パートI:ツリーとしてのビットコイン、永続性と深い構造

空想

おそらく私はもっと勇敢でした。このシリーズのパート1のタイトルは、「ビットコインはヤシの木であり、フィアットはココナッツです」のように、より魅力的なものになっていたでしょう。しかし、良くも悪くも、そのようなタイトルは、少し多すぎる高さで飽和しているように感じられ、そのような重いトピックには熱帯的で些細なものでした。

しかし、実際には、ヤシの木の画像は非常に正確でした。 21世紀に進むにつれて、ビットコインとフィアットのロードマップがどのように進化するかについての寓話。ダイオウヤシ、roystonea oleraceaは、激しいスコールで熱狂的に揺れていますが、土壌の奥深くでその根をしっかりと把握し続けることを決してやめません。そして、他の嵐と同様に、この木に必要なダーウィンの唯一の必要性は、可能な限り無傷で嵐を乗り切るための生存の1つです。

他の樹木や構造物は、自然の過酷な変動に降伏して降伏し、空が晴れると王室の手のひらが吸収する日光をより多く残す可能性があります。シロアリのコロニーとブラシの火によって代謝され、攻撃に耐えるのに十分な堅牢性を備えていなかったすべての破片が、緑豊かで肥沃な土壌に変化しました。再構築して繁栄するための新しいベースレイヤー。死を生命に変えることができる自然界でこれまでに観察された唯一の物理的媒体がたまたま土壌であるという事実に照らして、適切な比喩。同様に、絶対に希少で腐敗しない健全なお金は、衰退し、衰退した金融システムに経済的生命を吹き込むことができる唯一の経済的媒体です。

警告

「無害にあなたを追い越す離れた草原での時間

空中の特定の不安にぼんやりと気づいているだけです

気をつけたほうがいいです

犬がいる可能性があります

ヨルダンを見渡したところ、見たことがあります

物事は見た目とは異なります

危険が現実ではないふりをすることで何が得られますか

柔和で従順で、あなたはリーダーを追いかけます

よく踏まれた廊下を鋼の谷に下ります

なんて驚きです!

あなたの終末の衝撃の様子目

今では物事は実際に見た目どおりです

いいえ、これは悪い夢ではありません」

-Roger Waters、「Sheep」、1977

出典:Nareeta Martin、@ LudiMagistR

予言

「コンクリートの割れ目から生えたバラのことを聞いたことがありますか?

自然の法則が間違っていることを証明して、足を持たずに歩くことを学びました。

おかしい、それ夢を守ることで、新鮮な空気を吸うことを学んだようです。

誰も気にしないときにコンクリートから成長したバラは長生きします。」

–トゥパックシャクール、「コンクリートから咲いたバラ、1999

上で推論したビットコインの持続性の特徴を完全に理解する前に、そのような「抗脆弱性」(以下でさらに詳しく定義します)が必然的に雷の割れ目、スラップのように現れる方法と理由を文脈化することはおそらく役に立ちます顔、私たち全員がその非常に過小評価された有用性を目撃することを可能にします。

これを達成するために、ソクラテス式質問技法の修正版を使用して少し迂回しましょう。

理論:大衆投資家クラスのスタンピード

博学者の技術投資家であるBalajiSrinivasanは、分散型の偽名経済の概念モデルで、物議を醸すように次のように宣言しています。

「1800年代、誰もが農民でした。 1900年代には、誰もが製造業に従事していました。 2000年代には、誰もが投資家になります…そして、投資家になるまで人々が理解できないことの1つは、お金が豊富であるというこの考えです。」

-Balaji Srinivasan、「 PatrickO’Shaughnessyで最高のポッドキャストのように投資する“

出典:Balaji Srinivasan

A議論

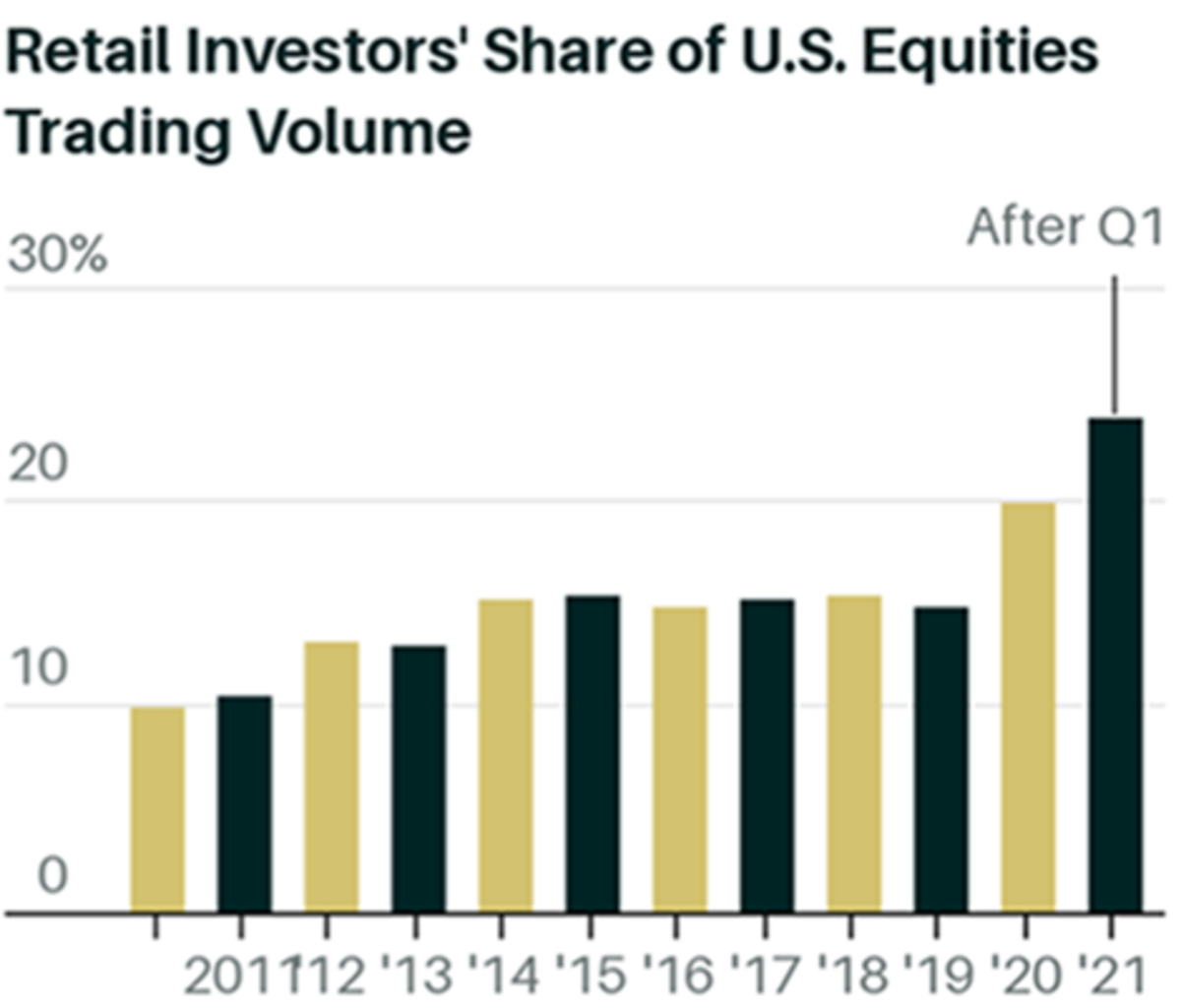

上記の声明を額面通りに受け止め、今のところ、進化する先験的現実として受け入れましょう。私たちのほとんどは、投資家クラスのリーチのそのような拡大が実際に急速に拡大する勢いを経験しており、特にパンデミック後の世界で加速していることに同意すると思います。確かな証拠(以下で説明)、および自主的な株式市場への投資を強調している観察された文化的スポットライトを否定することは困難です。私がこのエッセイを書いたとき、証拠はいたるところにあり、ニュースフィードをスクロールすることさえあります:

「ユーザーが予備の変更を投資できるようにする機能に取り組んでいるロビンフッド」

「予備の変更を投資すると新しい株式トレーダーにとってますます人気のある戦略になり、Acorns、Chime、Wealthsimpleなどの競合アプリの重要な部分です。」

– ブルームバーグ

ロビンフッドの象徴的なIPOが最近の記憶に刻み込まれているので、上記の見出しは私たちの議論の完璧な例です。マイクロファンドの株式市場への投資は、大規模投資家クラスへのこの進化の典型です。私は、ヘッジファンド業界での職業生活、FOMO、貪欲、不安の高まりの文化、友人や家族との個人的な交流、ソーシャルメディアに至るまで、この変化を身の回りで見ています。これが、多くの政策立案者やテクノクラートが意識的にインセンティブを与えようとしていることだと私は信じています。そしてそれは私を邪魔します。

そのような社会変革の意味は何ですか?そして、その根本的な原因は何ですか?

この観察から生じるこのような自由形式の質問は、私がそもそもスリニバサンの推測にとても惹かれ、興味をそそられる理由の1つです。彼の発言は、さまざまな議論への扉を開き、いくつかの非常に重要なテーマに触れています。

分散型経済の必然性に関連するこれらのテーマのいくつかは、このシリーズのパート2でより詳細に説明されるトピックです。それまでの間、大規模投資家クラスが奨励されている理由、それがさらに集中化につながる方法、これらすべての開かれたドアが一方向のエスカレーターであり、パスに依存する決定木につながることが保証されていることを理解して、ステージを設定しましょう、そして最終的にはほぼ無限の不安定性と全身の脆弱性を生み出します。

そして圧倒的に明らかになるのは、コインの片側にあるこの道の必然性と持続不可能性の間の全体的な相互作用です。そして、反対側のビットコインの持続性は、その順番が空中に持ち上げられるのを辛抱強く待って、熱狂的に回転しますが、顔を上に向けて着陸することを辛抱強く予想しているため、落ち着いて収集されます。

サンドイッチの比喩

スリニバサンの予言が無意識のうちに明らかにしているのは、世界経済が現在自分自身を見つけている危険な移行期の現実です。私たちは現在、地方分権化と中央集権化の間に不安定に挟まれた、混乱した状態にあります。

この流動的な時間的状態の文化的エネルギーは確かに特定の「空気中の不安」を引き起こしますが、不満の高まりは明白です。そして、COVID-19パンデミックの出来事が多くの傾向の激化を推進したように、これらの傾向の1つは、確かに「プロレタリアート」と積極的に拡大する投資家クラスの現れです。そして、そのような進歩には、自己啓発、短期的な新しい富の創造の機会、市場、リスク管理、お金、経済理論に関する金融教育など、多くの肯定的な属性がありますが、そのようなすべての利点は悲しいことに誤った方向に進んでおり、短いです-目撃された。結局、これらの非常に具体的なメリットは、不吉な力によって希薄化され、打ち負かされる運命にあります。

投資家クラスのコモディティ化がそのような危険な進化である理由の主な理由は、主にタイミングに起因する可能性があります。歴史的背景、およびこの大規模投資家社会が二次および三次導関数効果の形で必要とするものの意味。

この最初のセクションは、いくつかの財務データおよび用語で不可避的に重いため、以下で我慢してください。しかし、そのようなデータは、私たちが何が起こっているのか全体像を理解するのを助けるために不可欠であり、私たちの論文のより大きなアイデアを拡大するにつれて、記事とシリーズにさらに利益をもたらします。

私は終末論者ではありません。私はバンカーに住んでいません。私はあまりにも多くの投資家が過度に弱気な物語の犠牲になり、そのような否定性が難読化した大きな資産インフレを見逃しているのを見てきました。ただし、このエッセイの目的は、短期的な投資論文を提示することではありません。とはいえ、私が投資家として、子供たちが受け継ぐ世界を大切にする社会の一員として、ますます明確になり始めたことは、避けられない罠の証拠を増やしています。現実的な解決策が1つしかない罠。したがって、ここでの財務データは単なるツールであり、この洞察を理解するのに役立つ言語です。実際、このシリーズの主なメッセージは、金融と市場についてではなく、人間性、歴史、そして今世紀の大部分の結果にインセンティブとイデオロギーの対立が与える影響についてです。

それで、私たちが反応の連鎖の中で運命のブロックのこのウサギの穴をさらに下って行くとき、私と一緒に耐えてください。

ブロック1:歴史的背景が重要です。タイミングがすべてであることが判明

誤った前提と逆インセンティブに駆り立てられた大規模投資家クラスは、比類のない歴史的な資産インフレの期間の後に皮肉なことに形成されています。

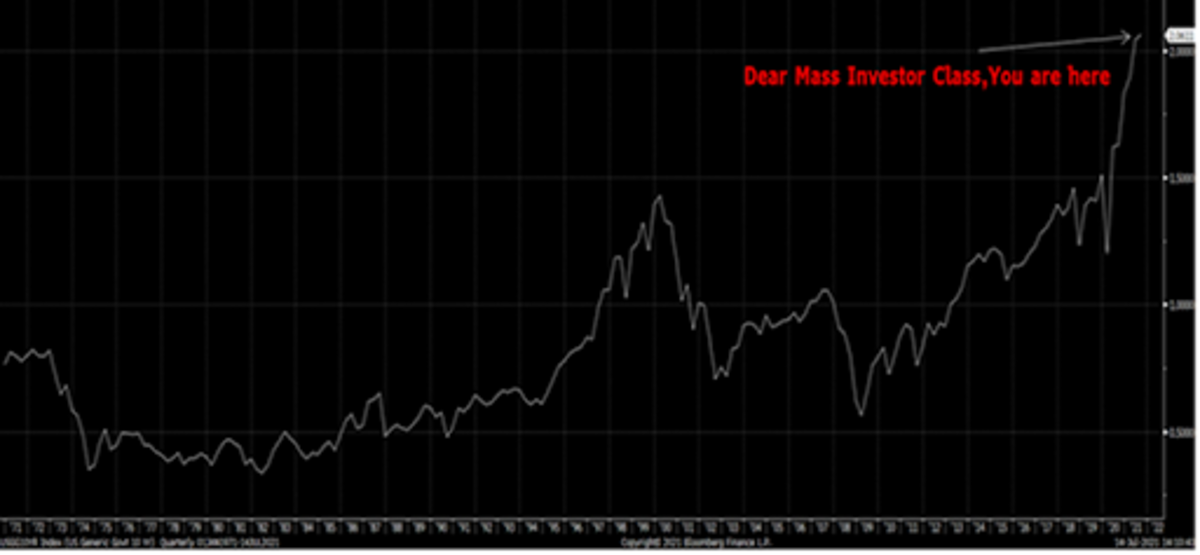

40年以上にわたる前例のない金融資産のインフレ、債務の蓄積、規制緩和、そして金融の豊かさを目の当たりにしました。リスクフリーレートが16%からほぼゼロになり、生産能力に対する株式市場が記録的であり(下のグラフを参照)、ほとんどすべての評価指標が過去最高であり、不合理な行動が見られる壮大な債券相場市場劇的に拡大しました(SPAC、r/WallStreetBets、ミーム株、小売証拠金債務、そしてもちろん「クリプト」ユニバースの多くのポケットによって例示されています)。

同時に、政府と企業のレバレッジも極端です。これらの統計は、社会保障、メディケア、年金債務、簿外防衛予算などの簿外政府の負債を考慮すると、さらに過剰になります。これは、バラ色の企業ガイダンスの仮定と、収益の追加トリックや積極的な会計エンジニアリング戦略で必死に創造的になる多くの企業管理チームを考慮に入れることに加えてです。別の言い方をすれば、個人投資家は、史上最大で最もホメリックな爆発党の1つの終わりに専門化しています。決まり文句の野球の比喩を許してください、しかしこれは、7ゲームの劇的なワールドシリーズフィナーレの後、オフシーズンの直前にマイナーリーグから呼び出されたプレーヤーのようなものです。

これは本当に社会にとって良い発展ですか?これは実際には、強気市場のピーク時に発生する観察された行動と参加のかなり典型的なものです。ただし、ここでは、典型的なバブル崩壊と比較して、いくつかの重要な違いがあります。

最初に、私たちは、新たに発見されたプロフェッショナリズムと権限を与えられたキャリアシフトを装って行われるこれらの投資の文脈でそのような行動に言及しています。富への権利の感覚があり、政策立案者と新規投資家の両方から、資本市場から富を獲得する権利であり、リスクをほとんど埋め込まずにそうすることが彼らの権利であるという期待があります。さらに、労働参加率の低下からも明らかなように、投資家社会は二重のリスクを生み出しています。他の労働形態を放棄する人が増えるにつれ、私たちは「実行者」ではなく「賃貸人」の社会になります。私たちは、常に専門化と分業の増加につながってきた歴史の矢を逆転させます。したがって、これまで以上に多くの個人が金融資産にさらされているだけでなく、この拡大するコホートは、他の場所での雇用の放棄と賃金の獲得という機会費用でそうしています。

賭け金は高く、許容誤差は低くなります。そして、そのような行動は、実際には、裕福な階級に反抗する手段として、そして政治的に、そのような資産の根本的な価値とリスクに関係なく、より多くの分配を見るための資産所有権の自由な権利として、文化的に支持されています。これは、単純な一時的な金融バブルとは異なります。これは成層圏に浮かぶ熱気球であり、地球のしっかりとした抱擁を二度と感じることはありません。

US名目ドルでのGDPに対する株式時価総額、1971年から現在まで。出典:@ LudiMagistR、ブルームバーグ

大規模投資家クラスの採用が加速しています。

2021年のこれまでの年間の株式流入率は約1兆ドルです。ある見方をすれば、これは過去20年間の株式への累積流入額の合計を上回っています!

出典:バンクオブアメリカ; Michael Hartnett

上のグラフは、2001年から2020年までの累積株式流入額8000億ドルと比較して、2021年の株式への年間流入額が1兆ドルであることを示しています。このエッセイを続ける前に、それを1分間沈めてください。最近では、非常に多くの非常識で前例のないチャート、ミーム、統計が表示されているため、このグラフを簡単に確認できます。しかし、これは本当に物事がどこに向かっているのかについて深刻な問題を抱えていることを示しています。

金融業界規制当局(FINRA)によって追跡されたレバレッジ株取引の証拠金は、歴史的に個人(または「小売」)投資家の興奮と株式市場内の貪欲の道標でした。

以下のグラフは、紫色の網掛け部分でマークされた、歴史的に不況が予想されていた証拠金債務の年間増加率を示しています。ただし、最近の期間では、マージンが歴史的に比類のないペースで急上昇し、おそらく短期的にピークに達することがわかります。

しかし、ここでの重要な観察は、この急激な上昇は、その紫色のバーの前ではなく、その後に発生したということです。証拠金債務は危機に先行するものではありませんでしたが、それに対する対応でした。 2009年にこれのヒントが見られましたが、それは銀行と住宅のレバレッジの大規模なパージと資産価値の大幅な評価減の後でした。 COVID-19危機はそのようなパージを可能にせず、リテールエクイティ投資を劇的に活性化するための政策を制定しました。これは新しい動作です。

ソース:Ed Yardeni(yardeni.com); NYSE; FINRA; @LudiMagistR

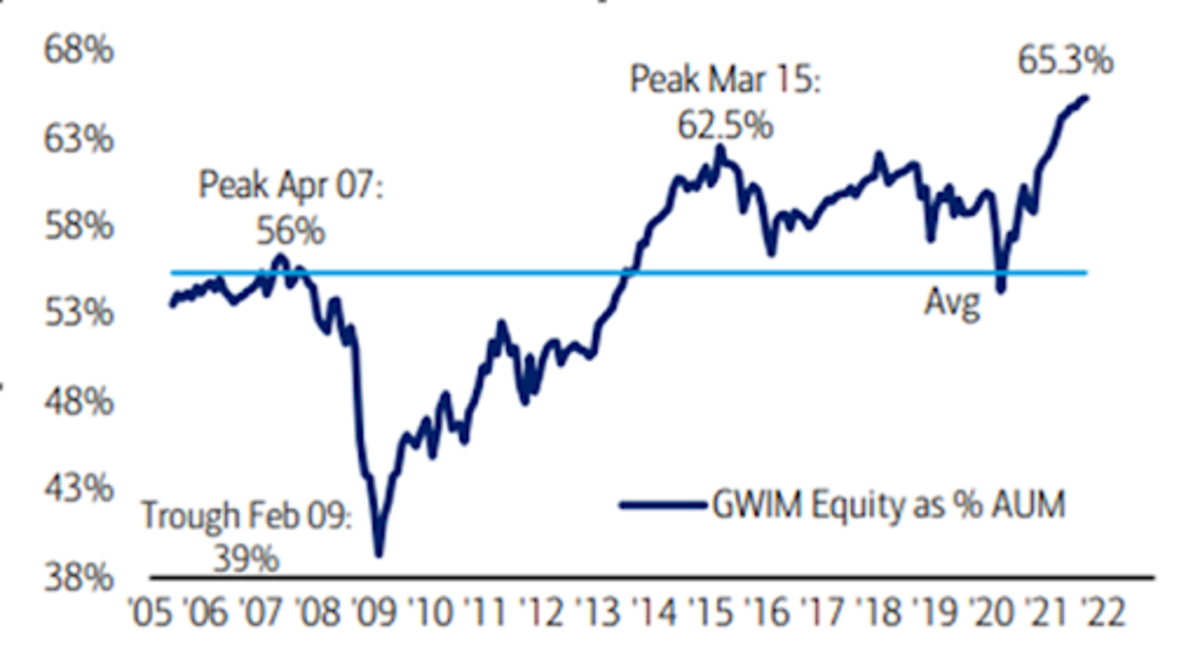

バンクオブアメリカ(BofA)ウェルスマネジメントのクライアントの株式配分は、過去最高です。

BofAプライベートクライアントの株式保有を運用資産の割合として示します。出典:バンクオブアメリカ; Michael Hartnett

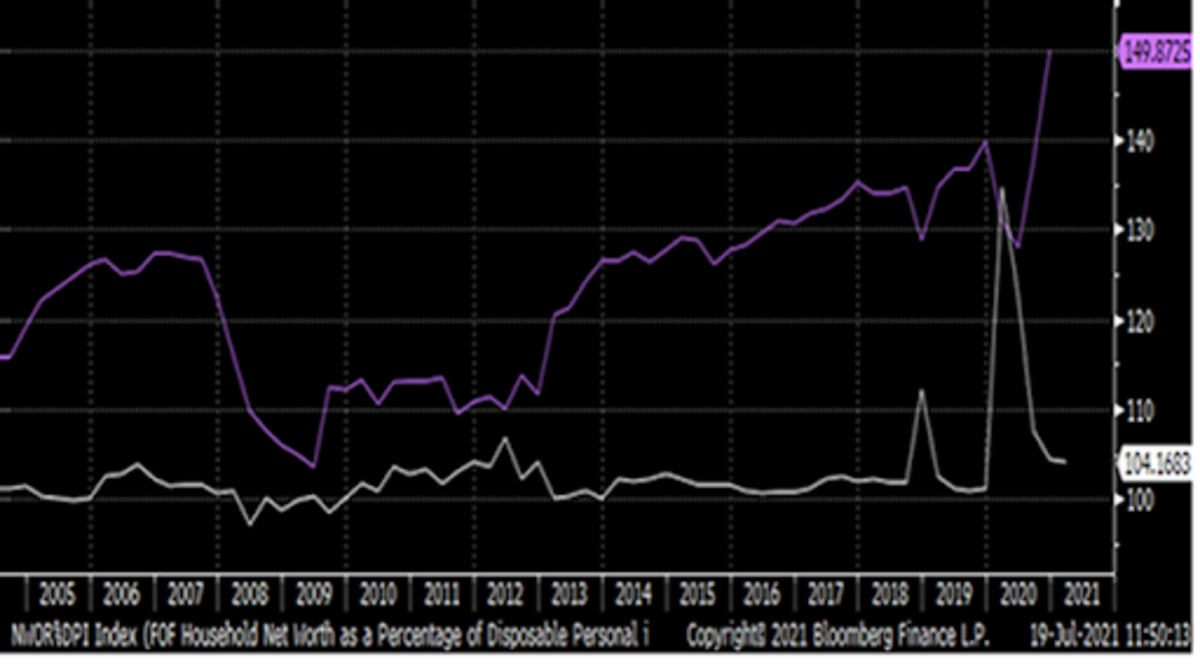

可処分個人所得(紫)のパーセンテージとしての家計純資産対個人貯蓄の前年比成長率/純資産前年比成長率の比率(白い線。出典:@ LudiMagistR、ブルームバーグ、セントルイス連邦準備制度

この最後のグラフが示しているのは、米国の個人がもはや超過収入からではなく、資産のインフレから貯蓄を構築していることです。定義上リスクがあります。現在、インフレに敏感な金融資産は、それらを所有する余裕のあるほとんどの世帯にとって主要な価値のある店舗です。

より歴史的な文脈として、以下は同じ世帯の純資産を1945年に遡る可処分所得。

出典:@LudiMagistR、ブルームバーグ、セントルイス連邦準備制度理事会

創造的破壊の場合の死

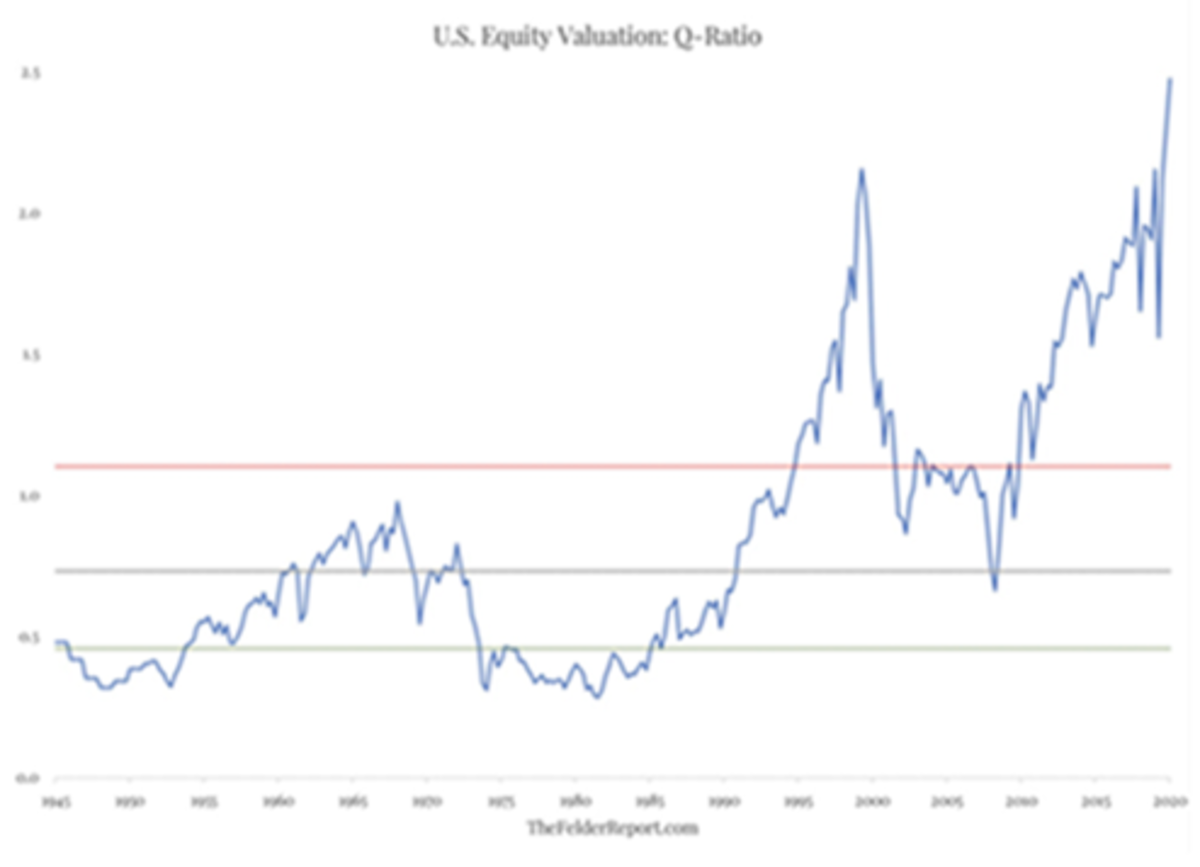

以下は、「Q比」としても知られるトービンの指数として知られる指標のグラフです。本質的には、株式市場の現在の時価総額を、その株式に関連する資産の実際の交換費用で割った比率です。

下のグラフに示されているように、この比率は歴史的に前例のないレベルです。チャートは第二次世界大戦後から現在までの範囲であり、株式評価は現在、それらの代替価値のほぼ2.5倍であることを表しています。これは、交換価格に近い75年の平均比率と比較されます。

確かに、この分析にはニュアンスがないわけではありません。デジタルエコノミーを特徴とする情報化時代に経済が移行し、資産が無形になり、知的財産などの交換コストを評価することが難しくなっているためです。そしてネットワーク効果の善意。しかし、この変化を考慮しても、現在のQ比率は、交換値の平均が1.4倍である1990年代のドットコム前のバスト時代やpost-dot.comと比較して、依然として交換値の3倍を超えています。バスト時代の平均は交換価格の2.3倍に近い。

データをどのようにスライスしても、これが示すのは、経済的現実から完全に逸脱した方法で経済的に評価されている企業の規模の大きさです。真に自由な市場に存在してはならない、いわゆる「ゾンビ」企業は、多くの場合、自らを維持するために大量の非生産的な債務を抱えており、そのような勇敢な新しい世界で繁栄しています。これらの実体は良いお金を閉じ込めて、腐敗した構造の中でそれを石化させ続けます。ハイイールド債に多くの時間を費やすプロの投資家として、私はこの狂気を日常的に見ています。

ある時点で、このような不均衡を調整する唯一の方法は、大規模なリストラ、破産、債務不履行、またはインフレのいずれかによるものです。インフレは、錬金術師の表面的な正直さのポーションで、代替価値の分母を高めるように機能します。人類の歴史を通して見られるように、インフレは、経済学者、ウォール街の投資家、そしてもちろん世界に対して2年から4年の見通しを持つ政治家にとってはるかに口当たりの良い解決策です。

しかし、この事実の皮肉なことに、そのような認識は、そもそも私たちがどのようにしてここにたどり着いたかを説明することでもあります。

Tobin’s Quotient、1945 to present:経済の代替価値に対する株式市場の評価。出典:フェルダーレポート

品質の否定

以下では、品質の低下の証拠をさらに観察できます。この例では、創造的破壊の崩壊とバランスシートの質だけでなく、企業全体の収益自体の質についても言及しています。

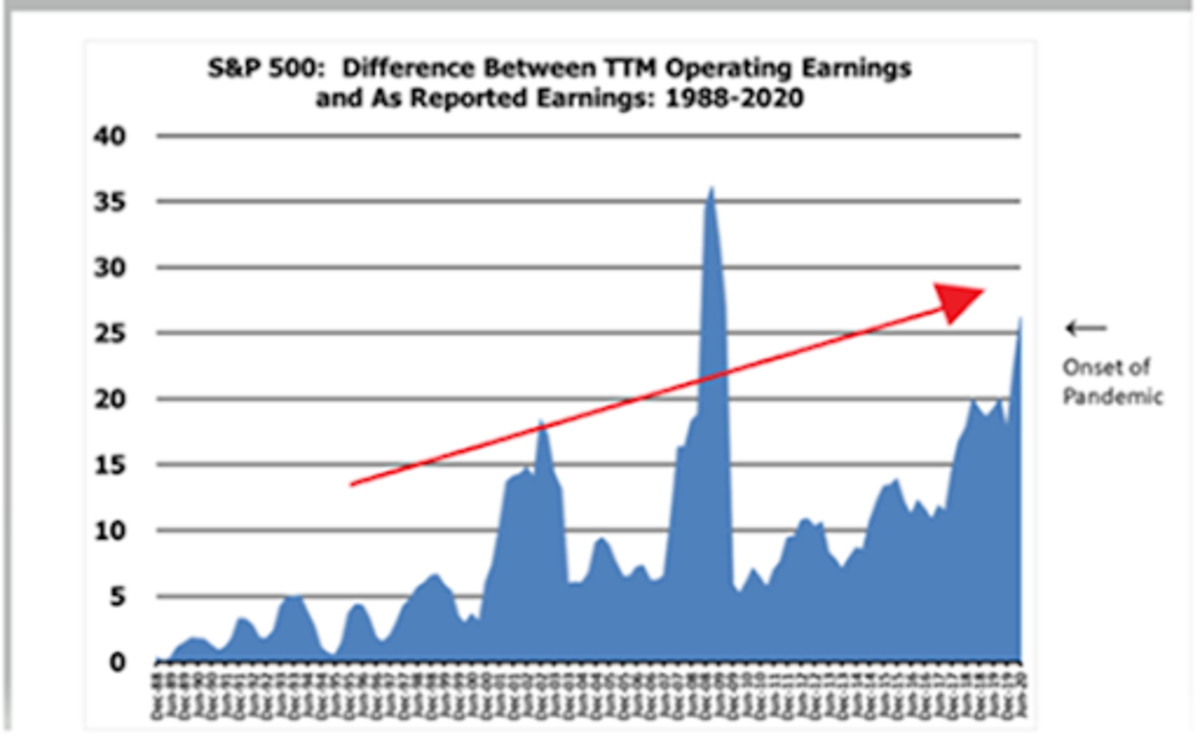

私たちの周りの複雑なデータの世界を確認するのに役立つと私たちが信頼しているまさにその指標は、測定値がターゲットになるまでゲーム化および操作されています。 GAAP、または「一般に認められた会計原則」は、不透明で恣意的で誤解を招くような追加による収益の低下を制限するように設計された会計プロトコルです。企業の真の実行率収益の可能性を正確に把握するために、実際に有効な非GAAP調整を行う必要がある場合があります。ただし、全体として、GAAPレポートに対するこのような「非GAAP」調整は、完全性と信頼性が低いという状況を生み出す傾向があります。

それにもかかわらず、私たちはそのような調整に非常に慣れているため、市場参加者と規制当局は段階的な逸脱を瞬く間に受け入れています。非GAAP調整が最初に「

以下のグラフは、非GAAPベースの収益からGAAPベースの収益を差し引いたスプレッドを示しています。

このスプレッドは、営業外損失が発生するにつれて不況で急上昇する傾向があります。 。しかし興味深いことに、景気後退を超えて数年で、トレンドはより弱い品質への道を再開します。

出典: Lark Research

ブロック2:熱風バルーン

この状況の結果、システムの脆弱性が急速に膨らみ、増加したデータの決定論的なパス依存性が必要になります。操作、政府の支援、規制、および自由市場の介入。

上記のような歴史的な評価と資産パフォーマンスのコンテキストは、金融資産のエクスポージャーをより多様でより多くの人口に拡大すると、経済に許容できないシステミックリスクが生じることを意味します。長期的には。ゲーム理論のフレーズを借りると、株式市場は単一障害点になります。

前回の記事「小さすぎるとインフレの物語の落とし穴を考える」で説明したように、これは、金融資産の作成ではなく、金融資産の作成による陰湿なマネー印刷の手段にもなります。私たちの両親と祖父母の世代の明らかなマネーサプライの拡大。モラルハザードの法令によって膨らませるこのインフレ、または暗黙的に保証された金融資産のインフレは、テクノロジーがますます多くの製品やサービスをより安くまたは完全にコストをかけずに、そして私たちが今経験しているような供給の制約が消費を引き起こしているときに、さらに簡単に達成できます物理的な「もの」の望ましくない、または場合によっては不可能ですらあります。

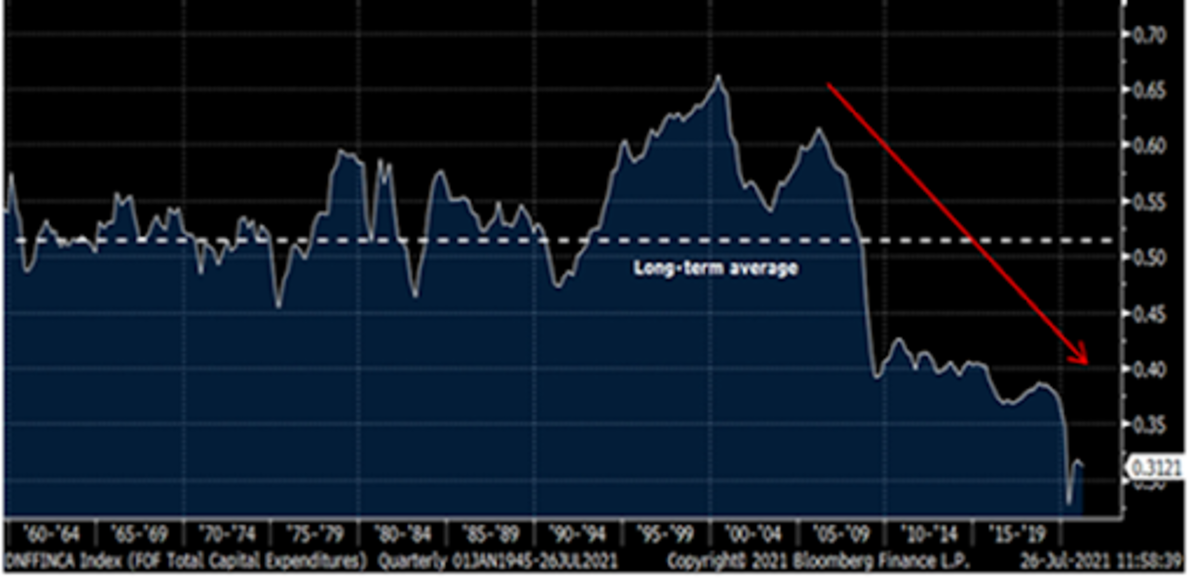

適切な価格の債券市場は、投資に対するリターンのハードルを生み出し、新しい生産的な資本を生み出すことができる努力のみを奨励します。過度に安い債務は、生産的な利益を必要とせずに、既存の資本ストックを活用することを奨励します。そして、新しい設備投資が最終的に行われる場合でも、明確なインセンティブは、貯蓄やキャッシュフローからではなく、その安価な資金調達で行うことです。これにより、最終的には生産的な資本配分者でさえ過剰なレバレッジの道をたどります。

一方、資産が膨らむにつれて、望ましい生活水準を維持する唯一の方法は、貯蓄を株式、債券、不動産。これは、インフレが体系的なモラルハザードによってほぼ保証されている場合、既存の資本ストックを再収穫する場合に比べて、新しい資本形成のための投資収益率が発揮されるまでに常に時間がかかるためです。これに加えて、抑圧され操作された金利が、新しい資本が投資されるまさにその未来から盗み出されているという事実(以下でさらに議論されます)。これにより、新しい資本ストックへの重要な投資の意欲がさらに失われます。

以下のグラフは、M2マネーサプライで測定された、システムに投入されたベースマネーの分母で割った、名目ドルでの米国の総資本支出の比率をプロットしています。ドットコム危機のピークに達して以来、新しい資本形成への投資は、新しいお金の創出に比べて急落しています。これは、新しい資本の形成ではないにしても、余分な新しいお金のすべてがどこに流れているかについての修辞的な質問をします。もちろん、その答えは金融資産です。

出典:ブルームバーグ; @LudiMagistR

したがって、インセンティブはStoliの堅いナメクジと同じくらい明確です。そして、過去30年間のほとんどの間、裕福な人だけがこのゲームデザインの一部であり、既存の資産である「プルーフオブステーク。”

しかし、ユビキタスなモラルハザード、さらなる時間の好みの縮小、そして新たに造られた貯蓄が最も明白になりつつあります。偽りの自由意志のこの決定木の効率的な次の段階。通路の両側の政策立案者は、そのような物語を受け入れるインセンティブを持っています。彼らは、中産階級の収入、教育、社会的セーフティネット、および税の再分配の改善に関連する古いプレイブックとは対照的に、中産階級の純資産を推進することを目指します。一方、右側は、アメリカの企業支配政治が富を共有し、同様に金融インフレと社会化資本主義を受け入れるという自己欺瞞の「希望」で、トリクルダウン供給側のマネタリスト経済学から彼らのバトンを喜んで渡します。権利は、資本市場のそのような中央集権化を不快であると認識しますが、ケインズ社会主義と再分配の代替案よりも優れています。双方は、莫大な費用はかかりますが、実際に結果をもたらすソリューションとコア原則を交換します。

あなたが下のチャートを見ている政策立案者であるならば、そのような巨大な相違を是正するための最もリスクが低く、最も明白なメカニズムは何でしょうか?簡単:「典型的な労働者の支払い」をS&P 500に結び付けるだけで、ブームになります。ミッション達成!

出典:経済政策研究所;連邦準備制度経済データ(FRED)

わかりました。それで、私たちが今ボールを転がしていて、実際にさまざまな方法で労働者災害補償を株式市場に結び付け始めていると仮定しましょう。しかし、そのような偉業はどのように達成されますか?政府が雇用主に株価指数の形で賃金を支払うように強制できるわけではありません。

まあ、直接ではありません。答えは、変更されたインセンティブの混合レシピにあります。上記のようなモラルハザードと暗黙の株価のバックストップは、確かにそのような戦略の震源地です。

しかし、他にも無限の可能性があります。米国市民が中国からの消費者の輸入よりも国内でより多くの投資と貯蓄を行うことを奨励する非グローバリゼーションの取り組み。テクノロジーと金融革新の自然な進歩は、単に「自分たちのことをしている」だけで、民主化された投資のためのより大きなオンランプを作成します。この例としては、上場投資信託(ETF)、ユーザーを簡素化するロビンフッドなどの取引プラットフォームなどがあります。経験、ソーシャルメディアを活用したブログ、YouTubeチャンネル、および信頼を構築し、文化レベルで大量のFOMOをこのブロスに振りかける代替のインフォテインメントプラットフォーム。もう1つの明らかなメカニズムは、金融投資に資金を振り向けるための所得税の引き上げと、株式市場のHODLing行動を奨励するためのキャピタルゲイン税の引き上げです。これらは単なる例です。ここでのポイントは、システムの自然なインセンティブによって、意図的にも有機的にも、そのような目標を推進するために利用できるツールボックスが無限にあるということです。

「でも待ってください」とあなたは言います。 「より高い貯蓄率とより少ない消費の何が問題になっていますか?結局のところ、これは多くのビットコイナーのコア原則ではありませんか?」

問題は、今日私たちが目撃しているような社会的キャリアシフトの前でさえ、彼らの基本的な価値はすでに戻ってこない点を超えており、多くの目を見張る市場参加者に苛立たしい宿命論を生み出していました。

何十年にもわたる割引率の低下により、将来から多くの価値が奪われており、根付くための将来の成長苗は残っていません。したがって、ここでの問題は、それ自体で貯蓄することではなく、個人が群がっている特定の貯蓄牧草地です。それが実際の価値のある店に注ぎ込まれていなければ、貯蓄は貯蓄ではありません。実際には正反対です。現在の生活水準を維持する唯一の方法は、永続的な資産価格の成長率を必要とし、その結果、ますます多くの債務が必要になります。

政府と規範的な文化的影響力者がそのような力学を大衆に輸出する場合、結果はどうなると期待すべきですか?それはユートピアの平等と豊かさですか?それとも、それは中央計画、疎外された自由市場、そして社会化された経済活動ですか?ご想像の通り!ドア番号2、ボブ!

出典:Business Insider、CBS

ブロック3:数学

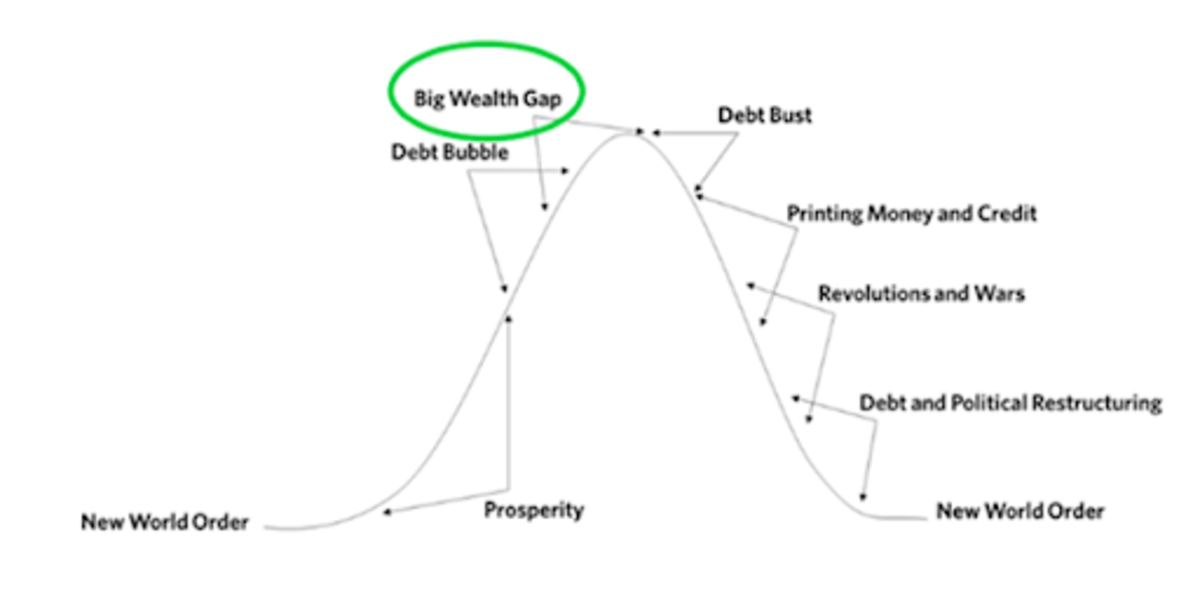

歴史的に大きな安定性と強さの期間の終わりに関連付けられてきた最も影響力のある変数の1つ富の不平等でした。このような歪度が全身崩壊の原因となることはめったにありませんが、ほとんどの場合、それは衰退の兆候であり、転換点を衰退に導く役割を果たします。マヤ人からローマ帝国、中国の3つの王国、オスマン帝国、フランス、ロシア、中国の革命に至るまで、富の不平等は常に大きな役割を果たしてきました。

出典:Ray Dalio、「The Changesing World Order」、第1章

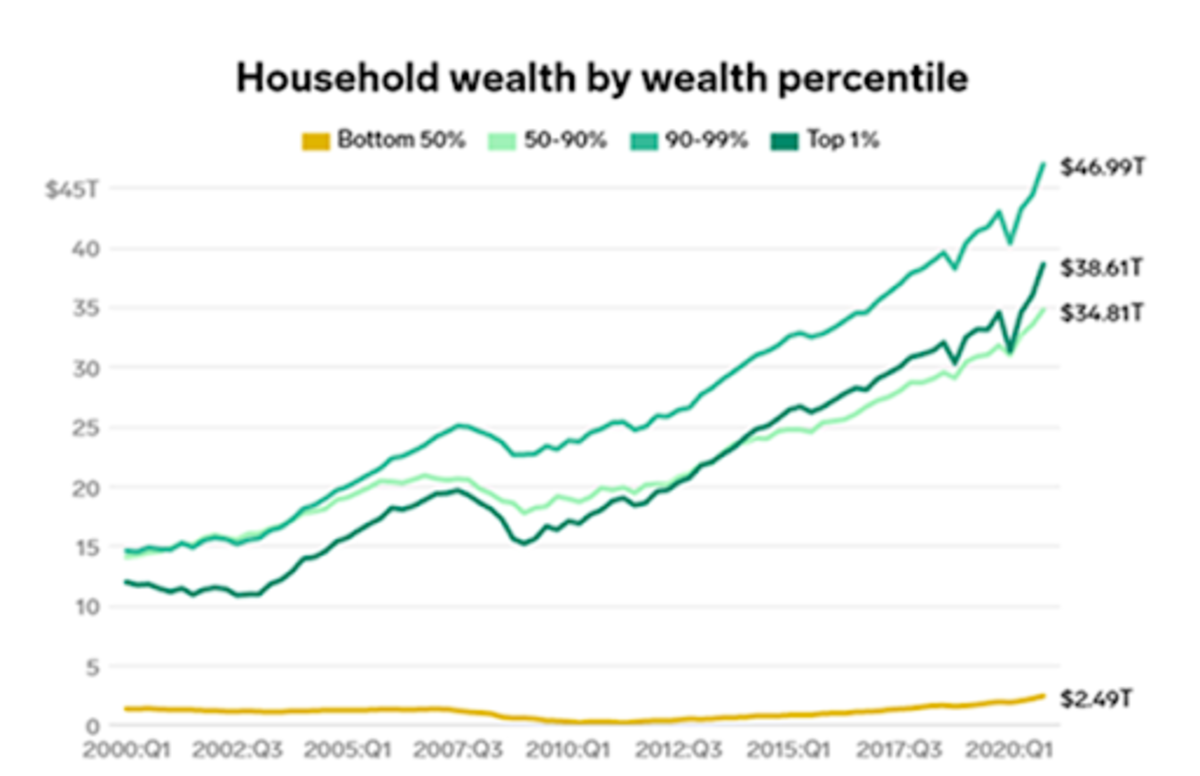

これは、大規模投資家クラスの戦略にとって大きな問題です。 This is because a goal of wealth redistribution with a strategy centered around asset inflation is statistically impossible to achieve.

Many proponents of this new investor class take the “fight fire with fire” approach. Yes, asset inflation — driven by modern monetary policy — has been the prevailing impulse of inequality over the last several decades. Why should the average individual not be able to get their just desserts as well? Ethically speaking, I take no issue with such retribution to some degree.

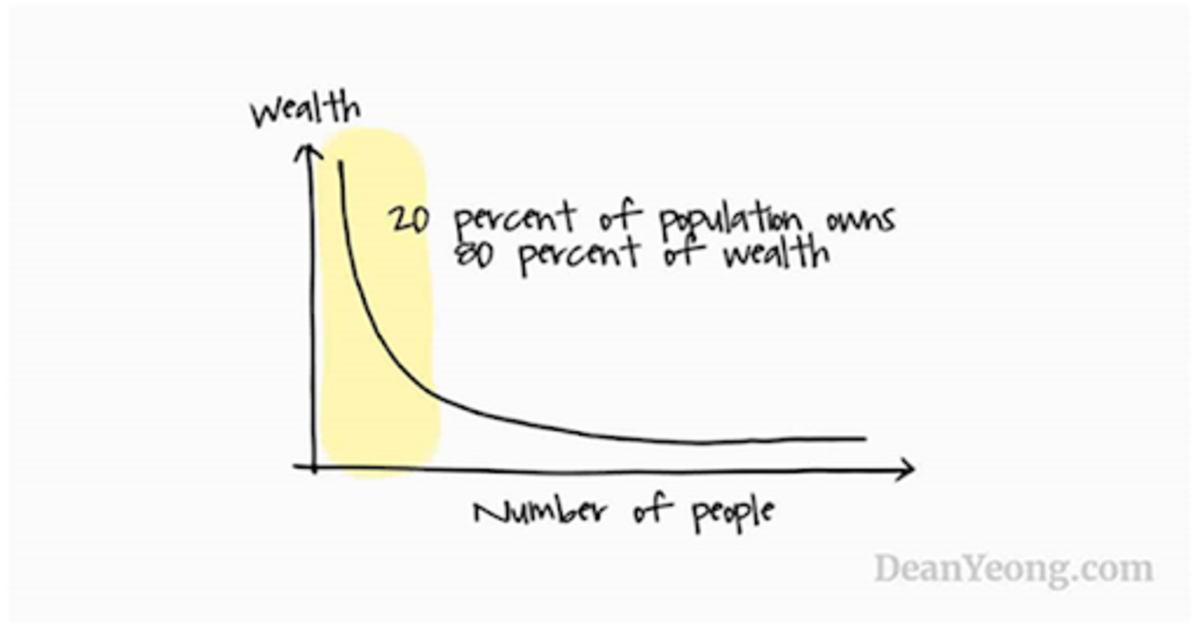

Unfortunately, it’s an illusion. The presiding growth curve that has been empirically witnessed as it pertains to wealth distribution has been found in the Pareto principle, a probability distribution whereby a small percentage of the sample group acquires most of the attainable value. Facets of this law, more colloquially known as the “80/20 rule,” are observed not just in wealth distribution, but prolifically throughout much of nature and human social environments.

We have experienced at least a half-century of Cantillon effects that have supported asset owners in exponentially outperforming relative to income owners. Even if we disposed entirely of such Cantillon effects and allowed the broader population equal access to financial assets going forward, and even if financial assets continued to generate historically anomalous returns, the “80 percenters” would never catch up. The reason for this is simply due to the nature of exponential growth curves as seen in the Pareto principle. Inequality would be maintained at the very least, if not continue its asymptotic expansion.

Pareto’s law: How asset inflation becomes a highly entropic state for wealth distribution, regardless of policy.

Source: DeanYeong.com

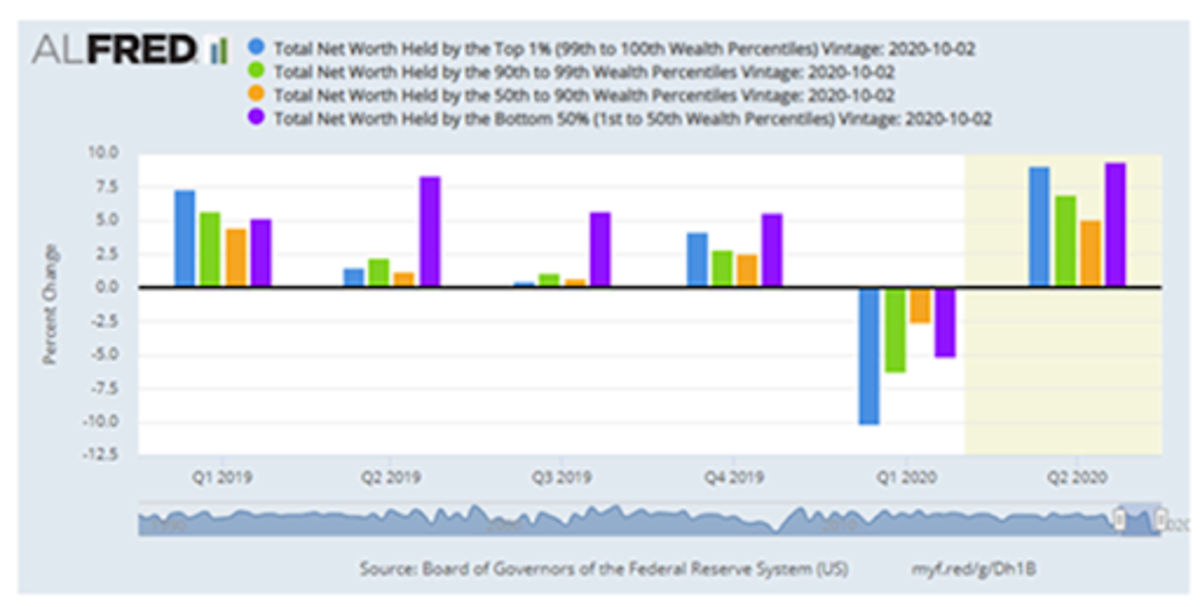

This Pareto probability distribution is exemplified quite dramatically after looking at 2020 as an outlier year, whereby the least wealthy percentiles actually saw the largest percentage improvement in wealth. However, while this is a lovely-sounding statistic for social media hype and political propaganda, it is purely a mathematical outlier caused by starting from such a low base and from such a low level of prior financial asset ownership.

Unfortunately, the banner year for the bottom 50% (purple bar below), did next to nothing to narrow the wealth gap from the top percentiles, as evidenced by the below chart.

Source: Federal Reserve

2020 did nothing to rectify the problems of inequality. In fact, inequality only got worse. Why would a continuation of asset inflation look any different in the future?

Source: Federal Reserve, “Distributional Financial Accounts”

If inequality cannot be corrected by the only policy tools available, the risks for social instability will only rise further. Ironically, when stability is threatened, this tends to only increase levels of centralization.

Have you ever been driving your car on a wet, slippery road, only to fish-tale unexpectedly? While our instinctual response would be to tense up and violently steer the wheel in the opposite direction to regain control, such a reaction would only worsen our dire predicament. One must steer into the chaos. Once control has gone, such a fate must be embraced, not opposed. This is the only way out. Further attempts at control only make matters worse.

Block Four: All Roads Lead To One Road, More Centralization

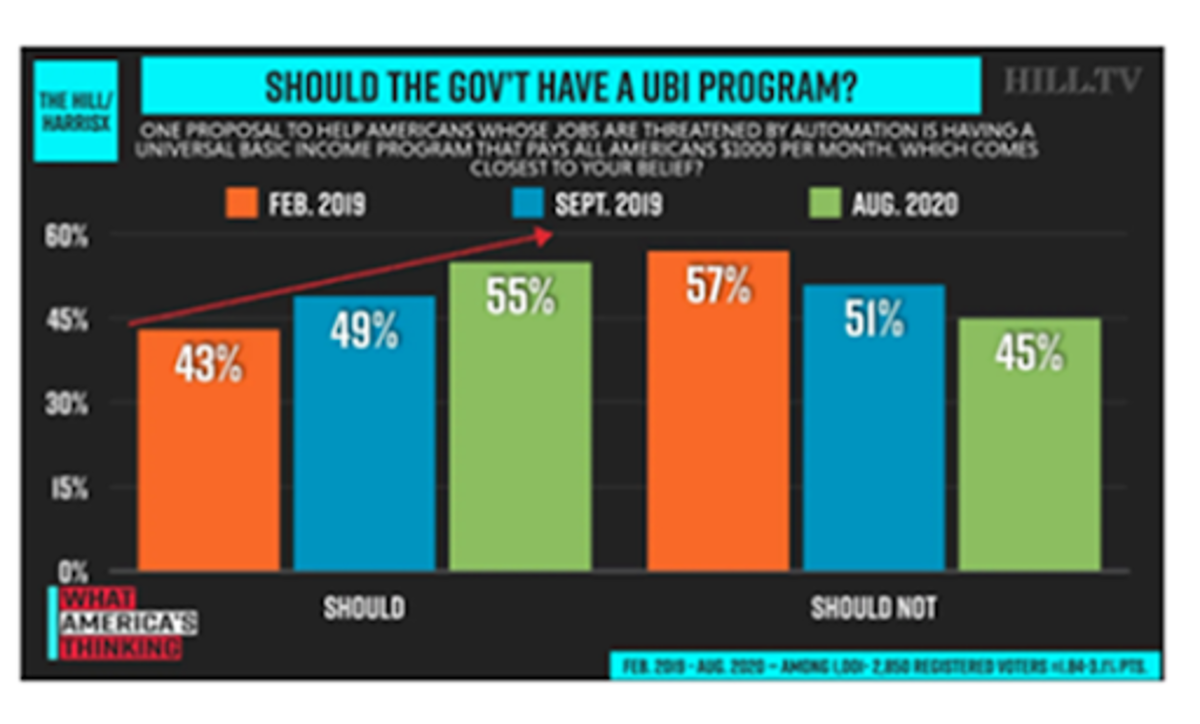

Once the inevitability of blocks one, two and three as stated above are appreciated, the path dependency of block four in our chain becomes absurdly apparent: Subsidizing asset prices through monetary debasement becomes the oblique way that society yields to ideologies like universal basic income (UBI).

UBI may end up in the very long run as explicit social welfare programs, or “helicopter money.” Of course, during COVID-19, we saw some discreet examples of this, turning something merely theoretical into a tangible part of the societal zeitgeist. However, it is a mistake to assume a linear path, that such policy will now settle as the initial and most effective vector for such policy going forward.

A more frictionless pathway would be the mechanism outlined above, whereby social welfare can be extolled circuitously. The brilliance of such a policy approach is that it would not require any incremental pieces of legislation, and no constitutional alterations to property rights. There are no foundational legal constraints. This implies that our current institutions have the power to accomplish such social welfare goals today.

One could argue that some changes would certainly make these aims easier to administer, like augmenting the Federal Reserve Act of 1913 and expanding the powers of the U.S. Treasury Department. However, the key point here is that such change is not required. If the reader finds this too far fetched, I would recommend listening to the taped conversations between ex-President Richard Nixon, and then-Federal Reserve Chairman Arthur Burns. It has happened before in this country, and in less dire circumstances.

Source: TheHill.com

UBI advocates are here, and they have their own network effects:

“The map references not only networks with the sole purpose of advocating UBI, but also all organizations (networks, foundations, platforms, political parties, working groups within political parties, societies, study groups, etc.) that advocate for UBI.” Source.

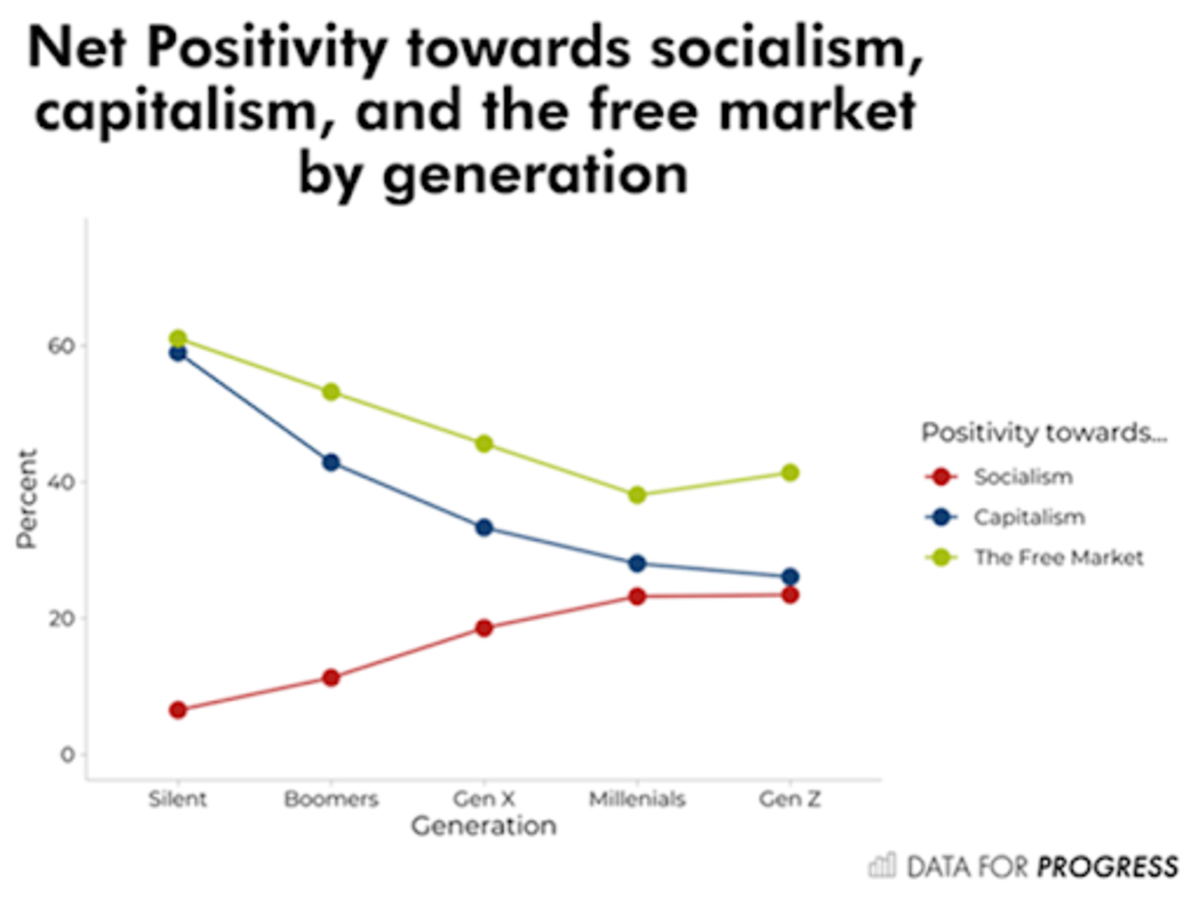

American openness toward socialism, and a commensurate disdain for capitalist ideals, has increased dramatically over the last four generations. This has been well documented with recent generations, particularly millennials, but it is important to recall that such a trend has been consistent well before that, even with the boomer generation relative to their parents and grandparents.

This is rather alarming when one considers that this generation has been the biggest beneficiary of financial asset prices (coincident with the full embrace of the fiat monetary system) of any generation in American history.

A Quick, “Passifict” Detour: Passive Investing Socializes Capitalism

Bitcoin may be humanity’s historically most perfect manifestation of a pacifist revolution, but passive investing is also a revolution, only with completely opposite implications.

Historical analogues are always dangerous, and each generational crossroads exhibit unique characteristics that can change the entire spectrum of outcomes. However, as a reference point, current trends reverberate with echoes of previous centralizing efforts designed to redirect our collective future and shift the public behavior, reminiscent of Franklin D. Roosevelt’s “new deal,” as well as Nixon’s “great society,” or even going back to German Chancellor Bismarck and his social welfare policies in the 1880s, which greatly enhanced the Second Reich’s military capacity.

Passive or indexed investing vehicles such as exchange-traded funds (ETFs) are yet another example of this shift toward a “mass investor class.” While such a trend may seem innocuous, it is cultivating the seeds of enormous societal change.

As discussed by Inigo Fraser-Jenkins, a highly-regarded maverick quantitative equity strategist at Wall Street firm Bernstein, passive investing can be compared to Marxism. This may sound hyperbolic, but unfortunately, I believe he is on to something important here, the point being that the democratization of capital markets by way of ETF proliferation and other passive investing products inadvertently leads to a socialization of capital.

It would all but complete our societal transgression from liberal democracy to social democracy, a trend that has been gradually underway, but accelerating over the past 75 years. Fraser-Jenkins compared passive investing to other societal externalities like the tragedy of the commons, whereby behavior that may be optimal for the individual investor can be quite negative for the aggregate society when all actors behave the same way (we will return to the problem of the commons later).

The unfettered expansion of passive investing does not look likely to subside any time soon. This is especially obvious when one simply looks at the below chart, or even at the hiring behavior on Capitol Hill, like the large representation of Blackrock alumni acquiring key roles in the current White House administration. Blackrock is the number-one manufacturer of passive investment vehicles in the world, with over $1.8 trillion in assets under management (followed by Vanguard in second place at $1.2 trillion).

Additionally, ESG and clean energy investment mandates further this shift, creating new products to bundle into thematic passive investment securities. Such bundles make it easier for ESG-approved companies to redirect capital away from those companies that do not fit the homogenous definitions prescribed. To be clear, there is nothing intrinsically bad about incentivizing cleaner energy and more sustainable economic practices. Of course, this is a good thing! However, when rules for such behavior become formalized, complex, and sometimes arbitrary and naively general, they impinge upon the competitive dynamics of free markets that would accomplish such goals more effectively.

Instead, such rules generalize the flow of investment, compensating those market participants best suited to game such a system. The new game defines the winners as those best able to adhere to the appropriate definitions as a means of acquiring low-cost capital. In a road paved with good intentions, we potentially end up in hell, robbing free markets of innovation, nuance, and differentiation. We write new rules of the game, rules that thoughtlessly increase centralization.

Mike Green, a distinguished researcher of passive investment stated back in 2020:

“Of managed assets, [passive investment] is now greater than 50% [and over 40% of total market capitalization]. That split though, is not uniform across demographics. Millennials are almost 95% passive. Boomers are only 20% passive. For the vast majority of millennials, their only exposure to the market… We make a lot of hype about things like Robin Hood and stuff, but the actual assets are tiny. The vast majority of the money that they’re getting is actually just going into things like Vanguard target-date funds.”

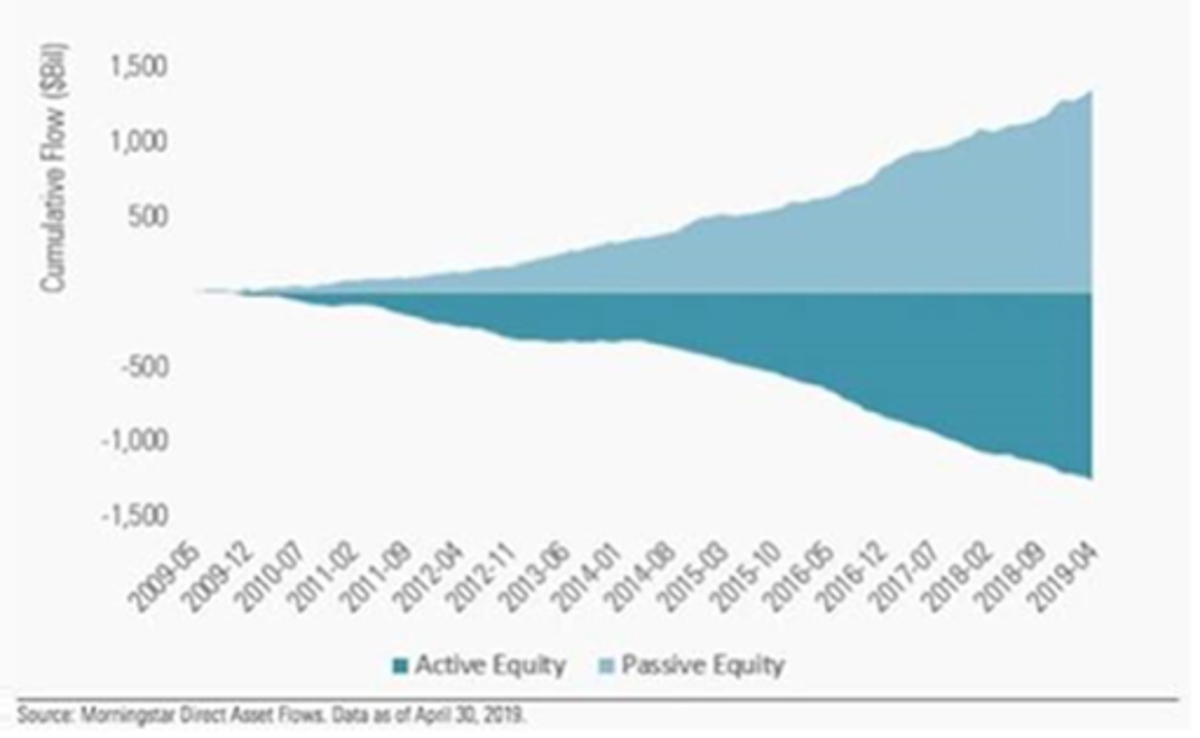

Active equity managers have seen outflows every year and passive investment vehicles have seen inflows every single year since 2006. And this trend is only accelerating:

Source: Morningstar

Source: The Wall Street Journal

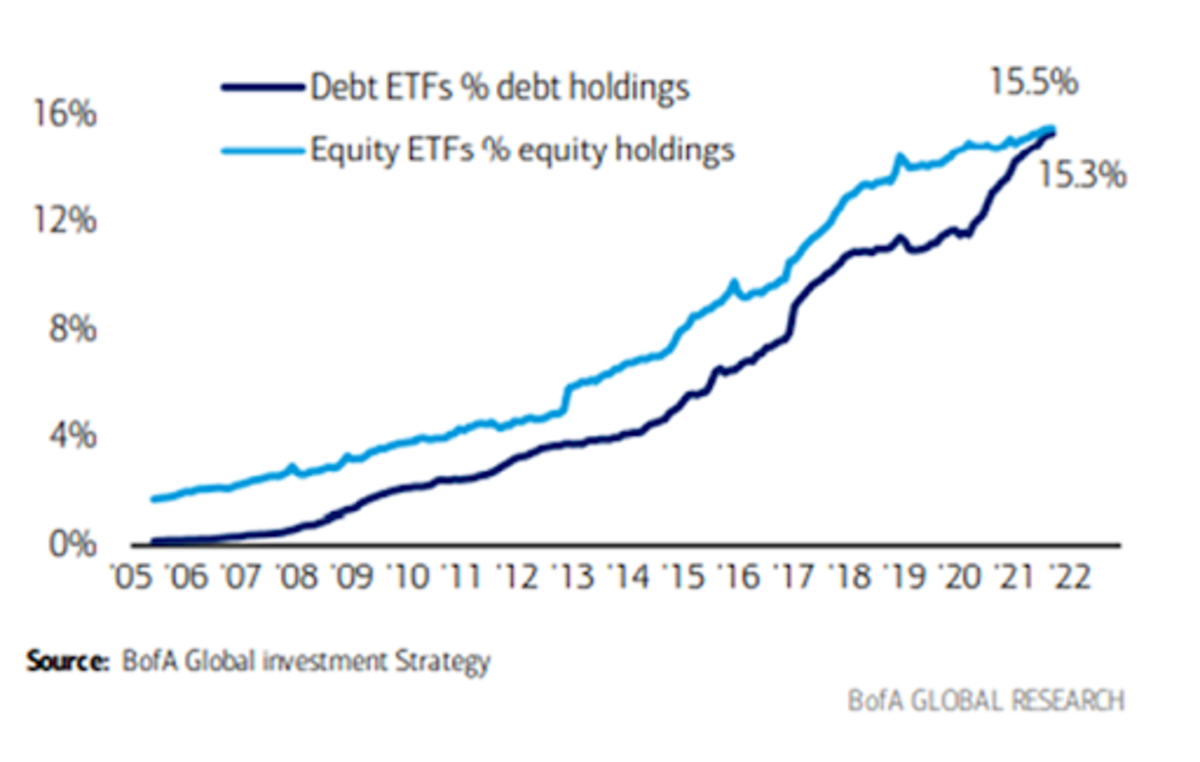

Bank of America’s private client ETF holdings as percentage of assets under management (AUM). A hard trend to fight:

Source: Bank of America, Michael Hartnett

The passive singularity: Millennials have 95% of their retirement savings invested in passive vehicles. What is the logical conclusion of this freight train?

“One of the challenges that gets created as passive becomes a larger and larger share is that there becomes no discretion. There is no consideration of should the incremental dollar go in in the exact same fashion, right? That passive player has no instruction to sell. You exhibit increased inelasticity in terms of each incremental dollar that goes in. Imagine a scenario in which 100% of the owners of a company were passive and you tried to buy a share. There is no price at which they would be willing to sell to you unless they received an instruction from their end investors saying to sell shares to you. Prices could theoretically become infinite on that type of dynamic. Eventually, you would expect somebody to respond by saying, ‘All right, I will sell an additional share to you.’ Traditionally, that’s been accomplished by price-sensitive or return-sensitive discretionary managers who say, “Okay, this price is unwarranted by the fundamentals. Therefore, I’m willing to sell some of these shares to this person who’s expressing, in my view, an irrational demand for these shares.” If that demand is so strong and it gets absolutely extreme, people can synthetically create shares by shorting, but that is incredibly dangerous to do, an environment in which stocks are exhibiting this reduced elasticity.” –Green

The mass investor class faces a big incentive problem: What does the internet, digital property, and a tragedy of the commons have in common? Our retirement accounts.

The dismantled connection of choice from the capital allocation process brought about by passive investment proliferation has implications beyond the clear destruction of price signals. This is no small statement. A destruction of price signaling is as destructive as things can get for a capitalist system. Prices are the main form of communication we use in society to make appropriate economic decisions and choices. Its dissolution is of existential importance.

However, there are other problems to consider from this evolution of behavior as well. Ever since the runup to the 2016 U.S. presidential election, and at an accelerating pace since the onset of the COVID-19 pandemic, society has become more aware of the vast concentration of power that the internet giants and social media platforms carry.

Pockets of government and pockets of new and growing cultural progressive movements have quite easily influenced and incentivized these platforms to actively censor speech in our democracy. This is not a political statement, and this is not a judgement about the people being censored, but merely a factual observation about a key tenant of our democratic institutions. If the U.S. Constitution can be likened to the “core protocol algorithm” dictating the manner in which our collective network operates, this is a clear attack on one of the most vital rules of the protocol. How can we so readily dilute our core principals?

First, network effects are powerful. The ability of the internet companies to sustain and grow off individual resources, with extremely low detachment rates, cannot be underestimated.

How did this come to be? A failure in timing. As is often the case with disruptive technology, its usage preceded an appropriate infrastructure to handle it. Unfortunately, the Byzantine Generals Problem was not solved before the advent of the internet. Consequently, we have been suffering the consequences that a lack of enforceable property rights leads to in a digital world. A winner takes all society.

This is what the internet got wrong. You didn’t own anything. No one had any stake on the internet. Instead, value has been extracted by those who figured out ways to own the on-ramps and access points to the internet instead.

This group has become the “landlord class” of the internet, and the vast majority of value proffered by the internet and its myriad innovations of social communication has been funneled through this layer. The consequence, of course, has been more inequality, more surveillance and control, and more concentration of power. Further, we’ve witnessed a trend toward a reduction of quality of information. There is a diffusion of responsibility that engulfs the internet when ownership is so opaque and ephemeral. We are incentivized to create more noise than signal because when no one owns the land, there is no incentive to be a steward of that land to ensure its long-term sustainability, utility and productivity. Instead, the incentives align so as to be solely transactional. The more information one can manage, control and recapitulate, the more one can develop network effects and externalize the social and economic cost of a system that produces excessive noise and underproduces enough structured signals that could offer synergistic benefits across societal planes. That cost is shared by all of society. It’s a tragedy of the commons. All because the internet couldn’t address digital property rights.

The second issue here is that network effects also impact passive investing. Most passive vehicles are ETFs, that are indexed and weighted by market capitalization. The bigger you are, the more capital you attract. Size matters, aptitude and productivity do not. This takes us back to the Pareto principle and the 80/20 rule, setting the stage for increasingly non-linear distributions of capital. And in a world where access to low-cost capital is a massive competitive advantage, we end up with an obvious outcome. The big continually get bigger, and the small get only smaller. Or worse, the upstart disruptors may never have a chance, and we would never even know what could have been.

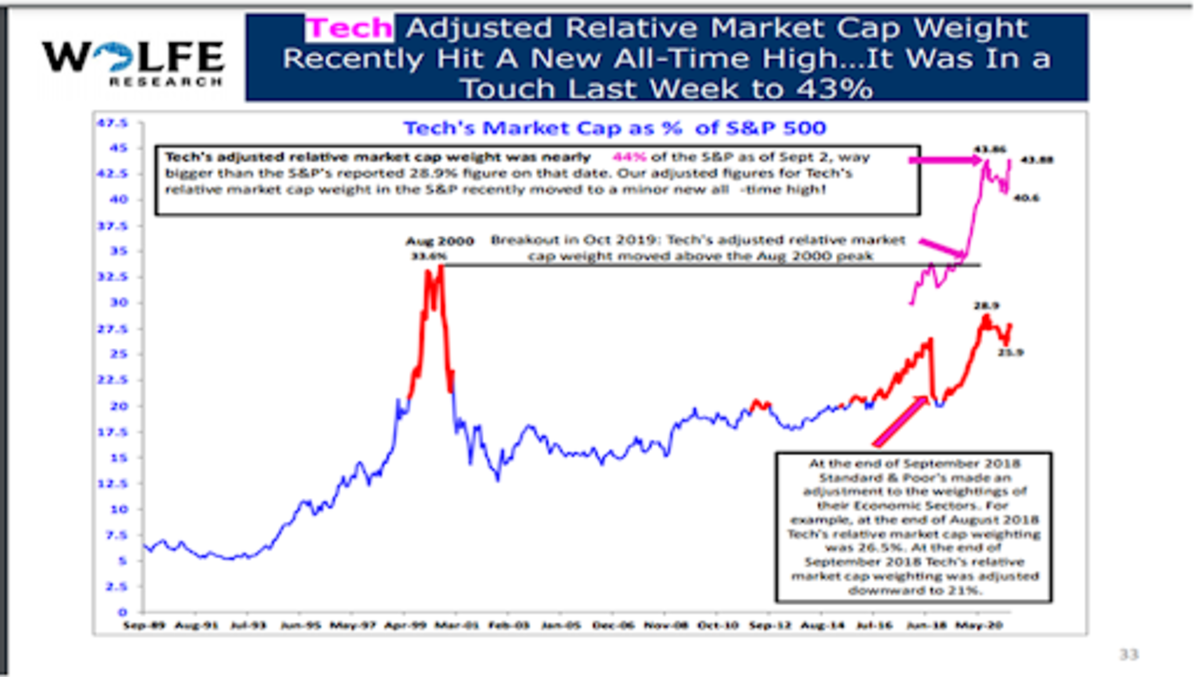

That brings us to the present, where just six behemoths have a near majority control of the entire equity market. Most investors do not blink at this statistic any longer. Professional investors have been numbed to such lopsidedness. However, imagine if such inequality persisted within the domain of political parties? In democratic institutions? In your childrens’ classrooms? But the real question we need to start seriously and honestly asking ourselves is this:

If the below chart only becomes even more extreme in its weighting distribution, and if our collective wealth is increasingly tied to the index it represents, what will our incentives be as the companies involved become even more centralized?

About 45% to 50% of our savings are tied to companies that could be actively censoring us, and indirectly eroding the very principles of the system that allowed them to prosper. This share of our savings will only grow further. Will we object? I certainly hope so. But so far, there is little evidence to support that aspiration. Unfortunately, passive investing, alongside a mass investor class, is likely to only help internet platforms and capital markets centralize further.

Major stock indices are mainly just six names now: Apple, Amazon, Facebook, Google, Microsoft and Nvidia, totaling 42% of the equity market.

Source: Wolfe Research

Block Five: All Roads Lead To Zero

What happens when zero volatility is the new equilibrium?

After our modest digression into passive investing, let us now return to the last block in our chain. The final and most deadly flaw in the chain reaction socializing financial assets relates to volatility and the cost of capital. Mathematically speaking, publicly-administered financial markets that demand continuous appreciation, distributed broadly and without diversification, will require volatility to trend toward zero over time.

A simple law in financial markets, when assessing an asset’s volatility (as measured by its standard deviation of returns over a given period), is that the more vulnerable to uncertainty an asset is, the less it can absorb volatility. This is why, for example, equity investors are generally willing to pay lower valuation multiples for cyclical or economically-sensitive sectors relative to secular growth or defensive industries. These types of companies are more vulnerable to unforeseen events. When our financial markets are a tool of policy rather than an expression of free market capital allocation, we eventually become incapable of withstanding any uncertainty. And manipulation to affect policy outcomes would be the only way to ensure uncertainty’s suppression. If successfully orchestrated, volatility must eventually collapse toward a zero bound to accommodate this.

As our centralized debt trap expands in circumference, the risk-free rate must also trend toward zero, as has been the case over the past 40 years. Over time, the consequence of this could even be the elimination of the need for a private sector.

This last section is essential to our thesis, as it is the bridge that transports us from the current transitional sandwich era where we find ourselves juxtaposed between centralization and decentralization. This is the last stop on this transitional train as we push relentlessly down the path toward a more authoritarian world order. Given its level of importance in our story, it requires some more detailed explanation.

Centralization As A Black Hole: The Volatility Singularity

Source: Disney, Pixar

What is the volatility singularity? Previously, we have established the logical chain of cascading events that are required in our world’s existing model.

Debt must go up, so stocks must go up. Thus, rates must go down, so volatility must go down. When this happens debt will logically go up, leveraging the system even more, so stocks must go up to prevent collapse and inflate the debt bubble with a greater equity cushion… (stop for breath)… So, rates must go down again until zero, so volatility must go down until zero.

Volatility collides with zero. Everything goes to infinity. Yippie! The transcendent state where the difference between nothing and everything gets very fuzzy and rather philosophically confusing. Just as observed in the case of black holes, where physics starts to behave mysteriously and spooky as one approaches the event horizon, so too do economies. Things start to get pretty eerie as we approach the zero point event horizon in volatility.

Thinking about the problem in the following simplified manner may be helpful:

Anything divided by zero equals infinity. Financial assets returns are a function of volatility. A common formula used to calculate risk-adjusted returns is called the Sharpe ratio, which is an asset’s return during a given period, minus a market risk-free rate, divided by the investment’s standard deviation of returns. If volatility is, for all intents and purposes, equal to zero, so too is its standard deviation. Thus, we end up in a confounding situation in which excess returns are divided by nothing, and therefore magically become, well… everything.

Image source. Source of quote: Kurt Vonnegut, “Slaughterhouse-Five”

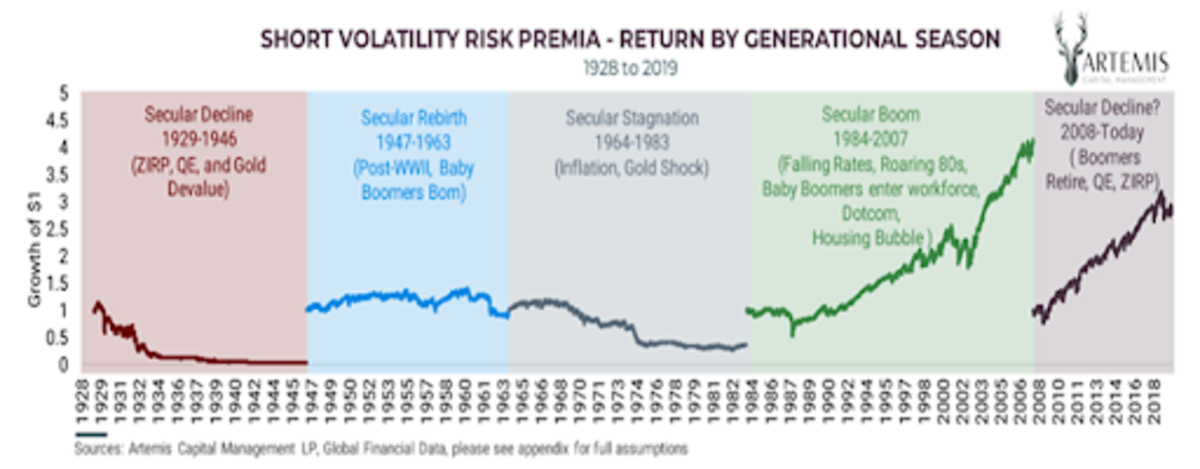

As macro volatility fund manager Christopher Cole excellently laid out in a 2020 piece titled “The Allegory Of the Hawk And The Serpent,” an investment strategy designed to short volatility, or benefit when it decreases, experienced temporally anomalous returns since the early 1980s, right when the financialization of Wall Street took off exponentially, and right as Alan Greenspan et al. began a campaign of moral hazard, at a time known as “The Greenspan Put.”

The stock market and nearly all financial assets in aggregate then become just a mere proxy for this “short volatility” expression.

Source: Artemis Capital, @vol_christopher

An Endangered Golden Goose

Cole, like many others, believes this period of declining volatility is mean reverting and must therefore repeal its nearly 40-year journey. While certainly possible over a cyclical short term time horizon given the magnitude of the move, a spike in volatility is unlikely to be palatable for any sustained period. The reason, as you might have guessed, is because of the deterministic nature of acceptable outcomes laid out above. The violence to the system that a spike in volatility would require would eviscerate so much wealth, so many debt obligations, that the policy response would be equally violent. Such a response is all but guaranteed because the crisis would be existential for those in power.

This outcome becomes more assured each day that goes by with greater reliance on financial assets to lift us into the future, each day that a citizen puts their first dollar of savings into such a system, and each day that another dollar is diverted away from new capital expenditure in favor of being recycled instead back into the existing sinkhole.

Below is a graph of the realized one-year volatility in the Dow Jones Industrial Index going all the way back to 1895. The pre-WWII average of this proxy for stock market volatility was about 20%, witnessing only one to two “black swan” spikes during a 50-year span. Meanwhile, the post-WWII average has been closer to 14.5%, with three black swan events observed only within a 30-year period!

This graph gives us two important pieces of information:

Volatility is trending lower over time. A move from 20% to 14.5% may not sound significant, but this is a nearly 30% decline in average volatility. The positive effect of such a shift has on underlying asset prices cannot be overstated. A system of declining volatility has come at the heavy cost of greater susceptibility to bouts of near-disastrous black swan events, external and internal shocks. And these events are not capable of being permitted to clear the imbalances that caused them, to self correct, as the system would break before such catharsis could be attained. Instead, each successive crisis forces policymakers to intervene at much lower levels of volatility than in the pre-WWII era. This of course fuels greater abdication of responsibility, which fuels the next crisis as we rinse and repeat, racing toward zero.

Source: @LudiMagistR, Bloomberg

Centralization Is A Fabergé Egg: Systems Which Require Stability And Efficiency Are Always Extremely Fragile

I recently came across a white paper authored by Ben Inker and Jeremy Grantham, famed hedge fund investors at GMO. They conducted a data mining project and looked at the prior periods of frothy financial markets like the 1999 to 2000 period, and similar historic periods of strong performance and excess returns. They were surprised to find that it wasn’t earnings growth, the level of real interest rates, or even GDP growth that mattered during such periods of excess and euphoria.

Instead, they found three consistent variables that were always part of the equation:

Atypically high profitability for one or some segments of the economy (this is finance speak for maximal efficiency rather than maximal productivity)The stability of GDP (as a proxy for overall economic activity)The stability of the rate of inflation

In short, markets care not about actual levels of growth, inflation and profits. Predictability is what matters. A financialized system and a mass investor class requires stability and loathes uncertainty. Said differently, our system of monetary inflation rewards monopoly formation, values efficiency over productivity, and requires reduced volatility to sustain itself.

Given that volatility is a natural phenomenon of any free system, suppressing it requires external and artificial forces. It requires a central authority to manage the system and to solve for low volatility. Our central bank policy of monetizing moral hazard is evidence of this. Moral hazard from this prism is simply a function that solves for low volatility, at all costs. And there are a lot of costs.

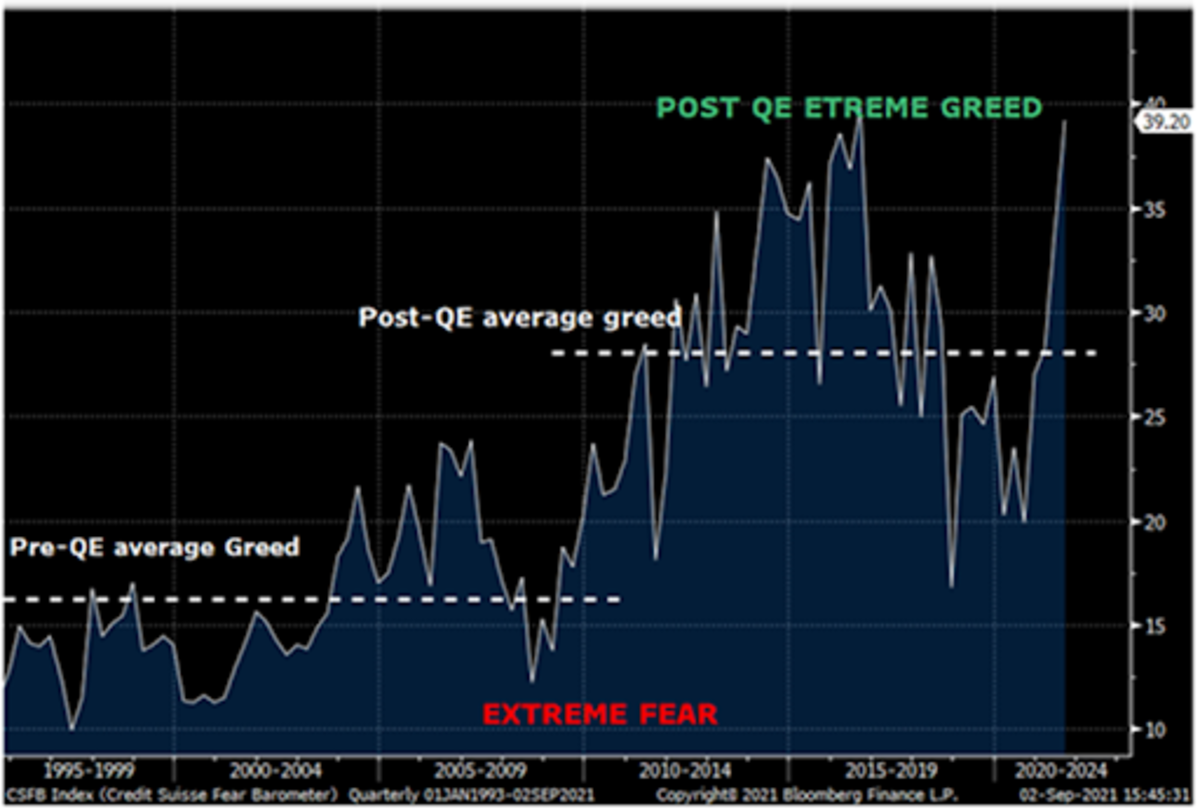

Moral hazard visualized: Credit Suisse Fear And Greed Index. Source: @LudiMagistR; Bloomberg; Credit Suisse

The Difference Between A Medicine And A Poison Often Comes Down To Dosage

While the importance of gains in efficiency are indeed a requisite aspect of technological progress as well as a tremendous generator of wealth for those providing such efficiency gains, there is always a trade off. A great example of this is the Bitcoin block size war of 2017, as well as the many utility protocols proliferating the crypto universe, optimizing for network throughput at the cost of much weaker decentralization. The irony is that the many use cases of blockchains become completely obsoleted without decentralization. Efficiency is great. It’s exciting. It often is associated with innovation. To a point.

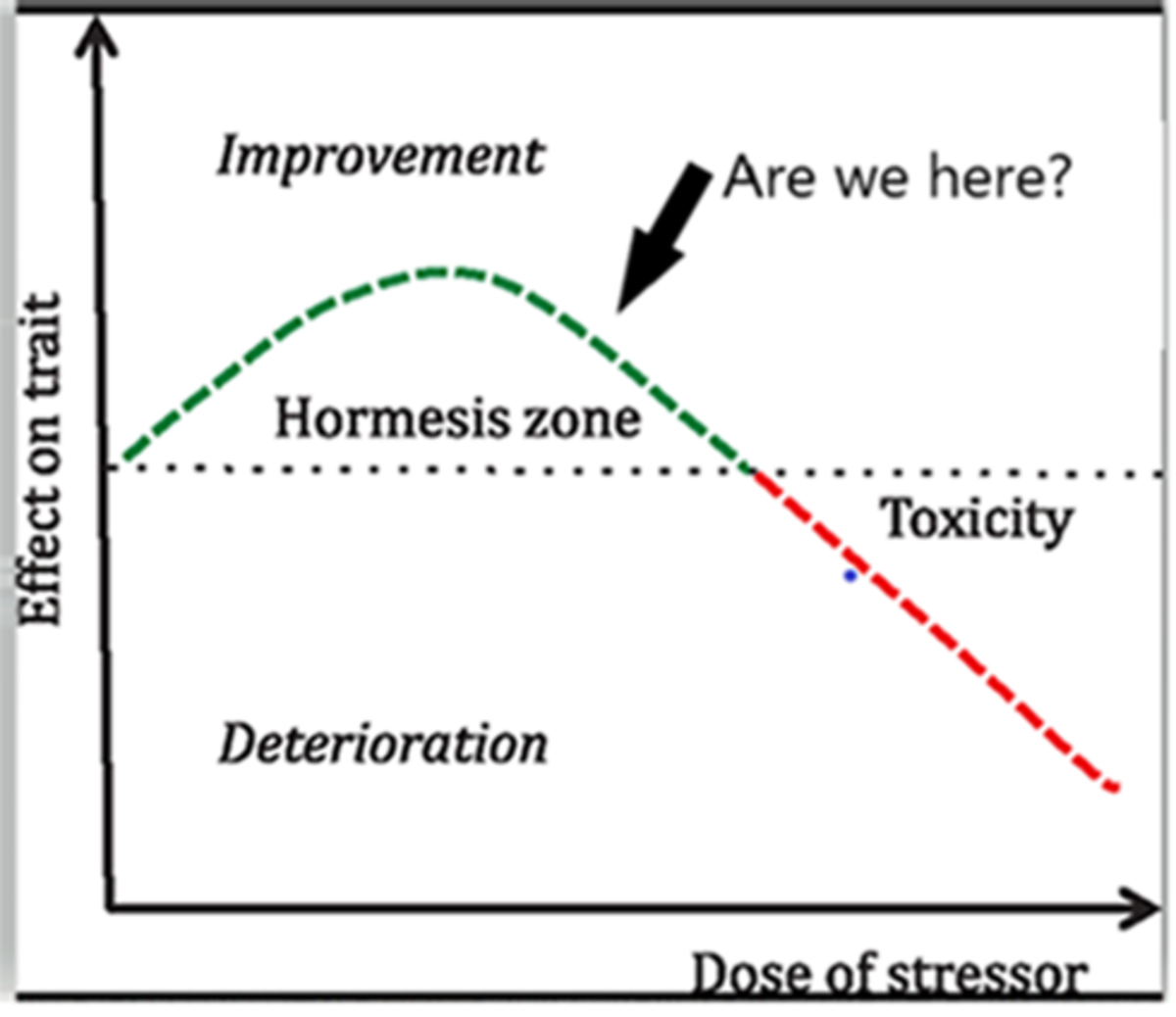

Where is this point?

Any marginal gain in efficiency requires a marginal loss of resilience. Given that resilience is vague and incandescent, a decline can seem harmless until it suddenly breaks completely. This means that the relationship between efficiency and resilience is non-linear. There is always a point on the curve where the benefit of efficiency gains become precipitously overwhelmed by the cumulative trade-offs.

Source: Nassim Taleb, “Antifragile”; @LudiMagistR

Ok, fine. Let’s agree that the financial system is in fact becoming more fragile. What does this have to do with centralization of power? Shouldn’t a fragile system lead to the dissolution of power?

Short answer? No.

Less short answer? A centralizing power depends on vulnerability to validate its own existence. As the costs of centralization mount, is becomes existentially vital for an authority to lay claim on the sole ability to medicate the very ailments it fabricates, so as to traverse unstable times unscathed. Fragility maintains power. Power thrives on fragility.

Efficiency Is A Great Barometer Of Where We Are In The Macro Cycle

Why? Efficiency naturally peaks at the end of a regime. By the end of the regime, everyone assumes the cycle to be permanent because no one remembers a different world. We succumb to recency bias, forget history, and inadequately discount the inevitability of change.

Efficiency, fundamentally, is a way of optimizing processes or work to a specific environment. By the end of a regime’s lifespan, an environment’s self-selected economic participants have naturally maxed out adaptations to that one environment, having gone “all in” on its defining characteristics.

Thus, like a grain of sand placed on a growing sandpile, all that is needed is just one inopportune shift and the whole system cascades down with surprising fragility. A meteor hits, and we are cold-blooded, energy-consuming goliaths. Good luck with that!

We’ve of course seen this story time and time again throughout history, both at biological and evolutionary scales when diversity is overcome by uniform specialization, and throughout the annals of human history. This is one explanation as to why empires always eventually fall. Their successes eventually become their weaknesses. Efficiency helps fuel dominance in a world that values power as a function of resources, but it leads to dangerous deficits in resiliency that inevitably make them easy to destroy. This is also why empires are often built over long periods of gradual ascent, but often fall precipitously. Non-linearity.

Thus, somewhat counterintuitively perhaps, periods of maximal efficiency will precede periods of instability and upheaval.

An Obituary For The Private Sector

Now, let us return to volatility.

As the boulder of zero volatility and a fully-managed economy slides precipitously toward its Newtonian fate, there will slowly materialize some incredibly powerful implications for the structure of private property rights. This is because zero volatility and a required real risk-free interest rate held at zero or negative levels will logically push the aggregate cost of capital to extremes.

When there is no risk of material loss for capital, there becomes no discrimination as to how to invest it. The decision-making process becomes tied much more to government policy goals, cronyism and bribery, and other characteristics very similar to those of communist systems of governance. The corporation and the entrepreneur lose their utility in this world.

The birth of the modern corporation can be traced back at least to Adam Smith’s 1776 classic, “Wealth Of Nations,” interestingly published the same year that colonists here in America sought independence.

In this work, he lashed out at the “business association,” his era’s version of the state-owned companies, or the precursor of the “military-industrial” complex, or in China’s case the Sovereign-Owned Enterprise (SOE). These were institutions like the British and Dutch East India companies in Smith’s time.

He argued against monopolist business practices, which in turn paved the way for the legal autonomy of business outside the direct control of the government. As far back as 1844, corporations began earning the status of “personhood,” eventually granting them 14th Amendment rights in 1886. This paved the way for the evolution of corporate oversight toward the domain of the court system and not that of the executive and legislative branches.

The point here is that while we sometimes think of corporations as gatekeepers, monopolists, greedy beneficiaries of consumerism, debt and inflationary growth, these adjectives describe their failures within our current system, not their original purpose. The corporation was originally designed to bestow greater power to the entrepreneur and decentralize power away from the state.

By providing legal protections like limited liability, the corporate structure allowed for individuals to combine resources without unmanageable personal risk, which in turn allowed for the competitive acquisition of capital for investment. So, when the cost of capital and the risk of capital become immaterial, the existential purpose for the corporation becomes difficult to justify. And so the economy centralizes further with the erosion of one more source of decentralization.

What is so exciting about Bitcoin within this context is that it replaces the vacuum created from an impotent corporate private market structure with something much more decentralized and much better suited for the evolving digital information economy. It helps an increasingly interconnected economy divide labor beyond its current stalemate.

Bitcoin is a medium of specialization. Corporations were invented to be a specializing spoke of private capital, allowing for greater and more scalable division of labor. Unfortunately, in a world where the digital realm is becoming the majority sphere of economic activity, where individual property rights had not been assured prior to Bitcoin, the corporation instead has more often become a rent seeker, a bottleneck for competition, and a gatekeeper of digital property. This has had the perverse effect of decreasing our collective ability to specialize. Bitcoin solves this problem.

However, I am getting ahead of myself. We will get into this exciting potential in greater detail in part two of this series.

A Dangerous Cocktail: Why The Pareto Principle Matters

As the world becomes more interconnected, relationships become more “Paretian,” and less “normal,” or mean reverting. This is because the Pareto principle has shown empirically that complex systems often demonstrate extremely asymmetrical distributions of effect. Effects that only magnify as the system grows larger.

Prior to the interconnectedness driven by technologies and the scalability of digital networks, such Pareto effects were only discernible at ultra-large scales or where the complexity of the system was much larger than witnessed in everyday life, in fields such as macroeconomics, astronomy, geology, ecology and theoretical physics. But over time it is being appreciated just how pervasive this Pareto dynamic truly is.

In the business world, it has been shown that roughly 20% of customers often produce 80% of a company’s revenue. Eighty percent of a company’s output, likewise, is often generated by 20% of its employees. The pattern is found in many random systems. Eighty percent of highway accidents occur at 20% of the path traveled (near home), 80% of the cost of building is spent on 20% of the structure, and 20% of the world population is responsible for 80% of the pollution. The list could go on. But this simplified 80/20 rule actually understates the impact, as it is simply an approximate guide, the map rather than the road itself.

In fact, this 80/20 ratio can often turn into 99.9999/.0001 quite easily. Take a simple example where the square root of the total nodes in a given network is the number of nodes that are deemed to have the most measurable impact on that network. If we start with 10 nodes, we have about three nodes fulfilling that role, or about 30%. If the network grows to 500 nodes, we get about 22 nodes, or less than 5% of the network. If we end up with 500,000 nodes on the network, the figure would be about 707 nodes providing that impact, or a stunningly small fraction of 0.1%. Non-uniformity scales exquisitely.

As we begin to see, the Pareto principle is powerful in large systems, and is so important today as the world interconnects exponentially and in increasingly fractal patterns. The bigger the network, the more extreme the variance. Decentralization is a natural outcome of network building, especially if allowed to flourish without interference or external exploitation. Therefore, it is a logical conclusion as a general principle that decentralization increases variance and begins to break down previous patterns of mean reversion that are so characteristic of normal probability distributions.

Conversely, centralization craves more uniformity. Otherwise, there become too many outliers in the herd to corral, and the system becomes unmanageable. As networks proliferate, governments increasingly are driven existentially to ramp up the use of power and coercion against this natural force.

Not only is the world experiencing greater dispersion of outcomes, it is also changing at an increasingly faster pace. Raw data is pouring torrentially down upon us, overwhelming our neural capacity more each day. We are confused, overwhelmed and looking for anchors, answers, and authority.

“Black swan” or “tail risk” events, by definition, are not predictable by any model. Otherwise, they would not be black swans. Models often give us a false sense of stability, understanding, and confidence. The renowned behavioral economist Daniel Kanneman has shown that even when we are given statistical predictions that we know to be spurious, we embarrassingly cannot help but feel assured and make more risky decisions based on such irrelevant data.

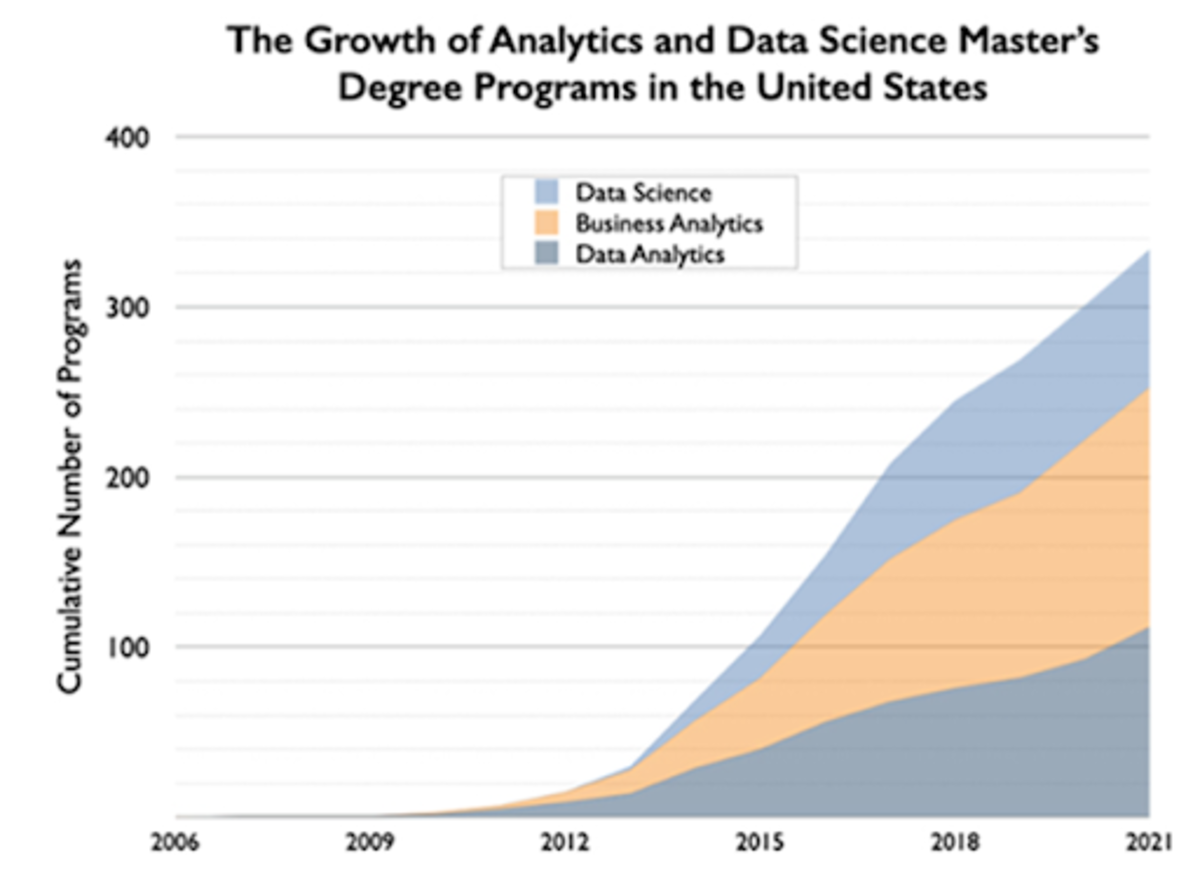

Nonetheless, the pace of change and data dumping has inspired us to overly romanticize and revere data accumulation, prediction, and data modeling techniques. We even have new professions that have popped up to deal with such issues, often aptly referred to as data “scientists.” Most major universities over the past decade have added degree programs for data science and it is now one the fastest-growing programs in academia.

Source: Michael Rappa, Institute for Advanced Analytics, May 2021

Now, let us more holistically recapitulate the situation described above. The cacophony of noise is getting ever louder, and meanwhile, our ability to filter this data to uncover the important signals hiding within has not improved at all.

We have developed technological tools that can filter the raw data and improve its informational extractability. However, these improvements are limited solely to endeavors that we are comfortable deferring to computers to manage for us. In all activities where humans still require involvement or apprehension, we are completely outmatched. On top of this, technology can be a tool, but it can also be a weapon. For every search, storage and AI tool that has helped to unbundle the noise into some semblance of a signal, there are other software tools that re-bundle the signal once again back into noise. Particularly social media, mainstream media, political propaganda and social science professions that overconfidently apply the newfound data abundance.

Taking all of these themes together, we have rampant technological shifts, overwhelming data propagation, and overconfident and confused human actors trying to adapt to these self-inflicted changes to achieve the unattainable: control. This means an increasing risk of the black swan events we so fiercely aim to circumvent. Less predictability, and more hubris as to our collective capacity to pattern-recognize and avoid those rare and historically pivotal events. This is a very dangerous cocktail.

An Homage To Endurance, Tenacity And Immutability

“I think much more likely is an even worse alternative: government will not cease inflating, but will, as it has been doing, try to suppress the open effects of this inflation. It will be driven by continual inflation into price controls, into increasing direction of the whole economic system. It is therefore now not merely a question of giving us better money, under which the market system will function infinitely better than it has ever done before… but of warding off the gradual decline into a totalitarian, planned system, which will, at least in this country, not come because anybody wants to introduce it, but will come step by step in an effort to suppress the effects of the inflation which is going on.” –Friedrich A. Hayek, “The Collective Works of F.A. Hayek,””Toward a Free Market Monetary System.”

Endurance, tenacity and immutability. While these attributes may sound too passive or unsubstantial to have value in our “move fast and break things” world, they are the exact traits required to survive the fragility of a system dashing feverishly towards instability.

Antifragility, an idea popularized in the 2012 book “Antifragile” by Nassim Taleb, describes systems or phenomena that gain strength from disorder. This book, part of a larger work focused on philosophical, statistical, and economic misconceptions relating to systemic risk, uncertainty, and randomness, has become part of the larger canon of Bitcoiner manifestos. This is despite Taleb’s recent baffling divorce from the community, which while a tad perplexing, should not detract from some of his work’s takeaways.

Bitcoiners have latched onto the themes of “Antifragile” as a framework to help elucidate some of Bitcoin’s game theory. How is it that there is no silver bullet that kills Bitcoin, there is no competitor that can magically overtake it, there is no government that can shut it down, and there is no central authority that can censor or confiscate it?

But the message does not stop there. Most important to the thesis of antifragility, each attack vector and shock to the system in fact causes Bitcoin to become stronger.

As Taleb writes:

“Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better. This property is behind everything that has changed with time: evolution, culture, ideas, revolutions, political systems, technological innovation, cultural and economic success, corporate survival, good recipes (say, chicken soup or steak tartare with a drop of cognac), the rise of cities, cultures, legal systems, equatorial forests, bacterial resistance … even our own existence as a species on this planet. And antifragility determines the boundary between what is living and organic (or complex), say, the human body, and what is inert, say, a physical object like the stapler on your desk… The antifragile loves randomness and uncertainty, which also means — crucially — a love of errors, a certain class of errors.”

We have seen firsthand how the market can reward an asset that exhibits antifragility. Astute macro investor Louis Gavkal has wisely observed that this is how the U.S. treasury market has evolved.

Today, investors have institutionalized portfolio management, packaged into strategies like 60/40 asset allocations (bonds/stocks), and slightly more volatility-adjusted strategies such as risk parity. However, this love affair with the treasury market as a diversification tool has not always been the case, especially from the perspective of global investors. In fact, treasuries may be losing this status. The godfather of risk parity, Ray Dalio himself, just recently confirmed the view that he would rather own bitcoin than bonds.

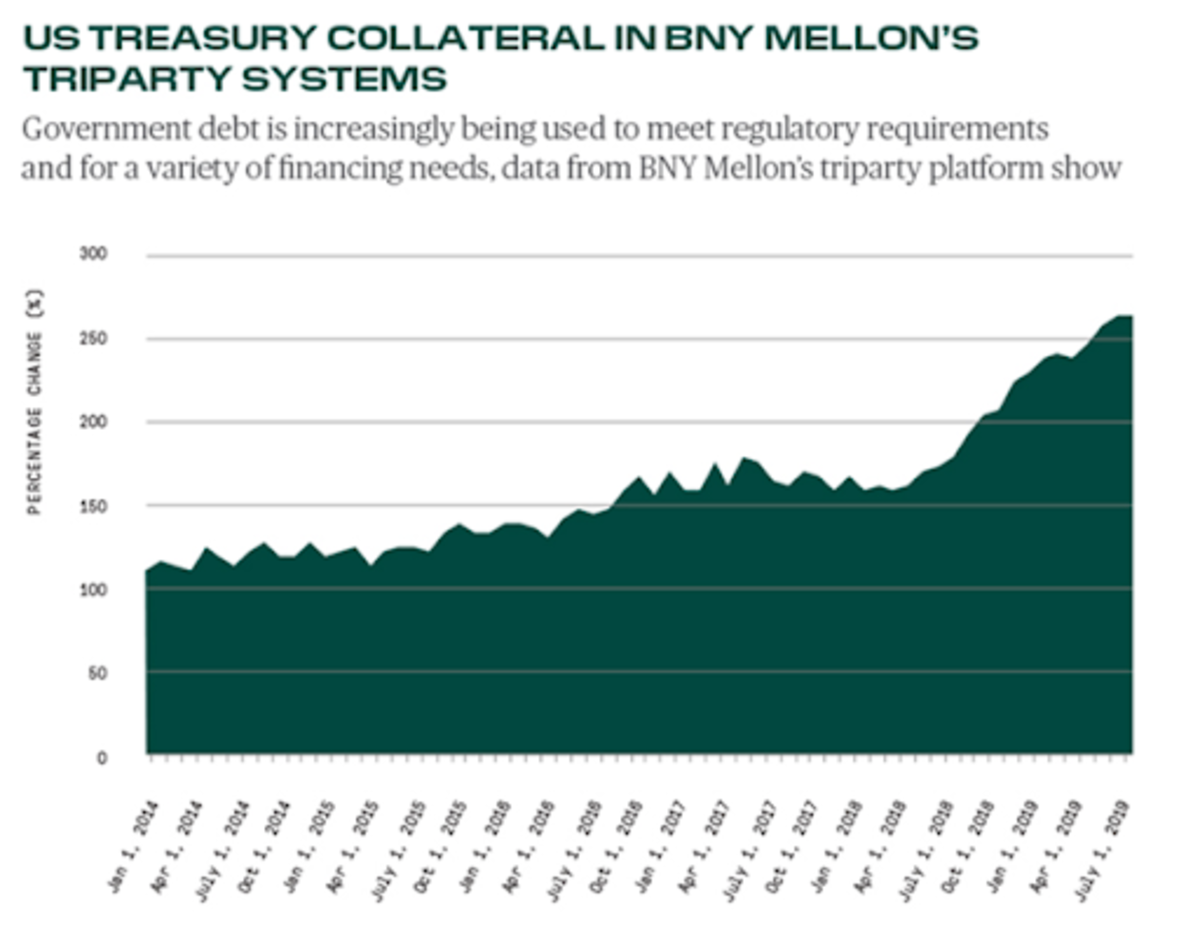

What has historically given treasuries their stature of primacy for so many years was the dollar’s reserve currency role. A feat attained through war, geopolitical victories, petrodollar arrangements, and the trade-offs of increasing consumerism and domestic debt accumulation in the U.S. to supply dollars abroad. All punctuated by a parallel hyper-financialization of our economy, with regulatory incentives to own treasuries and a global system addicted to dollar-based leverage and short of adequate collateral.

This collateral shortage has become particularly acute after quantitative easing has been significantly reducing the public supply of treasuries since 2009. All of these factors have helped create a treasury market monster with very resilient network effects for the U.S. dollar. Resilient to deleveraging elsewhere, resilient to market volatility, resilient to dollar shortages, and even resilient to cyclical inflation.

The treasury market is a massive battleship that has been chugging along full steam in one direction for many years. However, this ship is now altering its course. And this process is ever so slowly chipping away at those network effects. As the U.S. dollar necessarily loses some strength as a reserve money, the system will either need to deleverage or find a new source of collateral, a new antifragile asset.

Source: BNY Mellon

One way to think of the U.S. treasury market’s ability to maintain buyers and holders despite real interest rates, at least at negative 1% (depending on your gauge of inflation), is that this market has become a weigh station, a storage space for dollar-denominated assets, intended to balance existing portfolios of dollar-denominated equity, real estate and corporate debt holdings, as a reserve account that incentivizes participants to remain within the bounds of the existing USD ecosystem.

The Eurodollar system, U.S. dollars banked or held outside of the U.S. banking system, evolved to help accomplish this goal more efficiently at the global level.

The Eurodollar market size has exploded as the U.S. economy began to financialize in earnest: First in the early 1980s and then again in the 1990s and post-dot-com burst.

The start of this in the early 1980s coincided with the start of a 40-year bull market in U.S. treasuries:

Source: Federal Reserve Board

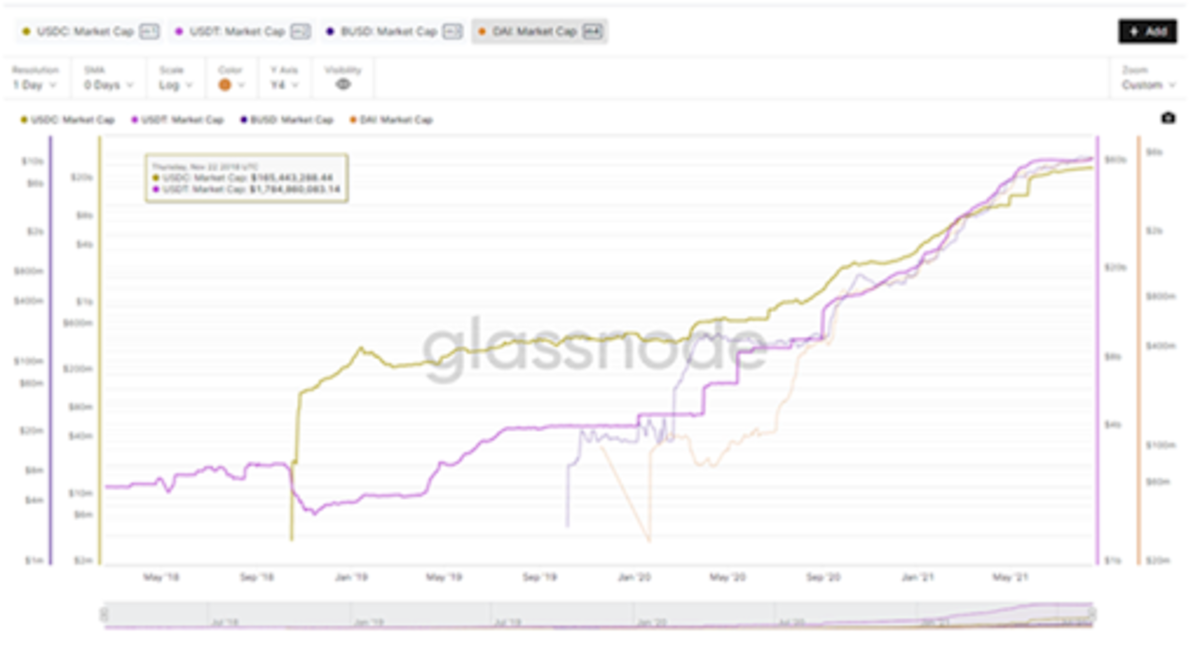

Such a concept of captively on-ramped capital is actually very similar to the stablecoin market in the Bitcoin and cryptocurrency ecosystems.

Source: @LudiMagistR; Glassnode

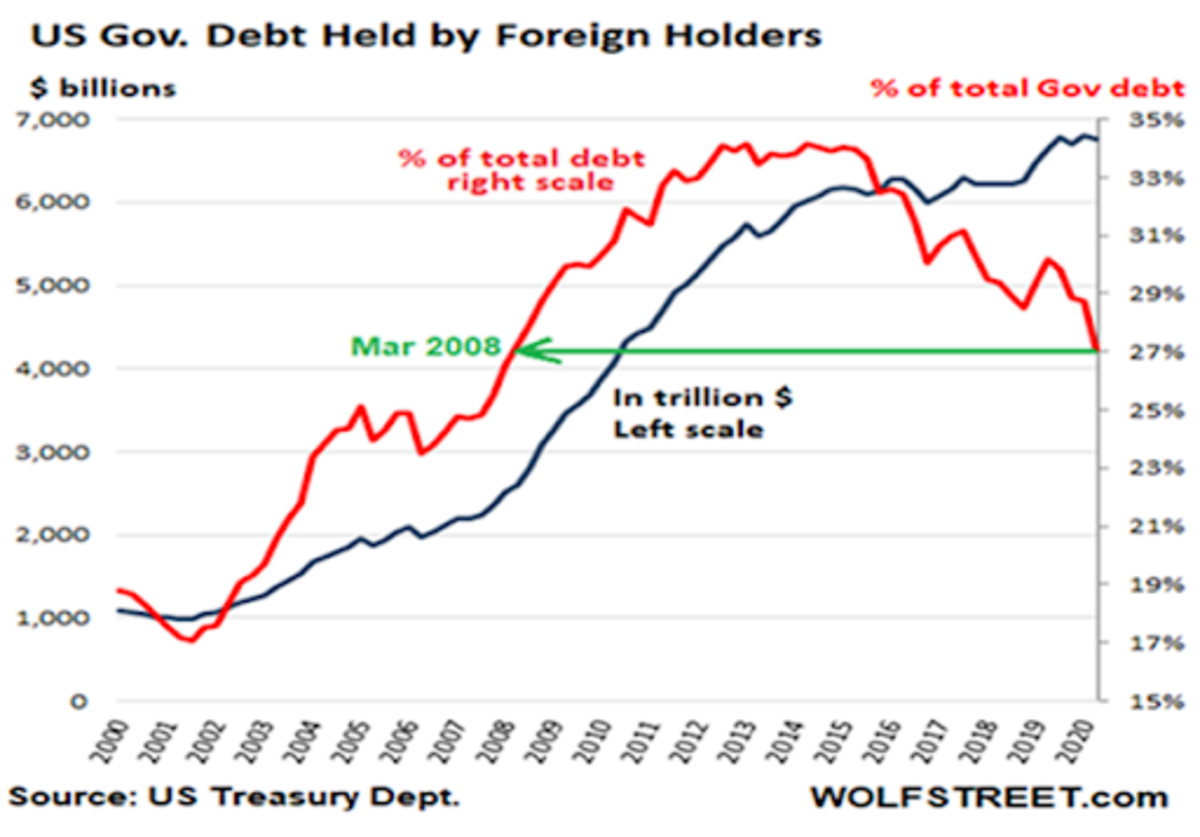

Unfortunately, for the U.S. dollar fiat ecosystem, there are signs of deterioration within its network effect. Foreign users are balking.

Source: Wolfstreet.com

A Poetic Phrase: Bitcoin Is A “Deep Structure”

“In a Paretian world, surface events can become a distraction, diverting attention from the deep structures molding these surface events. Surfaces are extraordinarily complex and rapidly evolving while the deep structures display more simplicity and stability. These deep structures are profoundly historical in nature — they evolve through positive feedback loops and path dependence. Snapshots become misleading and understanding requires a dynamic view of the landscape.” –John Hagel

We live in a world where things are intentionally made to fall apart. Quantity and popularity are valued above quality and depth. The news cycle is a meager 24 hours. Medical and health problems are addressed ex post facto with newly-invented medications and treatments, rather than by way of lifestyle changes and preventative measures.

Products are meant to become obsolete. Buildings are designed to last 20 years rather than 200. Tweets share ephemeral memes instead of lasting ideas, investments are made for instant return potential rather than lasting productive impact. And interest rates have collapsed to near zero, allowing us the mathematical permission to discount the future so that it is indistinguishable from the present.

We have lost our ability to think long term. We have no appreciation for durability over time. Therefore, we do not particularly value persistence because its main attribute is indeed durability over time.

Taking this a step further, if we do not place any material value on resilience, how could we value antifragility at the societal level? This is because antifragility is simply resilience in the form of a productive asset. By this I mean something that is durable, but also something that improves over time. It is no wonder then, that even Bitcoiners may be undervaluing antifragility.

This irony is further extended by the fact that just at the time when civilization least values such a high-powered form of durability and productivity happens to also be when these attributes are most desperately needed.

“An Ocean’s Ode To Volatility”

Oh waves, Crash thunderously

Unshackle my bounty of lost minerals

So they may rise and greet my surface foam

Antifragility is an embrace of volatility.

Volatility is the mathematical expression of what biologists and evolutionary scientists might call a “stressor.” Biological organisms crave stasis. Volatility, on the other hand, is a natural characteristic of all complex systems. This is because the greater the number of variables, the greater the number of possible outcomes. Stressors lead to adaptation and growth, which leads to survival, which builds resilience, which lays the foundation for more resilience and growth.

It is a positive compound growth formula because the more resilient we get, the more volatility we can swallow, without choking on it. As implied above, an increase in volatility can be thought of in this context as just a greater range of circumstances. But this can come from two sides, like a matrix of potential outcomes.

On one axis, you have a quantity and variety of stressors, but on the other you also have a quantity and variety of reactions, responses and results. In a decentralized system, both axes expand over time, generating an exponential function as two growing variables are multiplied by one another. When systems lack a centralized gatekeeper, more stressors are allowed to propagate. Likewise, there is greater diversity and heterogeneity of participants that can react uniquely to these stressors.

When this happens, life happens. Creativity manifests. Innovation blossoms. Individuals are at their best. Societies are at their best. We experience more possibilities and improve our probabilistic odds of discovering something of immense value, and we do so exponentially.

A principle: Bitcoin, like all of nature’s evolutionary survivors, is forged of persistence. And persistence is forged from savings.

As Albert Einstein is (perhaps apocryphally) credited with saying: “The most powerful force in the universe is compound interest.”

Compound interest is one of the most impressive growth formulas experienced in the natural and economic worlds, and its most efficient avenue for success is antifragility.

Regardless of whether Einstein indeed ever uttered these words, the important takeaway here is that of Pareto distribution curves in exponential growth. The reason the “powerful force” of compounding growth is driven by antifragility is because it is raised by the exponent of time itself.

Survive like our palm tree and you get to keep compounding. As long as the other variables in the equation do not change materially, time will do the heavy lifting. This speaks to an important point on the importance of resilience when it comes to financial assets, as consistency through time is what leads to such tremendous abundance.

“What’s the most powerful force in the universe? Compound interest. It builds on itself. Over time, a small amount of money becomes a large amount of money. Persistence is similar. A little bit improves performance, which encourages greater persistence, which improves persistence even more. And on and on it goes.” –Daniel H. Pink, “The Adventures Of Johnny Bunko”

In a previous article, I cited the above quote referring to what I perceived to be bitcoin’s ability to compound a type of accrued interest over time relative to fiat benchmarks. My argument laid out how something like hyperbitcoinization could result from this compounding power law function, and therefore see its growth curve actually accelerate in the future, rather than level off in an asymptotic “s-curve” shape — something that may be underappreciated even by the most ardent bulls.

Interest earned, in a free market, is the equilibrium price required to balance one’s time preference of consumption relative to savings. One of the oldest axioms of economics, Say’s law, observes that we are always both consumers and producers. Even as consumers, we are producers of specialized labor to accumulate resources to be used to consume at some future point.

Money, a human social technology of value and communication, is perhaps one of the few practical instances we can witness of a limitless power law function, as it stores labor over time. In a power law equation where time itself is the variable to which the function is raised, this creates a powerful compounding effect. That is, as long as the calculated value can persist over time.

An absolutely scarce money accrues its interest as the residual incremental productivity gained from marginal output. New productive labor can only scale if work can be continually divided and specialized. Such scaling, in turn, can only occur if there is adequate savings of excess production.

Excess saving leads to specialization, allowing for innovation and productivity gain, in turn generating additional savings. If this equation is disrupted then this virtuous progression collapses.

What does all the above have to do with antifragility and persistence? It points to a fatal flaw in an increasingly centrally-controlled fiat money system.

It is a matter of first principles. There simply cannot persist a functional money in a society whose main product is credit. Things can start fine but the nature of credit is similar to a drug, especially when the transmission of credit is centralized by a trusted rule-making body. Such a system encourages at least two horribly problematic outcomes:

Participants will look to gain favor with the arbiter of power to attain access to that power of debt, so as to gain wealth and power themselves. Representative democracy devolves into special interest democracy. The arbiter will print more money when it suits them, and if such credit is too costly, will project the cost back across the rest of society. Some will be impacted more than others. Arbitrary rulemaking and politicization flourish like weeds.

This in turn incentivizes everyone operating in such a society to play the same game so as not be left in the dust. Everyone must maximize their debt accumulation, and thus a credit-based fiat economy can only go in one direction.

Of the utmost importance here is to understand that the incentives do not self-correct the imbalances they create. Fiat is “Paretian.” They only make the imbalances greater over time, and the price required to disincentivize such behavior is something to which no participant would voluntarily agree. The optimal strategy for any adversary whose opponent’s biggest weakness is their own structure of operation, is patience and persistence.

As Peter Thiel and Blake Masters noted in 2014’s “Zero To One,” a disruptive technology must have, as a rule of thumb, something to the tune of a ten-times improvement relative to its adversary to overcome the inertial Lindy effects of that incumbent. A supreme beauty of Bitcoin, embedded in its antifragility, is the simple conclusion that as our incumbent increasingly centralizes, the ten-times improvement will become self-evident. All Bitcoin must do is persist.

However, while Bitcoin’s antifragility is indeed a powerful force, it would dissolve instantaneously without decentralization. As such, the nature of bitcoin’s decentralized structure will be at the core of part two of this series.

Coda: A Motive For Decentralization

At its best, debt is faith in future excess savings. In its worst incarnation, debt is a Ponzi scheme, continually stealing from the future to fund the present’s unwillingness or inability to save excess consumption. The obvious deleterious impacts on future growth notwithstanding, the other problem pertinent to this conversation is how such a system stunts and even altogether abruptly halts human social scaling vis a vis specialization.

And since specialization is the overarching force that leads to human innovation, we are left with a big problem for progress. The more that human ingenuity and energy can link itself without entropy to its innate will to specialize, the more information we can decrypt. This means more societal nodes, synapses and economic pathways, leading to previously unthinkable new ideas and opportunities.

The conclusion of the dynamic laid out above is that the incentive to correct the imbalances of a fiat-based, centrally-controlled credit system must come from outside the system, if no participant within the system has any reason to opt out. From a historically catalytic perspective, Bitcoin is a technological savings innovation and accelerant designed to reverse unhealthy and unsustainable societal incentives. But it definitionally must do all this, and as we shall see, can only do all this from the outside. And the only way to be outside of a centralized system, is to be fully decentralized.

In my professional life, I have been honored to have learned firsthand from some great mentors, including Wall Street veteran Marty Zweig. Beyond his status as a pioneering and legendary macro investor, he also coined the phrase “don’t fight the Fed,” a simple axiom that adheres to the notion of following the path of least resistance.

Very zen, right? Consequently, throughout my career as a macro investor, I have found that discovering this path of least resistance is of the utmost importance, as it is the most probable corollary when dealing with complex systems of inertia. A mass investor class, the socialization of financial assets, and centralization, my friends, is such a path.

Unfortunately, the imbalances laid out in this essay are likely to only rise from here. I have discussed the path dependency of this conclusion by way of analyzing the options available to us, and solving for the path of least resistance.

But there is another reason why the above scenario is likely inevitable. While the cost of carrying our imbalances is high, it is not yet sufficiently high enough to reverse the stubborn inertia of the system to recalibrate.

We suffer from a culture of short-termism. Both “liberal” solutions of fiscal deficits and redistribution, as well as “conservative” solutions of Reaganomics, tax cuts, and other supply-side, neo-classical measures have all failed. This is because both only address the short term motives of the current generations, rather than addressing the fundamental problems, which are structural and intergenerational in nature.

There is a time preference mismatch. As we kick the proverbial can, we are in essence just reallocating costs out into the future. Do not be fooled by this temporal delusion. The costs do not actually move out into the future as if transported in some time machine. They persist in the present, but are obfuscated by a mask of financial engineering, giddiness at the prospect of overnight wealth, and the immense power of narrative. Under this façade, the costs continue to accrue, in the form of inflation, wealth and income inequality, political fissures, geopolitical instability, and declines in the quality of production, to name a few.

But equilibrium always finds a way. And these costs must continue to build until the weight of their burden is so overwhelming that addressing them becomes unavoidable and rational.Below sums up the idea:

“Whilst the cost of carrying the imbalances is now a real loss of capital rather than an opportunity cost, it is still a relatively minor cost compared to the economic, social, political and even potential geopolitical cost of clearing the system. It is therefore in no one’s interest to clear the system in the short term. Instead, expect the imbalances to increase aggressively, and their cost to soar. Real yields will collapse, and with them, real GDP will decline, certainly into a deep recession, and probably severe economic depression. Whilst that will eventually lead to the public rejecting the present system of unlimited government, lifting real yields again, as it is probably not for the next five to 10 years, it can be ignored for the time being. Instead, the trade is more imbalances.”-Renowned British economist and Wall Street macro strategist Andrew Lees,”Hiding The Imbalances In Plain Sight”

“The trade is more imbalances.” I like that. That is a safe bet. It’s a bet on the current trajectory. That is a “don’t fight the Fed” type of trade. Bitcoin is a similar bet. But it’s more than a financial trade, it’s a bet for our future.

We live in times that, in hindsight, will likely be perceived as having been a monumental crossroads.

Two growing forces are on a collision course. As a result of the aforementioned procession of events, we are deterministically barreling toward a world in which a mass investor class is indeed ubiquitous, uniform and publicly managed. The benefits may feel terrific if not outright euphoric at the beginning of this journey, but the costs will accrue “gradually, then suddenly,” to hat tip a Parker Lewis phrase.

Private free market capital allocation will be crowded out, productivity will continue to falter despite abundant technological innovation, economic resilience to volatility and disruptive change will atrophy, monetary debasement will erode our cost of living on an accelerating treadmill, and inequality will stubbornly continue to expand exponentially. The common denominator of all these costs is systemic fragility.

It is worth reminding ourselves again at this stage of our Socratic journey that none of this comes to pass by way of malevolent design, or of one political party relative to the other. We are heading in this direction as a product of false choices that have cornered us into an inexorable debt trap.

This has unfolded by way of a windy half-century road of best intentions gone awry. A road pock-marked with asset bubbles, moral hazard, slippery-sloped tributaries flowing into busted dams, cascading into tipping points, and catapulted further downstream by the gravity of inertial political malaise. Unless we can find a plausible, new and imaginative path to fully decentralize the economy, it will end up fully centralized instead. The result is binary. Authoritarianism or autonomy. This is the battle of the 21st century, and it is of the utmost importance.

This is a guest post by Aaron Segal. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.