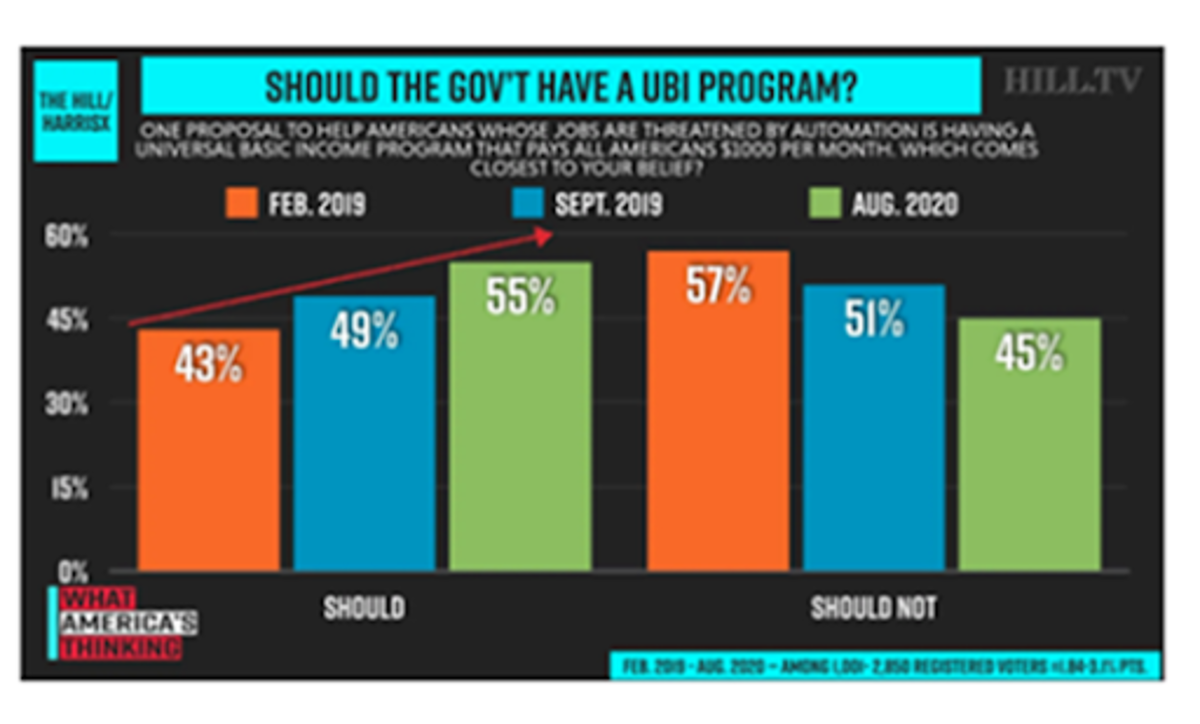

Once the inevitability of blocks one, two and three as stated above are appreciated, the path dependency of block four in our chain becomes absurdly apparent: Subsidizing asset prices through monetary debasement becomes the oblique way that society yields to ideologies like universal basic income (UBI).

UBI may end up in the very long run as explicit social welfare programs, or “helicopter money.” Of course, during COVID-19, we saw some discreet examples of this, turning something merely theoretical into a tangible part of the societal zeitgeist. However, it is a mistake to assume a linear path, that such policy will now settle as the initial and most effective vector for such policy going forward.

A more frictionless pathway would be the mechanism outlined above, whereby social welfare can be extolled circuitously. The brilliance of such a policy approach is that it would not require any incremental pieces of legislation, and no constitutional alterations to property rights. There are no foundational legal constraints. This implies that our current institutions have the power to accomplish such social welfare goals today.

One could argue that some changes would certainly make these aims easier to administer, like augmenting the Federal Reserve Act of 1913 and expanding the powers of the U.S. Treasury Department. However, the key point here is that such change is not required. If the reader finds this too far fetched, I would recommend listening to the taped conversations between ex-President Richard Nixon, and then-Federal Reserve Chairman Arthur Burns. It has happened before in this country, and in less dire circumstances.

Source: TheHill.com

UBI advocates are here, and they have their own network effects:

“The map references not only networks with the sole purpose of advocating UBI, but also all organizations (networks, foundations, platforms, political parties, working groups within political parties, societies, study groups, etc.) that advocate for UBI.” Source.

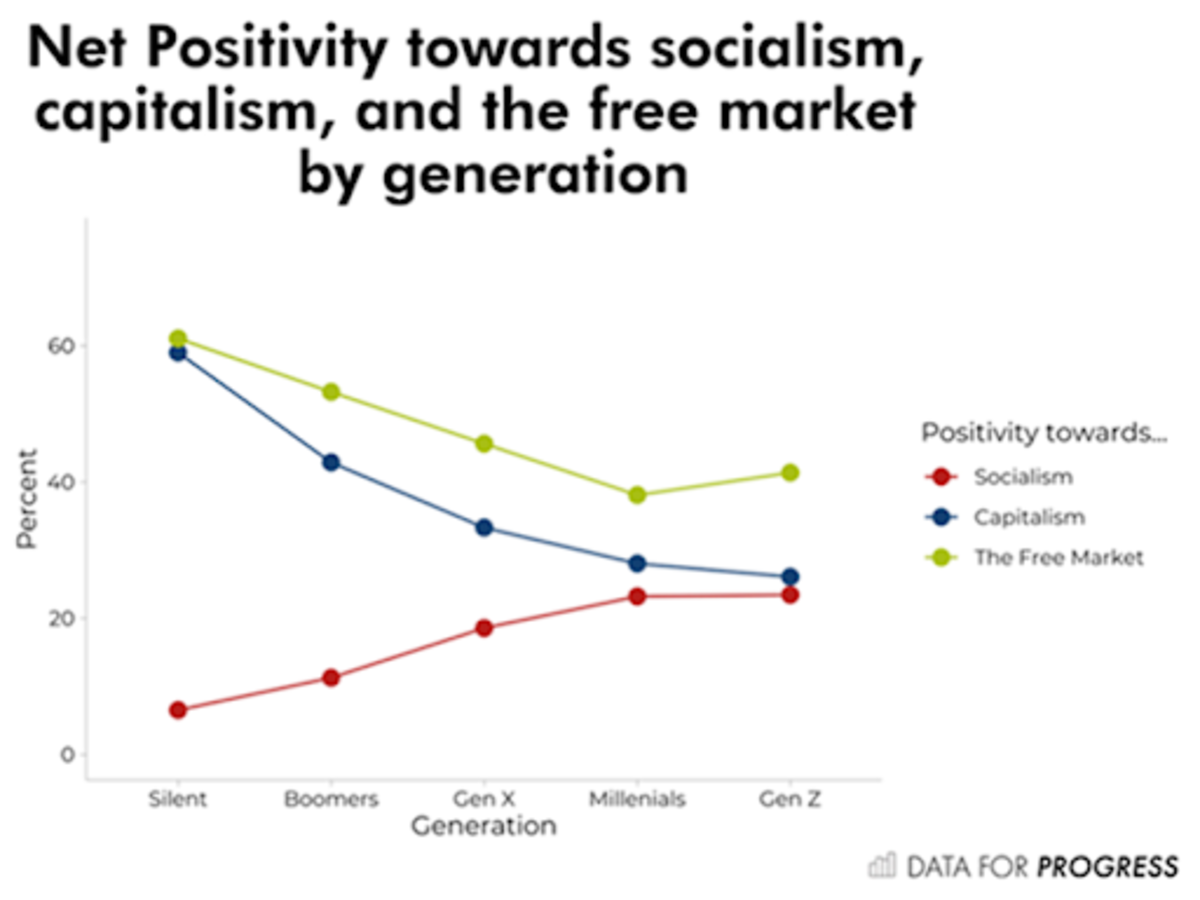

American openness toward socialism, and a commensurate disdain for capitalist ideals, has increased dramatically over the last four generations. This has been well documented with recent generations, particularly millennials, but it is important to recall that such a trend has been consistent well before that, even with the boomer generation relative to their parents and grandparents.

This is rather alarming when one considers that this generation has been the biggest beneficiary of financial asset prices (coincident with the full embrace of the fiat monetary system) of any generation in American history.

A Quick, “Passifict” Detour: Passive Investing Socializes Capitalism

Bitcoin may be humanity’s historically most perfect manifestation of a pacifist revolution, but passive investing is also a revolution, only with completely opposite implications.

Historical analogues are always dangerous, and each generational crossroads exhibit unique characteristics that can change the entire spectrum of outcomes. However, as a reference point, current trends reverberate with echoes of previous centralizing efforts designed to redirect our collective future and shift the public behavior, reminiscent of Franklin D. Roosevelt’s “new deal,” as well as Nixon’s “great society,” or even going back to German Chancellor Bismarck and his social welfare policies in the 1880s, which greatly enhanced the Second Reich’s military capacity.

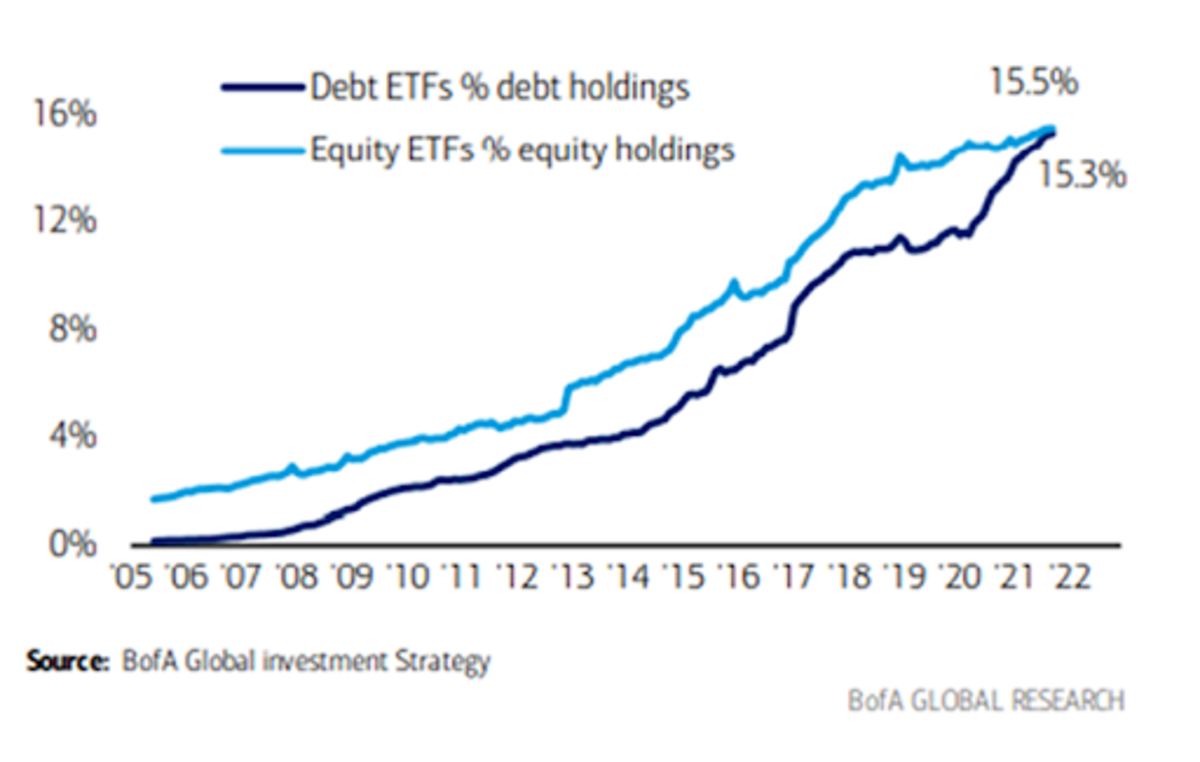

Passive or indexed investing vehicles such as exchange-traded funds (ETFs) are yet another example of this shift toward a “mass investor class.” While such a trend may seem innocuous, it is cultivating the seeds of enormous societal change.

As discussed by Inigo Fraser-Jenkins, a highly-regarded maverick quantitative equity strategist at Wall Street firm Bernstein, passive investing can be compared to Marxism. This may sound hyperbolic, but unfortunately, I believe he is on to something important here, the point being that the democratization of capital markets by way of ETF proliferation and other passive investing products inadvertently leads to a socialization of capital.

It would all but complete our societal transgression from liberal democracy to social democracy, a trend that has been gradually underway, but accelerating over the past 75 years. Fraser-Jenkins compared passive investing to other societal externalities like the tragedy of the commons, whereby behavior that may be optimal for the individual investor can be quite negative for the aggregate society when all actors behave the same way (we will return to the problem of the commons later).

The unfettered expansion of passive investing does not look likely to subside any time soon. This is especially obvious when one simply looks at the below chart, or even at the hiring behavior on Capitol Hill, like the large representation of Blackrock alumni acquiring key roles in the current White House administration. Blackrock is the number-one manufacturer of passive investment vehicles in the world, with over $1.8 trillion in assets under management (followed by Vanguard in second place at $1.2 trillion).

Additionally, ESG and clean energy investment mandates further this shift, creating new products to bundle into thematic passive investment securities. Such bundles make it easier for ESG-approved companies to redirect capital away from those companies that do not fit the homogenous definitions prescribed. To be clear, there is nothing intrinsically bad about incentivizing cleaner energy and more sustainable economic practices. Of course, this is a good thing! However, when rules for such behavior become formalized, complex, and sometimes arbitrary and naively general, they impinge upon the competitive dynamics of free markets that would accomplish such goals more effectively.

Instead, such rules generalize the flow of investment, compensating those market participants best suited to game such a system. The new game defines the winners as those best able to adhere to the appropriate definitions as a means of acquiring low-cost capital. In a road paved with good intentions, we potentially end up in hell, robbing free markets of innovation, nuance, and differentiation. We write new rules of the game, rules that thoughtlessly increase centralization.

Mike Green, a distinguished researcher of passive investment stated back in 2020:

“Of managed assets, [passive investment] is now greater than 50% [and over 40% of total market capitalization]. That split though, is not uniform across demographics. Millennials are almost 95% passive. Boomers are only 20% passive. For the vast majority of millennials, their only exposure to the market… We make a lot of hype about things like Robin Hood and stuff, but the actual assets are tiny. The vast majority of the money that they’re getting is actually just going into things like Vanguard target-date funds.”

Active equity managers have seen outflows every year and passive investment vehicles have seen inflows every single year since 2006. And this trend is only accelerating:

Source: Morningstar

Source: The Wall Street Journal

Bank of America’s private client ETF holdings as percentage of assets under management (AUM). A hard trend to fight:

Source: Bank of America, Michael Hartnett

The passive singularity: Millennials have 95% of their retirement savings invested in passive vehicles. What is the logical conclusion of this freight train?

“One of the challenges that gets created as passive becomes a larger and larger share is that there becomes no discretion. There is no consideration of should the incremental dollar go in in the exact same fashion, right? That passive player has no instruction to sell. You exhibit increased inelasticity in terms of each incremental dollar that goes in. Imagine a scenario in which 100% of the owners of a company were passive and you tried to buy a share. There is no price at which they would be willing to sell to you unless they received an instruction from their end investors saying to sell shares to you. Prices could theoretically become infinite on that type of dynamic. Eventually, you would expect somebody to respond by saying, ‘All right, I will sell an additional share to you.’ Traditionally, that’s been accomplished by price-sensitive or return-sensitive discretionary managers who say, “Okay, this price is unwarranted by the fundamentals. Therefore, I’m willing to sell some of these shares to this person who’s expressing, in my view, an irrational demand for these shares.” If that demand is so strong and it gets absolutely extreme, people can synthetically create shares by shorting, but that is incredibly dangerous to do, an environment in which stocks are exhibiting this reduced elasticity.” –Green

The mass investor class faces a big incentive problem: What does the internet, digital property, and a tragedy of the commons have in common? Our retirement accounts.

The dismantled connection of choice from the capital allocation process brought about by passive investment proliferation has implications beyond the clear destruction of price signals. This is no small statement. A destruction of price signaling is as destructive as things can get for a capitalist system. Prices are the main form of communication we use in society to make appropriate economic decisions and choices. Its dissolution is of existential importance.

However, there are other problems to consider from this evolution of behavior as well. Ever since the runup to the 2016 U.S. presidential election, and at an accelerating pace since the onset of the COVID-19 pandemic, society has become more aware of the vast concentration of power that the internet giants and social media platforms carry.

Pockets of government and pockets of new and growing cultural progressive movements have quite easily influenced and incentivized these platforms to actively censor speech in our democracy. This is not a political statement, and this is not a judgement about the people being censored, but merely a factual observation about a key tenant of our democratic institutions. If the U.S. Constitution can be likened to the “core protocol algorithm” dictating the manner in which our collective network operates, this is a clear attack on one of the most vital rules of the protocol. How can we so readily dilute our core principals?

First, network effects are powerful. The ability of the internet companies to sustain and grow off individual resources, with extremely low detachment rates, cannot be underestimated.

How did this come to be? A failure in timing. As is often the case with disruptive technology, its usage preceded an appropriate infrastructure to handle it. Unfortunately, the Byzantine Generals Problem was not solved before the advent of the internet. Consequently, we have been suffering the consequences that a lack of enforceable property rights leads to in a digital world. A winner takes all society.

This is what the internet got wrong. You didn’t own anything. No one had any stake on the internet. Instead, value has been extracted by those who figured out ways to own the on-ramps and access points to the internet instead.

This group has become the “landlord class” of the internet, and the vast majority of value proffered by the internet and its myriad innovations of social communication has been funneled through this layer. The consequence, of course, has been more inequality, more surveillance and control, and more concentration of power. Further, we’ve witnessed a trend toward a reduction of quality of information. There is a diffusion of responsibility that engulfs the internet when ownership is so opaque and ephemeral. We are incentivized to create more noise than signal because when no one owns the land, there is no incentive to be a steward of that land to ensure its long-term sustainability, utility and productivity. Instead, the incentives align so as to be solely transactional. The more information one can manage, control and recapitulate, the more one can develop network effects and externalize the social and economic cost of a system that produces excessive noise and underproduces enough structured signals that could offer synergistic benefits across societal planes. That cost is shared by all of society. It’s a tragedy of the commons. All because the internet couldn’t address digital property rights.

The second issue here is that network effects also impact passive investing. Most passive vehicles are ETFs, that are indexed and weighted by market capitalization. The bigger you are, the more capital you attract. Size matters, aptitude and productivity do not. This takes us back to the Pareto principle and the 80/20 rule, setting the stage for increasingly non-linear distributions of capital. And in a world where access to low-cost capital is a massive competitive advantage, we end up with an obvious outcome. The big continually get bigger, and the small get only smaller. Or worse, the upstart disruptors may never have a chance, and we would never even know what could have been.

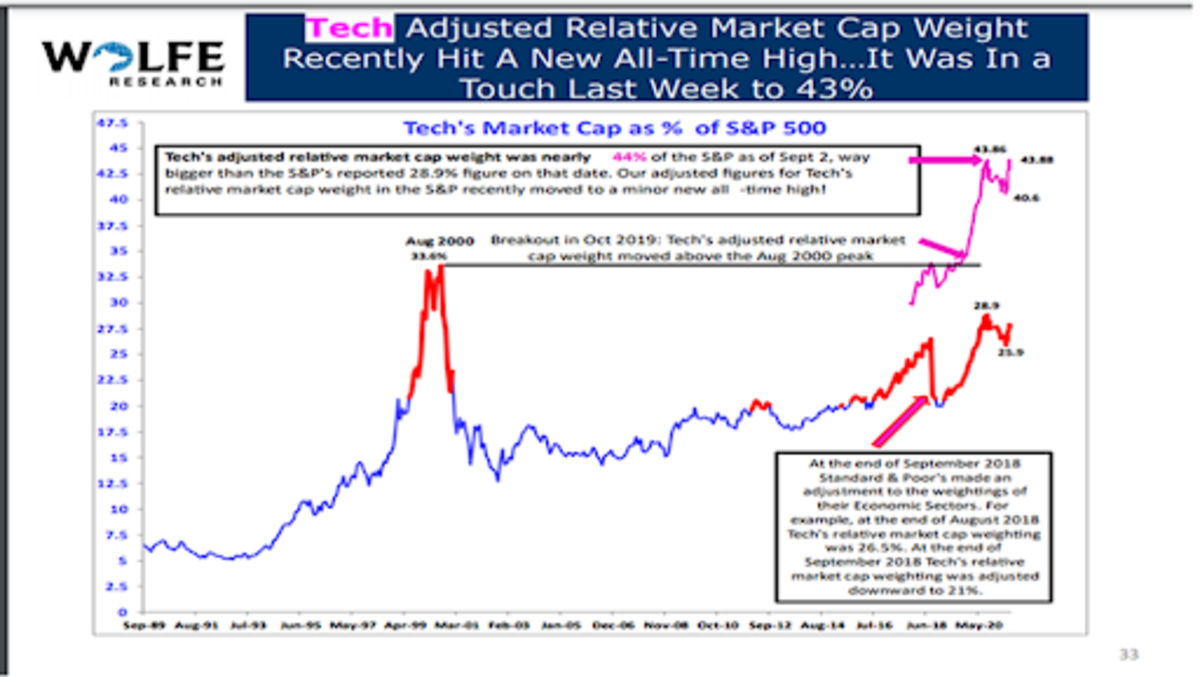

That brings us to the present, where just six behemoths have a near majority control of the entire equity market. Most investors do not blink at this statistic any longer. Professional investors have been numbed to such lopsidedness. However, imagine if such inequality persisted within the domain of political parties? In democratic institutions? In your childrens’ classrooms? But the real question we need to start seriously and honestly asking ourselves is this:

If the below chart only becomes even more extreme in its weighting distribution, and if our collective wealth is increasingly tied to the index it represents, what will our incentives be as the companies involved become even more centralized?

About 45% to 50% of our savings are tied to companies that could be actively censoring us, and indirectly eroding the very principles of the system that allowed them to prosper. This share of our savings will only grow further. Will we object? I certainly hope so. But so far, there is little evidence to support that aspiration. Unfortunately, passive investing, alongside a mass investor class, is likely to only help internet platforms and capital markets centralize further.

Major stock indices are mainly just six names now: Apple, Amazon, Facebook, Google, Microsoft and Nvidia, totaling 42% of the equity market.

Source: Wolfe Research

Block Five: All Roads Lead To Zero

What happens when zero volatility is the new equilibrium?

After our modest digression into passive investing, let us now return to the last block in our chain. The final and most deadly flaw in the chain reaction socializing financial assets relates to volatility and the cost of capital. Mathematically speaking, publicly-administered financial markets that demand continuous appreciation, distributed broadly and without diversification, will require volatility to trend toward zero over time.

A simple law in financial markets, when assessing an asset’s volatility (as measured by its standard deviation of returns over a given period), is that the more vulnerable to uncertainty an asset is, the less it can absorb volatility. This is why, for example, equity investors are generally willing to pay lower valuation multiples for cyclical or economically-sensitive sectors relative to secular growth or defensive industries. These types of companies are more vulnerable to unforeseen events. When our financial markets are a tool of policy rather than an expression of free market capital allocation, we eventually become incapable of withstanding any uncertainty. And manipulation to affect policy outcomes would be the only way to ensure uncertainty’s suppression. If successfully orchestrated, volatility must eventually collapse toward a zero bound to accommodate this.

As our centralized debt trap expands in circumference, the risk-free rate must also trend toward zero, as has been the case over the past 40 years. Over time, the consequence of this could even be the elimination of the need for a private sector.

This last section is essential to our thesis, as it is the bridge that transports us from the current transitional sandwich era where we find ourselves juxtaposed between centralization and decentralization. This is the last stop on this transitional train as we push relentlessly down the path toward a more authoritarian world order. Given its level of importance in our story, it requires some more detailed explanation.

Centralization As A Black Hole: The Volatility Singularity

Source: Disney, Pixar

What is the volatility singularity? Previously, we have established the logical chain of cascading events that are required in our world’s existing model.

Debt must go up, so stocks must go up. Thus, rates must go down, so volatility must go down. When this happens debt will logically go up, leveraging the system even more, so stocks must go up to prevent collapse and inflate the debt bubble with a greater equity cushion… (stop for breath)… So, rates must go down again until zero, so volatility must go down until zero.

Volatility collides with zero. Everything goes to infinity. Yippie! The transcendent state where the difference between nothing and everything gets very fuzzy and rather philosophically confusing. Just as observed in the case of black holes, where physics starts to behave mysteriously and spooky as one approaches the event horizon, so too do economies. Things start to get pretty eerie as we approach the zero point event horizon in volatility.

Thinking about the problem in the following simplified manner may be helpful:

Anything divided by zero equals infinity. Financial assets returns are a function of volatility. A common formula used to calculate risk-adjusted returns is called the Sharpe ratio, which is an asset’s return during a given period, minus a market risk-free rate, divided by the investment’s standard deviation of returns. If volatility is, for all intents and purposes, equal to zero, so too is its standard deviation. Thus, we end up in a confounding situation in which excess returns are divided by nothing, and therefore magically become, well… everything.

Image source. Source of quote: Kurt Vonnegut, “Slaughterhouse-Five”

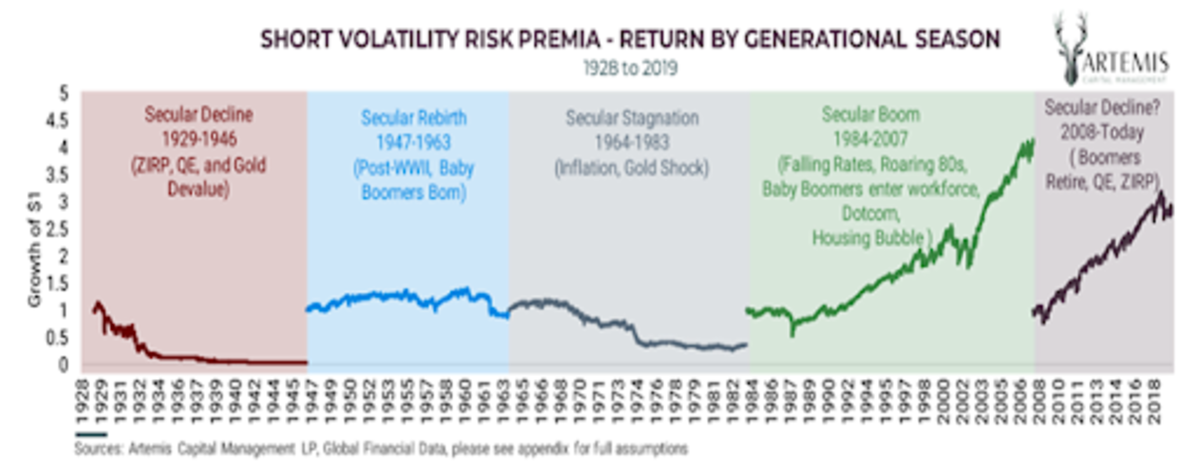

As macro volatility fund manager Christopher Cole excellently laid out in a 2020 piece titled “The Allegory Of the Hawk And The Serpent,” an investment strategy designed to short volatility, or benefit when it decreases, experienced temporally anomalous returns since the early 1980s, right when the financialization of Wall Street took off exponentially, and right as Alan Greenspan et al. began a campaign of moral hazard, at a time known as “The Greenspan Put.”

The stock market and nearly all financial assets in aggregate then become just a mere proxy for this “short volatility” expression.

Source: Artemis Capital, @vol_christopher

An Endangered Golden Goose

Cole, like many others, believes this period of declining volatility is mean reverting and must therefore repeal its nearly 40-year journey. While certainly possible over a cyclical short term time horizon given the magnitude of the move, a spike in volatility is unlikely to be palatable for any sustained period. The reason, as you might have guessed, is because of the deterministic nature of acceptable outcomes laid out above. The violence to the system that a spike in volatility would require would eviscerate so much wealth, so many debt obligations, that the policy response would be equally violent. Such a response is all but guaranteed because the crisis would be existential for those in power.

This outcome becomes more assured each day that goes by with greater reliance on financial assets to lift us into the future, each day that a citizen puts their first dollar of savings into such a system, and each day that another dollar is diverted away from new capital expenditure in favor of being recycled instead back into the existing sinkhole.

Below is a graph of the realized one-year volatility in the Dow Jones Industrial Index going all the way back to 1895. The pre-WWII average of this proxy for stock market volatility was about 20%, witnessing only one to two “black swan” spikes during a 50-year span. Meanwhile, the post-WWII average has been closer to 14.5%, with three black swan events observed only within a 30-year period!

This graph gives us two important pieces of information:

Volatility is trending lower over time. A move from 20% to 14.5% may not sound significant, but this is a nearly 30% decline in average volatility. The positive effect of such a shift has on underlying asset prices cannot be overstated. A system of declining volatility has come at the heavy cost of greater susceptibility to bouts of near-disastrous black swan events, external and internal shocks. And these events are not capable of being permitted to clear the imbalances that caused them, to self correct, as the system would break before such catharsis could be attained. Instead, each successive crisis forces policymakers to intervene at much lower levels of volatility than in the pre-WWII era. This of course fuels greater abdication of responsibility, which fuels the next crisis as we rinse and repeat, racing toward zero.

Source: @LudiMagistR, Bloomberg

Centralization Is A Fabergé Egg: Systems Which Require Stability And Efficiency Are Always Extremely Fragile

I recently came across a white paper authored by Ben Inker and Jeremy Grantham, famed hedge fund investors at GMO. They conducted a data mining project and looked at the prior periods of frothy financial markets like the 1999 to 2000 period, and similar historic periods of strong performance and excess returns. They were surprised to find that it wasn’t earnings growth, the level of real interest rates, or even GDP growth that mattered during such periods of excess and euphoria.

Instead, they found three consistent variables that were always part of the equation:

Atypically high profitability for one or some segments of the economy (this is finance speak for maximal efficiency rather than maximal productivity)The stability of GDP (as a proxy for overall economic activity)The stability of the rate of inflation

In short, markets care not about actual levels of growth, inflation and profits. Predictability is what matters. A financialized system and a mass investor class requires stability and loathes uncertainty. Said differently, our system of monetary inflation rewards monopoly formation, values efficiency over productivity, and requires reduced volatility to sustain itself.

Given that volatility is a natural phenomenon of any free system, suppressing it requires external and artificial forces. It requires a central authority to manage the system and to solve for low volatility. Our central bank policy of monetizing moral hazard is evidence of this. Moral hazard from this prism is simply a function that solves for low volatility, at all costs. And there are a lot of costs.

Moral hazard visualized: Credit Suisse Fear And Greed Index. Source: @LudiMagistR; Bloomberg; Credit Suisse

The Difference Between A Medicine And A Poison Often Comes Down To Dosage

While the importance of gains in efficiency are indeed a requisite aspect of technological progress as well as a tremendous generator of wealth for those providing such efficiency gains, there is always a trade off. A great example of this is the Bitcoin block size war of 2017, as well as the many utility protocols proliferating the crypto universe, optimizing for network throughput at the cost of much weaker decentralization. The irony is that the many use cases of blockchains become completely obsoleted without decentralization. Efficiency is great. It’s exciting. It often is associated with innovation. To a point.

Where is this point?

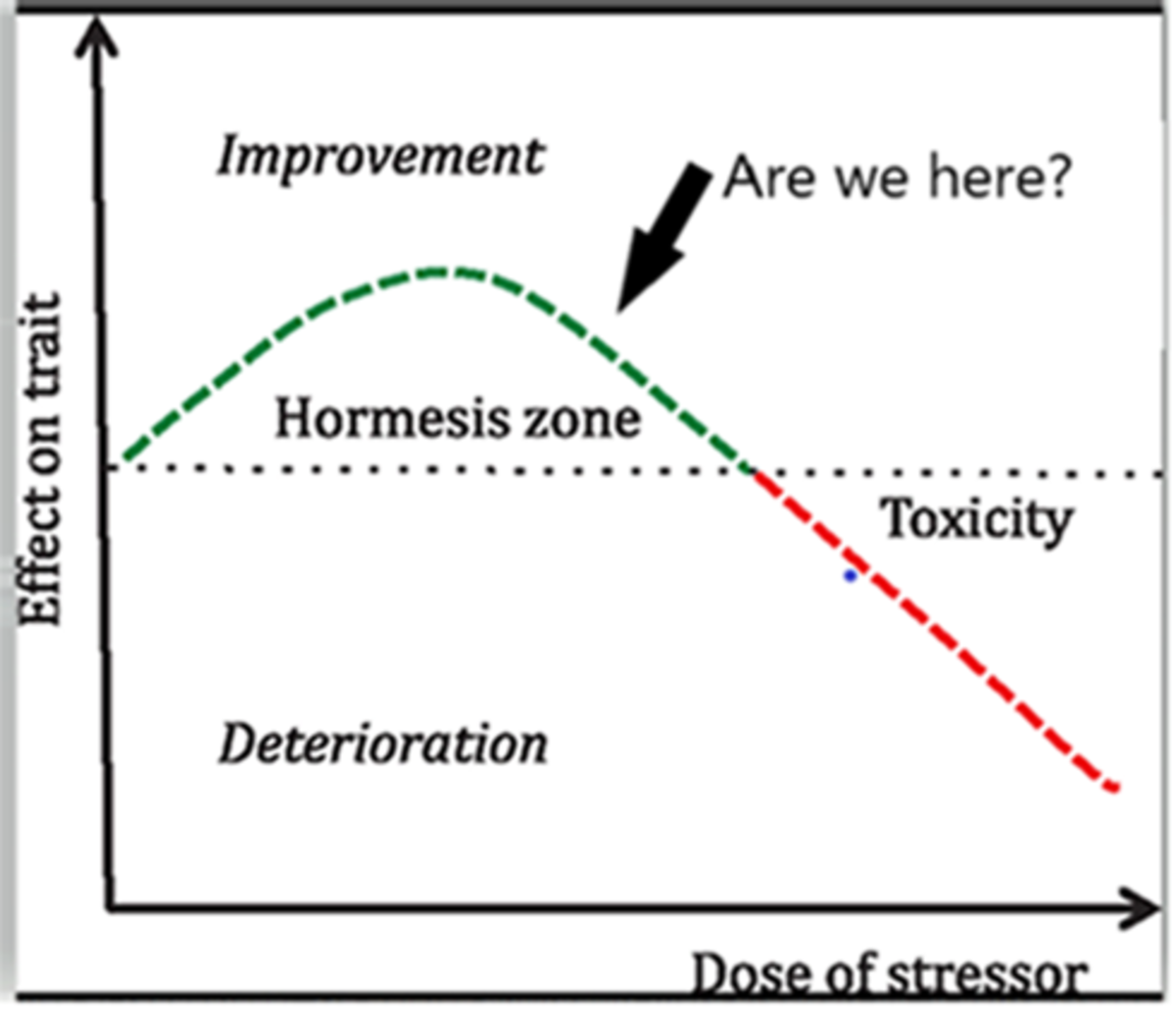

Any marginal gain in efficiency requires a marginal loss of resilience. Given that resilience is vague and incandescent, a decline can seem harmless until it suddenly breaks completely. This means that the relationship between efficiency and resilience is non-linear. There is always a point on the curve where the benefit of efficiency gains become precipitously overwhelmed by the cumulative trade-offs.

Source: Nassim Taleb, “Antifragile”; @LudiMagistR

Ok, fine. Let’s agree that the financial system is in fact becoming more fragile. What does this have to do with centralization of power? Shouldn’t a fragile system lead to the dissolution of power?

Short answer? No.

Less short answer? A centralizing power depends on vulnerability to validate its own existence. As the costs of centralization mount, is becomes existentially vital for an authority to lay claim on the sole ability to medicate the very ailments it fabricates, so as to traverse unstable times unscathed. Fragility maintains power. Power thrives on fragility.

Efficiency Is A Great Barometer Of Where We Are In The Macro Cycle

Why? Efficiency naturally peaks at the end of a regime. By the end of the regime, everyone assumes the cycle to be permanent because no one remembers a different world. We succumb to recency bias, forget history, and inadequately discount the inevitability of change.

Efficiency, fundamentally, is a way of optimizing processes or work to a specific environment. By the end of a regime’s lifespan, an environment’s self-selected economic participants have naturally maxed out adaptations to that one environment, having gone “all in” on its defining characteristics.

Thus, like a grain of sand placed on a growing sandpile, all that is needed is just one inopportune shift and the whole system cascades down with surprising fragility. A meteor hits, and we are cold-blooded, energy-consuming goliaths. Good luck with that!

We’ve of course seen this story time and time again throughout history, both at biological and evolutionary scales when diversity is overcome by uniform specialization, and throughout the annals of human history. This is one explanation as to why empires always eventually fall. Their successes eventually become their weaknesses. Efficiency helps fuel dominance in a world that values power as a function of resources, but it leads to dangerous deficits in resiliency that inevitably make them easy to destroy. This is also why empires are often built over long periods of gradual ascent, but often fall precipitously. Non-linearity.

Thus, somewhat counterintuitively perhaps, periods of maximal efficiency will precede periods of instability and upheaval.

An Obituary For The Private Sector

Now, let us return to volatility.

As the boulder of zero volatility and a fully-managed economy slides precipitously toward its Newtonian fate, there will slowly materialize some incredibly powerful implications for the structure of private property rights. This is because zero volatility and a required real risk-free interest rate held at zero or negative levels will logically push the aggregate cost of capital to extremes.

When there is no risk of material loss for capital, there becomes no discrimination as to how to invest it. The decision-making process becomes tied much more to government policy goals, cronyism and bribery, and other characteristics very similar to those of communist systems of governance. The corporation and the entrepreneur lose their utility in this world.

The birth of the modern corporation can be traced back at least to Adam Smith’s 1776 classic, “Wealth Of Nations,” interestingly published the same year that colonists here in America sought independence.

In this work, he lashed out at the “business association,” his era’s version of the state-owned companies, or the precursor of the “military-industrial” complex, or in China’s case the Sovereign-Owned Enterprise (SOE). These were institutions like the British and Dutch East India companies in Smith’s time.

He argued against monopolist business practices, which in turn paved the way for the legal autonomy of business outside the direct control of the government. As far back as 1844, corporations began earning the status of “personhood,” eventually granting them 14th Amendment rights in 1886. This paved the way for the evolution of corporate oversight toward the domain of the court system and not that of the executive and legislative branches.

The point here is that while we sometimes think of corporations as gatekeepers, monopolists, greedy beneficiaries of consumerism, debt and inflationary growth, these adjectives describe their failures within our current system, not their original purpose. The corporation was originally designed to bestow greater power to the entrepreneur and decentralize power away from the state.

By providing legal protections like limited liability, the corporate structure allowed for individuals to combine resources without unmanageable personal risk, which in turn allowed for the competitive acquisition of capital for investment. So, when the cost of capital and the risk of capital become immaterial, the existential purpose for the corporation becomes difficult to justify. And so the economy centralizes further with the erosion of one more source of decentralization.

What is so exciting about Bitcoin within this context is that it replaces the vacuum created from an impotent corporate private market structure with something much more decentralized and much better suited for the evolving digital information economy. It helps an increasingly interconnected economy divide labor beyond its current stalemate.

Bitcoin is a medium of specialization. Corporations were invented to be a specializing spoke of private capital, allowing for greater and more scalable division of labor. Unfortunately, in a world where the digital realm is becoming the majority sphere of economic activity, where individual property rights had not been assured prior to Bitcoin, the corporation instead has more often become a rent seeker, a bottleneck for competition, and a gatekeeper of digital property. This has had the perverse effect of decreasing our collective ability to specialize. Bitcoin solves this problem.

However, I am getting ahead of myself. We will get into this exciting potential in greater detail in part two of this series.

A Dangerous Cocktail: Why The Pareto Principle Matters

As the world becomes more interconnected, relationships become more “Paretian,” and less “normal,” or mean reverting. This is because the Pareto principle has shown empirically that complex systems often demonstrate extremely asymmetrical distributions of effect. Effects that only magnify as the system grows larger.

Prior to the interconnectedness driven by technologies and the scalability of digital networks, such Pareto effects were only discernible at ultra-large scales or where the complexity of the system was much larger than witnessed in everyday life, in fields such as macroeconomics, astronomy, geology, ecology and theoretical physics. But over time it is being appreciated just how pervasive this Pareto dynamic truly is.

In the business world, it has been shown that roughly 20% of customers often produce 80% of a company’s revenue. Eighty percent of a company’s output, likewise, is often generated by 20% of its employees. The pattern is found in many random systems. Eighty percent of highway accidents occur at 20% of the path traveled (near home), 80% of the cost of building is spent on 20% of the structure, and 20% of the world population is responsible for 80% of the pollution. The list could go on. But this simplified 80/20 rule actually understates the impact, as it is simply an approximate guide, the map rather than the road itself.

In fact, this 80/20 ratio can often turn into 99.9999/.0001 quite easily. Take a simple example where the square root of the total nodes in a given network is the number of nodes that are deemed to have the most measurable impact on that network. If we start with 10 nodes, we have about three nodes fulfilling that role, or about 30%. If the network grows to 500 nodes, we get about 22 nodes, or less than 5% of the network. If we end up with 500,000 nodes on the network, the figure would be about 707 nodes providing that impact, or a stunningly small fraction of 0.1%. Non-uniformity scales exquisitely.

As we begin to see, the Pareto principle is powerful in large systems, and is so important today as the world interconnects exponentially and in increasingly fractal patterns. The bigger the network, the more extreme the variance. Decentralization is a natural outcome of network building, especially if allowed to flourish without interference or external exploitation. Therefore, it is a logical conclusion as a general principle that decentralization increases variance and begins to break down previous patterns of mean reversion that are so characteristic of normal probability distributions.

Conversely, centralization craves more uniformity. Otherwise, there become too many outliers in the herd to corral, and the system becomes unmanageable. As networks proliferate, governments increasingly are driven existentially to ramp up the use of power and coercion against this natural force.

Not only is the world experiencing greater dispersion of outcomes, it is also changing at an increasingly faster pace. Raw data is pouring torrentially down upon us, overwhelming our neural capacity more each day. We are confused, overwhelmed and looking for anchors, answers, and authority.

“Black swan” or “tail risk” events, by definition, are not predictable by any model. Otherwise, they would not be black swans. Models often give us a false sense of stability, understanding, and confidence. The renowned behavioral economist Daniel Kanneman has shown that even when we are given statistical predictions that we know to be spurious, we embarrassingly cannot help but feel assured and make more risky decisions based on such irrelevant data.

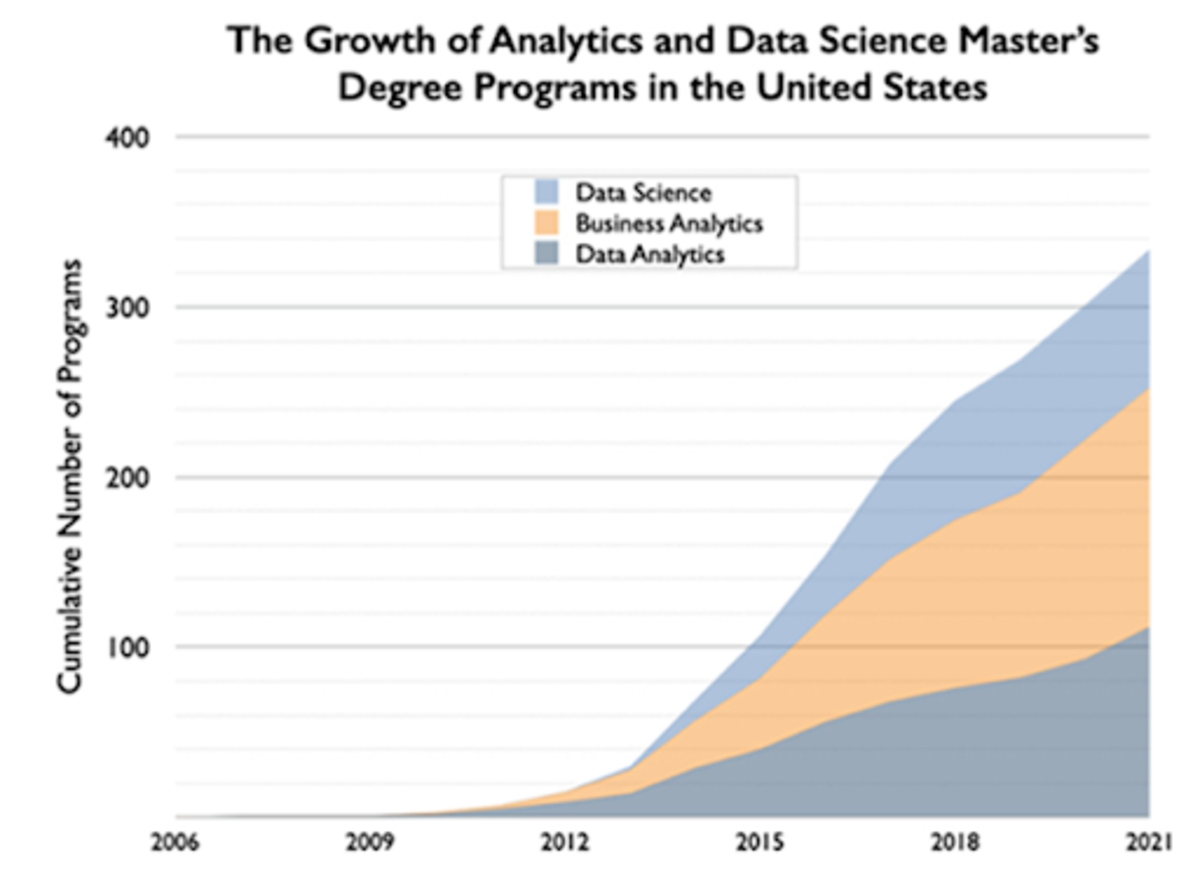

Nonetheless, the pace of change and data dumping has inspired us to overly romanticize and revere data accumulation, prediction, and data modeling techniques. We even have new professions that have popped up to deal with such issues, often aptly referred to as data “scientists.” Most major universities over the past decade have added degree programs for data science and it is now one the fastest-growing programs in academia.

Source: Michael Rappa, Institute for Advanced Analytics, May 2021

Now, let us more holistically recapitulate the situation described above. The cacophony of noise is getting ever louder, and meanwhile, our ability to filter this data to uncover the important signals hiding within has not improved at all.

We have developed technological tools that can filter the raw data and improve its informational extractability. However, these improvements are limited solely to endeavors that we are comfortable deferring to computers to manage for us. In all activities where humans still require involvement or apprehension, we are completely outmatched. On top of this, technology can be a tool, but it can also be a weapon. For every search, storage and AI tool that has helped to unbundle the noise into some semblance of a signal, there are other software tools that re-bundle the signal once again back into noise. Particularly social media, mainstream media, political propaganda and social science professions that overconfidently apply the newfound data abundance.

Taking all of these themes together, we have rampant technological shifts, overwhelming data propagation, and overconfident and confused human actors trying to adapt to these self-inflicted changes to achieve the unattainable: control. This means an increasing risk of the black swan events we so fiercely aim to circumvent. Less predictability, and more hubris as to our collective capacity to pattern-recognize and avoid those rare and historically pivotal events. This is a very dangerous cocktail.

An Homage To Endurance, Tenacity And Immutability

“I think much more likely is an even worse alternative: government will not cease inflating, but will, as it has been doing, try to suppress the open effects of this inflation. It will be driven by continual inflation into price controls, into increasing direction of the whole economic system. It is therefore now not merely a question of giving us better money, under which the market system will function infinitely better than it has ever done before… but of warding off the gradual decline into a totalitarian, planned system, which will, at least in this country, not come because anybody wants to introduce it, but will come step by step in an effort to suppress the effects of the inflation which is going on.” –Friedrich A. Hayek, “The Collective Works of F.A. Hayek,””Toward a Free Market Monetary System.”

Endurance, tenacity and immutability. While these attributes may sound too passive or unsubstantial to have value in our “move fast and break things” world, they are the exact traits required to survive the fragility of a system dashing feverishly towards instability.

Antifragility, an idea popularized in the 2012 book “Antifragile” by Nassim Taleb, describes systems or phenomena that gain strength from disorder. This book, part of a larger work focused on philosophical, statistical, and economic misconceptions relating to systemic risk, uncertainty, and randomness, has become part of the larger canon of Bitcoiner manifestos. This is despite Taleb’s recent baffling divorce from the community, which while a tad perplexing, should not detract from some of his work’s takeaways.

Bitcoiners have latched onto the themes of “Antifragile” as a framework to help elucidate some of Bitcoin’s game theory. How is it that there is no silver bullet that kills Bitcoin, there is no competitor that can magically overtake it, there is no government that can shut it down, and there is no central authority that can censor or confiscate it?

But the message does not stop there. Most important to the thesis of antifragility, each attack vector and shock to the system in fact causes Bitcoin to become stronger.

As Taleb writes:

“Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better. This property is behind everything that has changed with time: evolution, culture, ideas, revolutions, political systems, technological innovation, cultural and economic success, corporate survival, good recipes (say, chicken soup or steak tartare with a drop of cognac), the rise of cities, cultures, legal systems, equatorial forests, bacterial resistance … even our own existence as a species on this planet. And antifragility determines the boundary between what is living and organic (or complex), say, the human body, and what is inert, say, a physical object like the stapler on your desk… The antifragile loves randomness and uncertainty, which also means — crucially — a love of errors, a certain class of errors.”

We have seen firsthand how the market can reward an asset that exhibits antifragility. Astute macro investor Louis Gavkal has wisely observed that this is how the U.S. treasury market has evolved.

Today, investors have institutionalized portfolio management, packaged into strategies like 60/40 asset allocations (bonds/stocks), and slightly more volatility-adjusted strategies such as risk parity. However, this love affair with the treasury market as a diversification tool has not always been the case, especially from the perspective of global investors. In fact, treasuries may be losing this status. The godfather of risk parity, Ray Dalio himself, just recently confirmed the view that he would rather own bitcoin than bonds.

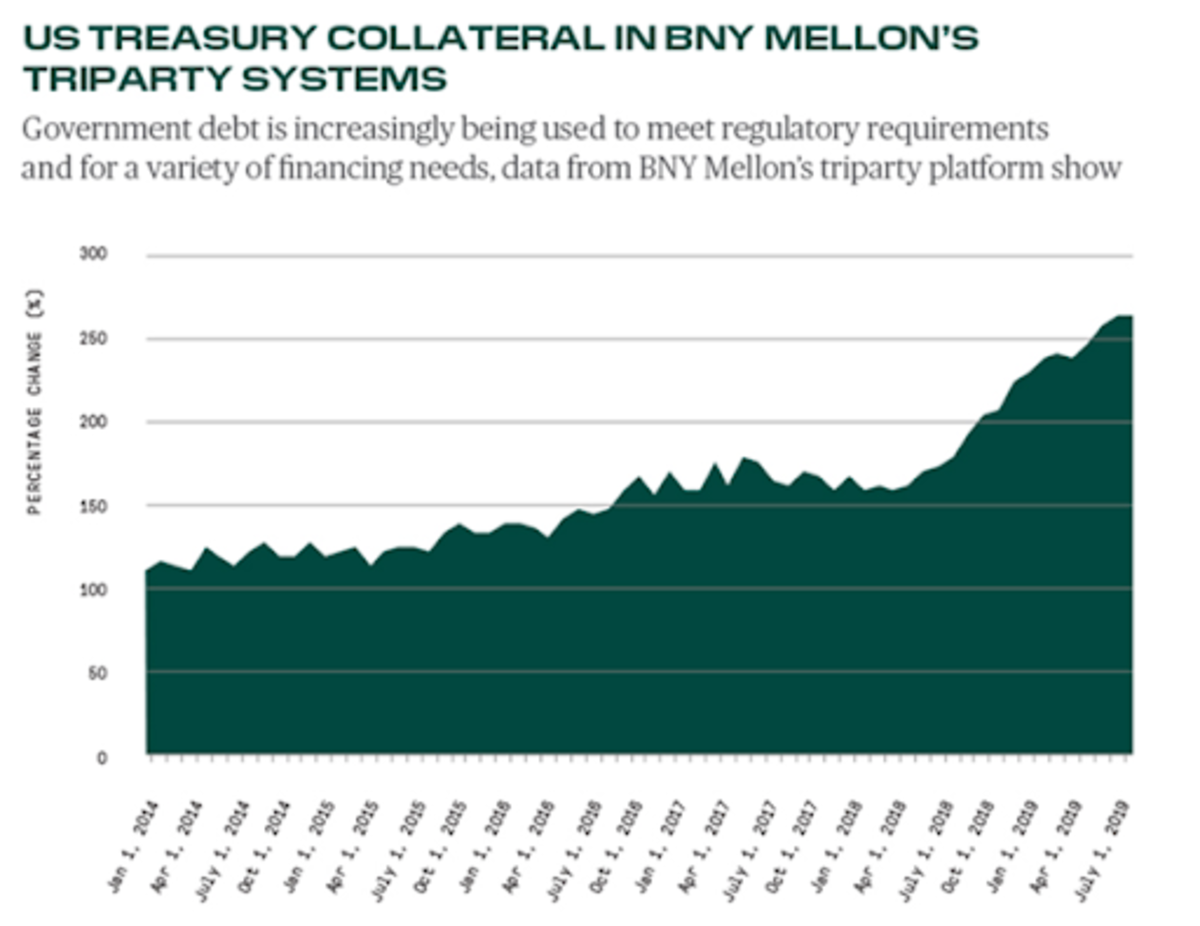

What has historically given treasuries their stature of primacy for so many years was the dollar’s reserve currency role. A feat attained through war, geopolitical victories, petrodollar arrangements, and the trade-offs of increasing consumerism and domestic debt accumulation in the U.S. to supply dollars abroad. All punctuated by a parallel hyper-financialization of our economy, with regulatory incentives to own treasuries and a global system addicted to dollar-based leverage and short of adequate collateral.

This collateral shortage has become particularly acute after quantitative easing has been significantly reducing the public supply of treasuries since 2009. All of these factors have helped create a treasury market monster with very resilient network effects for the U.S. dollar. Resilient to deleveraging elsewhere, resilient to market volatility, resilient to dollar shortages, and even resilient to cyclical inflation.

The treasury market is a massive battleship that has been chugging along full steam in one direction for many years. However, this ship is now altering its course. And this process is ever so slowly chipping away at those network effects. As the U.S. dollar necessarily loses some strength as a reserve money, the system will either need to deleverage or find a new source of collateral, a new antifragile asset.

Source: BNY Mellon

One way to think of the U.S. treasury market’s ability to maintain buyers and holders despite real interest rates, at least at negative 1% (depending on your gauge of inflation), is that this market has become a weigh station, a storage space for dollar-denominated assets, intended to balance existing portfolios of dollar-denominated equity, real estate and corporate debt holdings, as a reserve account that incentivizes participants to remain within the bounds of the existing USD ecosystem.

The Eurodollar system, U.S. dollars banked or held outside of the U.S. banking system, evolved to help accomplish this goal more efficiently at the global level.

The Eurodollar market size has exploded as the U.S. economy began to financialize in earnest: First in the early 1980s and then again in the 1990s and post-dot-com burst.

The start of this in the early 1980s coincided with the start of a 40-year bull market in U.S. treasuries:

Source: Federal Reserve Board

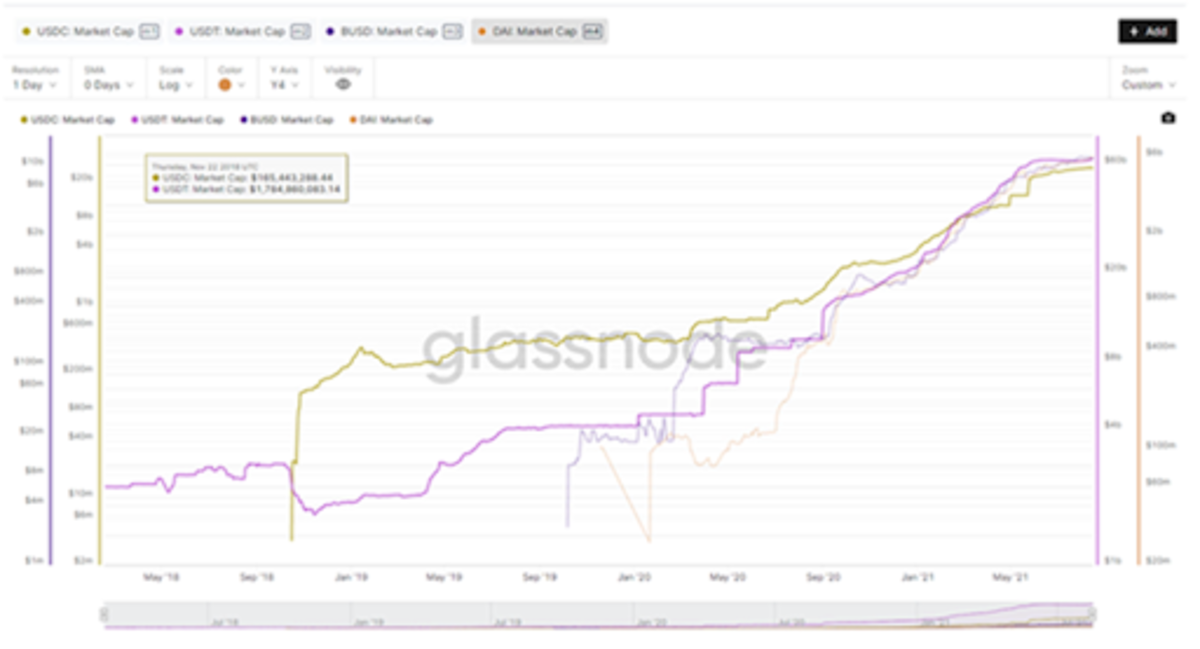

Such a concept of captively on-ramped capital is actually very similar to the stablecoin market in the Bitcoin and cryptocurrency ecosystems.

Source: @LudiMagistR; Glassnode

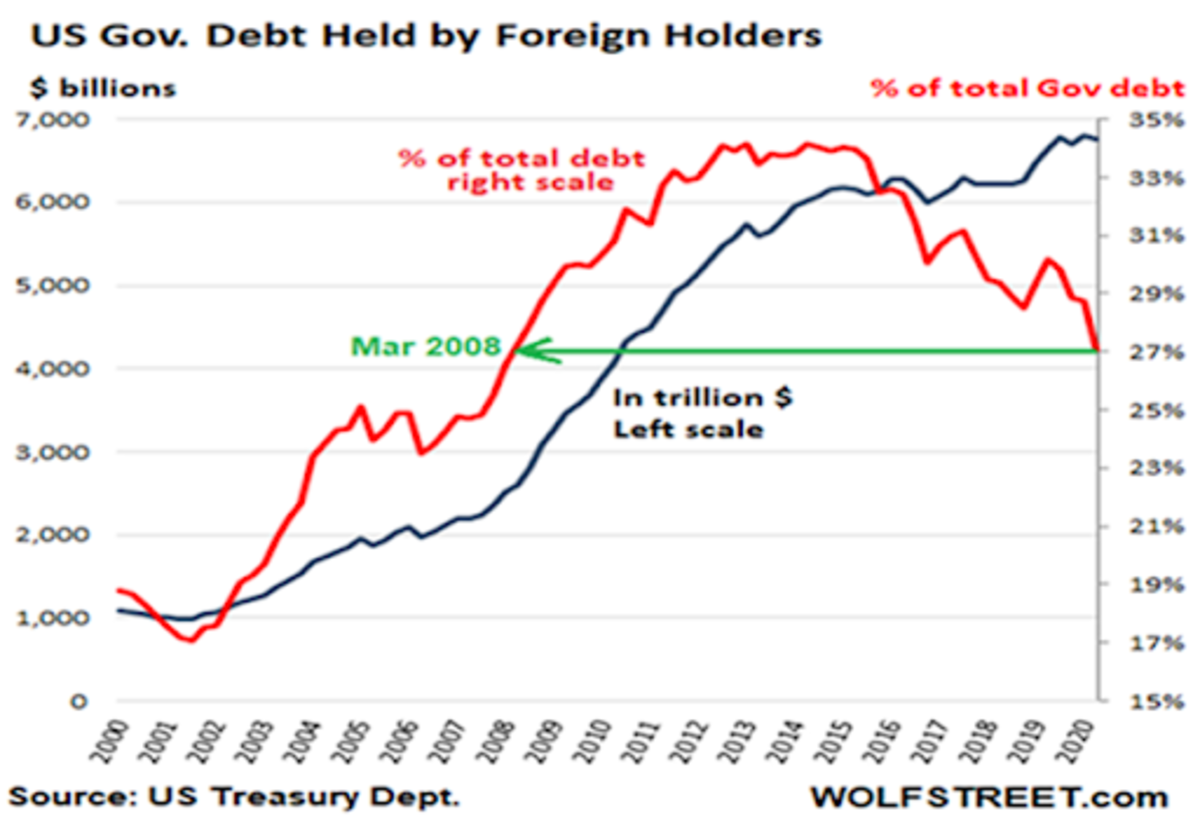

Unfortunately, for the U.S. dollar fiat ecosystem, there are signs of deterioration within its network effect. Foreign users are balking.

Source: Wolfstreet.com

A Poetic Phrase: Bitcoin Is A “Deep Structure”

“In a Paretian world, surface events can become a distraction, diverting attention from the deep structures molding these surface events. Surfaces are extraordinarily complex and rapidly evolving while the deep structures display more simplicity and stability. These deep structures are profoundly historical in nature — they evolve through positive feedback loops and path dependence. Snapshots become misleading and understanding requires a dynamic view of the landscape.” –John Hagel

We live in a world where things are intentionally made to fall apart. Quantity and popularity are valued above quality and depth. The news cycle is a meager 24 hours. Medical and health problems are addressed ex post facto with newly-invented medications and treatments, rather than by way of lifestyle changes and preventative measures.

Products are meant to become obsolete. Buildings are designed to last 20 years rather than 200. Tweets share ephemeral memes instead of lasting ideas, investments are made for instant return potential rather than lasting productive impact. And interest rates have collapsed to near zero, allowing us the mathematical permission to discount the future so that it is indistinguishable from the present.

We have lost our ability to think long term. We have no appreciation for durability over time. Therefore, we do not particularly value persistence because its main attribute is indeed durability over time.

Taking this a step further, if we do not place any material value on resilience, how could we value antifragility at the societal level? This is because antifragility is simply resilience in the form of a productive asset. By this I mean something that is durable, but also something that improves over time. It is no wonder then, that even Bitcoiners may be undervaluing antifragility.

This irony is further extended by the fact that just at the time when civilization least values such a high-powered form of durability and productivity happens to also be when these attributes are most desperately needed.

“An Ocean’s Ode To Volatility”

Oh waves, Crash thunderously

Unshackle my bounty of lost minerals